AVESTA Overview: August 18 - 29

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

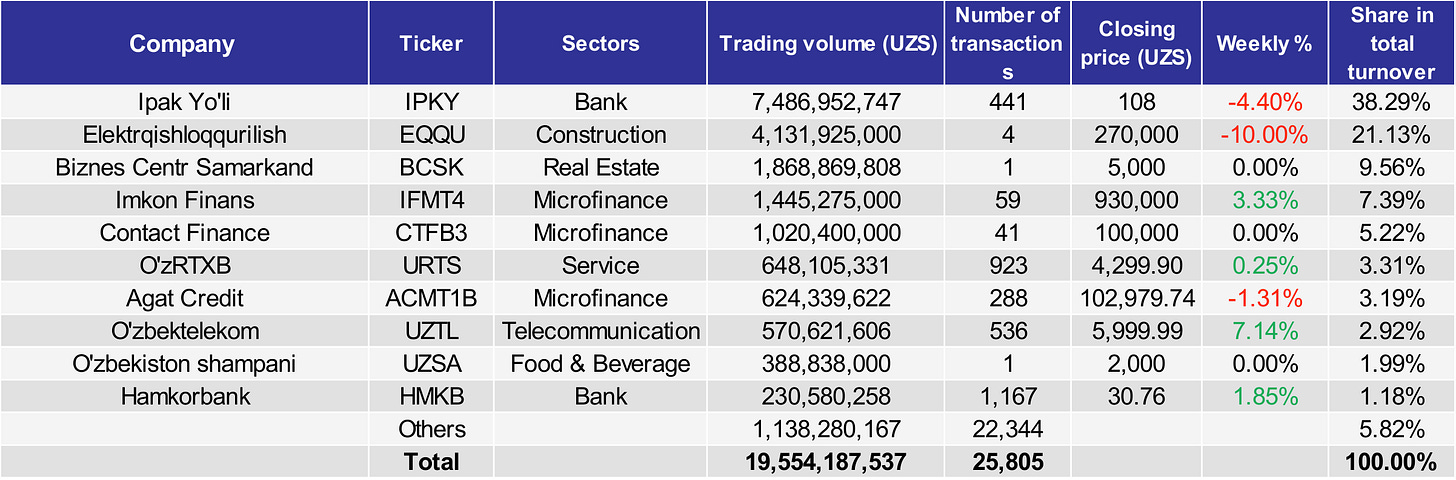

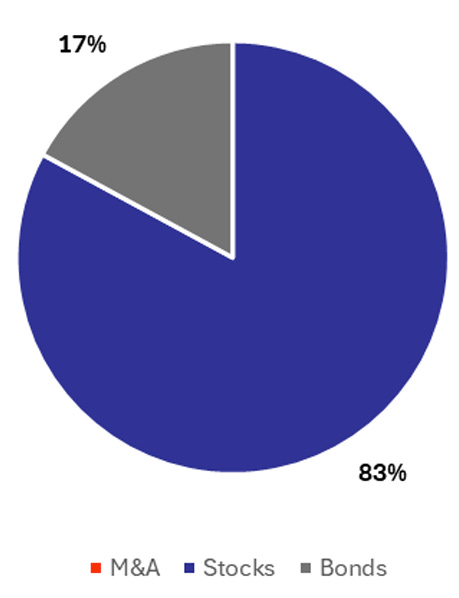

During the period, the Tashkent Stock Exchange recorded a turnover of 19.6bln UZS, resulting from 25,805 transactions. Stocks accounted for 83% of all transactions. Among the top ten trades, Ipak Yuli (IPKY) was the leading contributor, with a 38.3% share of the total turnover, equivalent to a trading volume of 7.5bln UZS. Elektrqishloqqurilish (EQQU) followed with a 21.1% turnover, representing a trading volume of 4.1bln UZS. Biznes Centr Samarkand (BCSK) secured the third place with a trading volume of 1.8bln UZS, constituting 9.6% of the total turnover. Hamkorbank (HMKB) was the last in the list with a 1.2% of turnover.

Bonds comprised the remaining 17% of total turnover. Imkon Finans (IFMT4) led the bond segment with a 7.4% share, corresponding to a 1.4bln UZS trading volume. Contact Finance followed with a 5.2% turnover, and Agat Credit with a 3.2% turnover.

During the period, 30% of listed companies experienced no change in their w-o-w prices. O’zbektelekom (UZTL) demonstrated the highest price increase at 7.1%. Imkon Finans (IFMT4) bonds appreciated from 900,000 to 930,000 UZS, resulting in a 3.3% increase. Hamkorbank (HMKB) and O'zRTXB (URTS) saw price increases of 1.9% and 0.25%, respectively. Conversely, Elektrqishloqqurilish (EQQU) showed the most significant decline, at 10%. Ipak Yuli (IPKY) and Agat Credit (ACMT1) experienced price decreases of 4.4% and 1.3%, respectively.

