AVESTA Overview: April 29 - May 10

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

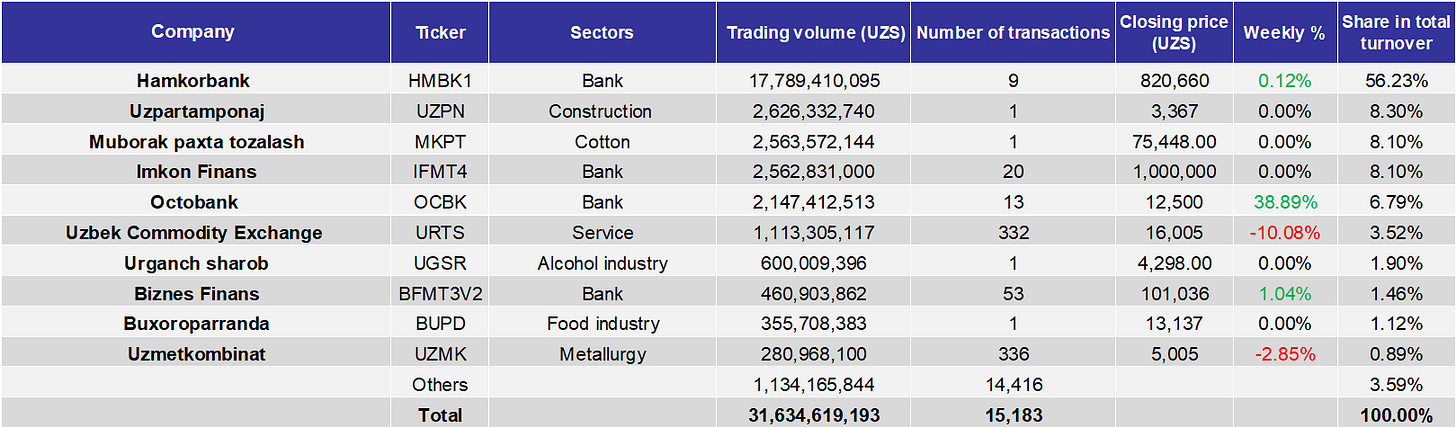

During the given period, trading on the Tashkent Stock Exchange reached 31.6bln UZS, which is 3.8 times more compared to the previous two weeks. This increase in trading activity can be primarily attributed to transactions involving HMBK1 debut discounted bonds, with a planned 22% coupon yield. Nine deals worth 17.8bln UZS have been executed so far. Additionally, several notable M&A transactions took place, involving UZPN (2.6bln UZS at 3,367 UZS), MKPT (2.6bln UZS at 75,448 UZS), UGSR (600mln UZS at 4,298 UZS), BUPD (355.7mln UZS at 13,137 UZS), and OCBK shares. The latter transaction was related to Mr. Tursunov I.B., the Chairman of the Board, increasing his equity stake in the company up to 97.83%. The deal volume equaled 2.1bln UZS at 1,000 UZS per share.

Collectively, all of the mentioned deals contributed to 82.4% of the total turnover during this two-week period. Similarly, in the previous period, a single TBMZ transaction for 3bln UZS at 5,200 UZS per share accounted for nearly one-third of the trading volume.

Excluding the impact of the aforementioned transactions, the trading volume increased by 2.8%. The number of securities traded totaled 80, three less than the previous period.

Half of the securities on the top 10 list maintained their closing price, primarily due to the prevalence of M&A transactions. The high presence of bonds in the list is also notable, with the HMBK1 debut bonds experiencing a 0.12% increase in their closing price since the issue date. Among the more liquid stocks, only URTS and UZMK made it to the top 10 by volume list. However, both of these stocks saw a decrease in their closing price, with URTS declining by 10.1% and UZMK decreasing by 2.9%.

AVEX increased by 4.4% during these two weeks.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

Ipotekabank JSCB (IPTB) announced the placement of UZS-denominated Eurobonds for 1.4trln UZS with a duration of 3 years and 20.5% coupon paid semi-annually on the Vienna Stock Exchange;

Local payment organization OSON entering the Kazakh market;

Cement factory with a capacity of 2.5mln tons a year was launched in the Andijan region;

Uzbekistan to establish projects on rare earth metals worth $500mln;

Ritz-Carlton entering the Uzbek market;

Azerbaijan, Kazakhstan and Uzbekistan to connect their energy systems to facilitate the sale of green energy to Europe;

AirProducts to construct a 120t/day capacity carbon dioxide (CO2) production facility for Navoiazot JSC for $15mln. It will help to capture raw CO2 from the ammonia production line and convert it into pure CO2 available for sale to soft-drinks producers and other consumers;

UzRTSB JSC (URTS) enabling online trading of domain names;

GDP growth in 1Q2024 reached 6.2%, while the CPI decreased down to 1.7%;

EU to grant 6mln EUR for the development of agriculture sector of Uzbekistan;

OPEK Fund to provide $20mln for the development of preschool education;

Italian Arsenale Group to build luxury tourist trains at enterprises owned by Uzbekistan Railways JSC;

EBRD to help Asakabank JSCB prepare for privatization and may consider pre-privatization investment in its equity;

OPEK Fund to provide $500mn for sustainable development of the country;

OVERVIEWHumo payment system, which accounted for over a third of p2p transactions in 2023, will be privatized;

49% equity stake in the Information Technology Center JV that maintains UzIMEI system operator will be privatized;

49.9% share in Tashkent Metallurgical Plant LLC will be privatized by the end of June 2025;

Ohangaronsement JSC (OHSM, OHSMP) was delisted from the Tashkent Stock Exchange from April 30th, 2024.