AVESTA Overview: April 14 - 25

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the period, trading volume on the Tashkent Stock Exchange reached 83.9bln UZS, which is three times higher compared to the previous period. This growth was primarily driven by heightened bond trading activity and the presence of several M&A transactions. The total number of securities traded during the period stood at 86, five more than the previous period.

Uzum Nasiya (UZUMN2B) dominated the market, accounting for nearly 75% of total turnover. Agat Credit (ACMT1B) followed with 8%, while Delta (DMMT2B) contributed around 2.5%. M&A deals involving SMBA, MIQE, and JASM collectively made up approximately 9% of turnover. This distribution highlights that bond instruments were the main drivers of volume during the period, contrasting with earlier months when M&A activity played a larger role.

Stock trading on the main platform remained limited. Only URTS and UNVB appeared in the top 10 by trading volume, together accounting for more than half of the turnover generated by shares. This reflects the market’s reliance on a few liquid names and a lack of broader participation in the stock segment.

In terms of price movements, most stocks saw modest gains of 1–2%, indicating low volatility. URTS stood out with an 11.3% increase, rising from 3,139 UZS to 3,495 UZS per share. While the period included a change in the company’s Chairman and the announcement of an EGM, these developments likely had little influence on the stock price. MIQE rose by 16.3%, though as part of an M&A deal, this price may not fully reflect market-based valuation. On the other hand, DMMT2B was the only security to decline, with its closing price falling by 1.0%.

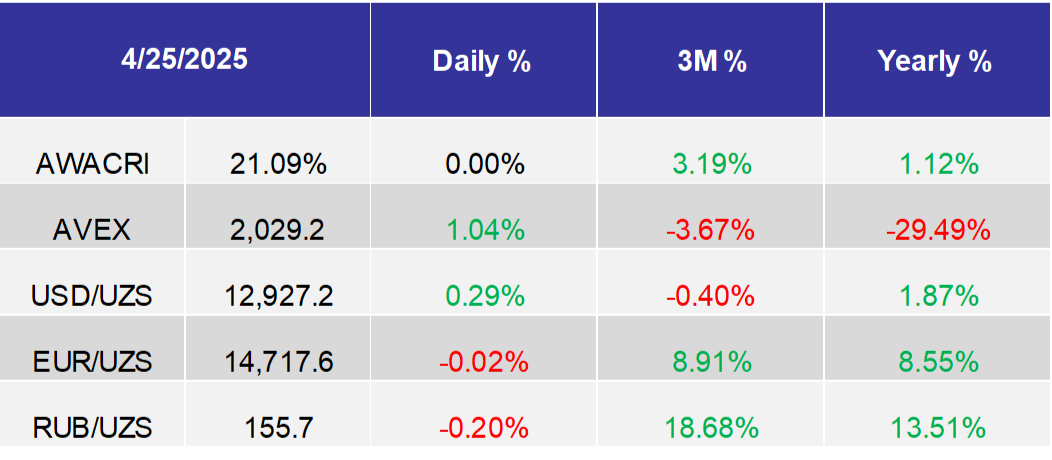

AVEX (Avesta Equity Index) grew by 0.7% over the two-week period.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

TBC Uzbekistan has launched online lending for small and medium-sized businesses. SME clients can now apply for business loans of up to 300mln UZS for a term of up to three years.

From June 1, 2025, the Central Bank of Uzbekistan will reduce the risk weight on small business loans to 75% (previously 100–200%) for loans up to 15bln UZS and total exposure not exceeding 0.2% of a bank’s regulatory capital;

IMF concluded its 2025 Article IV mission to Uzbekistan, highlighting strong economic performance with 6.5% GDP growth in 2024 and a 6% forecast for 2025. The fiscal deficit narrowed to 3.2% of GDP, while inflation remains high at 10.3% but is expected to ease to 8% by end-2025. The IMF urged continued tight monetary policy, SOE and bank privatization, fiscal discipline, and energy price liberalization, alongside improved statistics and governance reforms;

Used car prices in Uzbekistan continued to decline in March 2025. EVs also saw price cuts, the trend is likely driven by reduced auto lending and discount campaigns by dealers and manufacturers;

TBC Uzbekistan has launched online lending for small and medium-sized businesses. SME clients can now apply for business loans of up to 300mln UZS for a term of up to three years.

From June 1, 2025, the Central Bank of Uzbekistan will reduce the risk weight on small business loans to 75% (previously 100–200%) for loans up to 15bln UZS and total exposure not exceeding 0.2% of a bank’s regulatory capital;

IMF concluded its 2025 Article IV mission to Uzbekistan, highlighting strong economic performance with 6.5% GDP growth in 2024 and a 6% forecast for 2025. The fiscal deficit narrowed to 3.2% of GDP, while inflation remains high at 10.3% but is expected to ease to 8% by end-2025. The IMF urged continued tight monetary policy, SOE and bank privatization, fiscal discipline, and energy price liberalization, alongside improved statistics and governance reforms;

Used car prices in Uzbekistan continued to decline in March 2025. EVs also saw price cuts, the trend is likely driven by reduced auto lending and discount campaigns by dealers and manufacturers;

German KfW to provide 26.5mln EUR to support MSME businesses in Uzbekistan;

Korean Incheon International Airport Corporation to manage and modernize Urgench Airport;

Burger King to open in Uzbekistan, recently founder of International Beverages Tashkent (manufacturer of Pepsi and other beverages) purchased Burger King Kazakhstan;

Presidents of Kyrgyzstan, Tajikistan and Uzbekistan signed agreement on the Junction Point of the State Borders of the Three Countries, resolving Central Asia's last major border conflict;

EBRD to provide €20mln to Artikul Aziya Kabel, a major producer of copper cables and wires, to support production expansion and boost exports;

Uzbekistan to partner with US-based Esri to digitize, optimize, and transform its water management systems through satellite technology and AI.