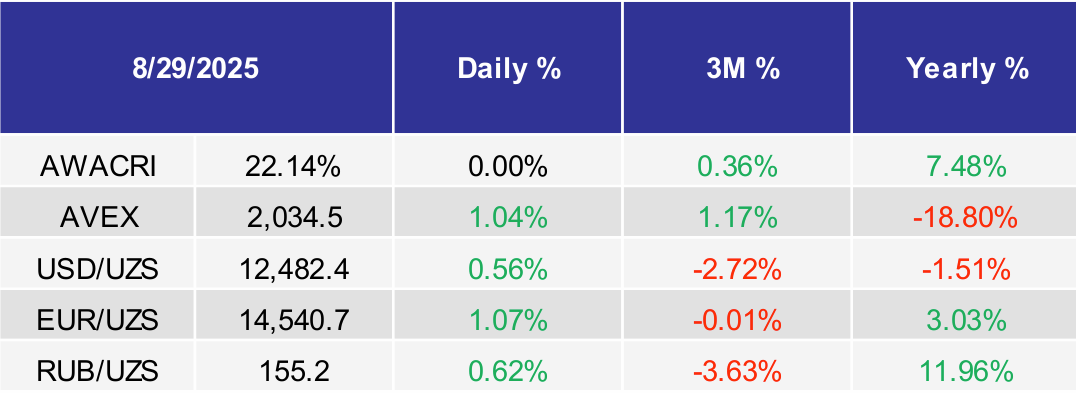

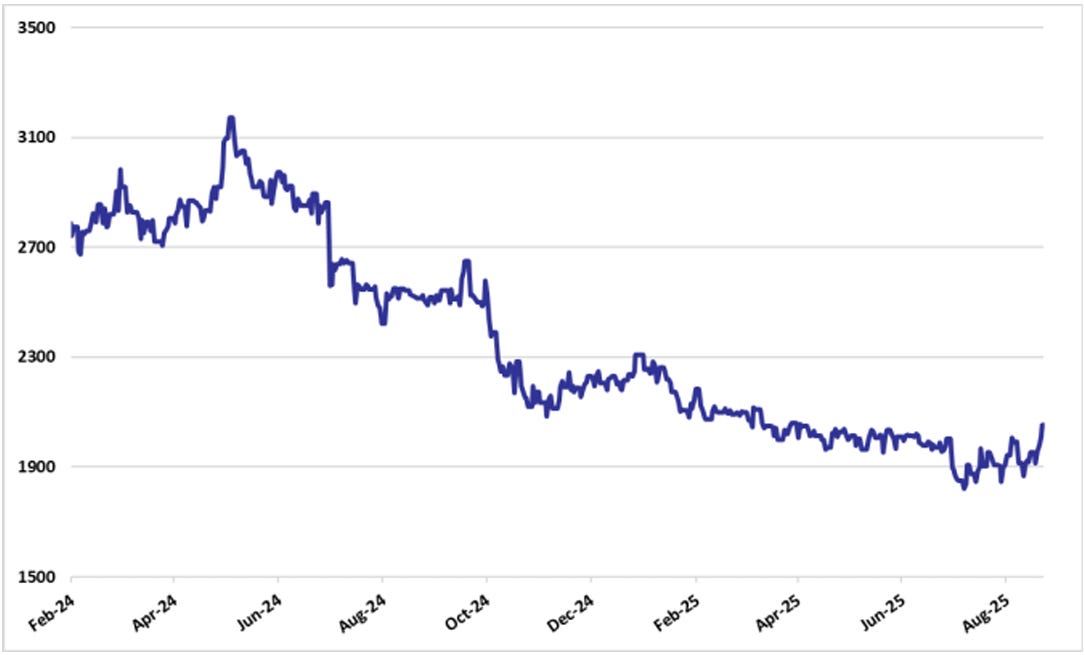

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

On August 11, 2025, the UzNIF held an extraordinary meeting where shareholders approved Franklin Templeton Asset Management as the fund’s official manager. Bobur Abdinazarov’s interim role ended, and Marius Dan was appointed to lead and register the changes;

Uzmetkombinat JSC (UZMK) signed a 39.24bln UZS spot deal with 49%-owned Li Da Metal Technology for 5,000 t of steel billets;

Uychi Paxta Tozalash JSC decided to cease operations effective 12 Aug 2025, with creditor claims accepted until 31 Dec 2025;

O‘zmetkombinat JSC (UZMK) announced changes in its executive and supervisory board composition, dated August 19, 2025. Abdullayev Baxodir Tojimirzayevich has been appointed as Acting Chairman and CEO, replacing Dilshod Axmedov;

Uzbek Commodity Exchange JSC (URTS) placed a 200bln UZS term deposit with Trastbank JSCB on August 25 2025, a deal equal to 43.16% of its net assets, approved by the supervisory board;

Payme JSC has entered into a material transaction with its affiliate, TBC Fin Service LLC, involving a 36bln UZS surety agreement;

Trastbank JSCB (TRSB) signed a 5.49bln UZS contract with affiliated Inco-Construction LLC for capital repairs of its “Digital” office.