AVESTA Overview: August 19 - 30

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the observed period, the volume of trade on the Tashkent Stock Exchange amounted to nearly 9.2bln UZS, which is 51.9% less than in the previous period. This decrease in volume is primarily attributed to M&A transactions in the current period. The total number of transactions hit 16,742, down by 11.5% compared to the previous period.

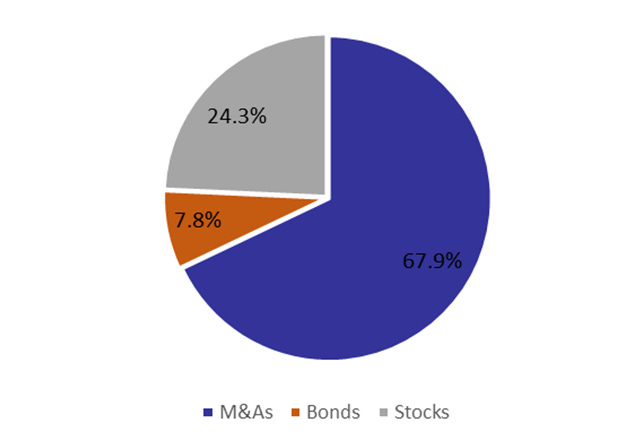

The total number of securities traded amounted to 72, a decrease of five from the previous period. M&A-related deal with OCBK shares for 5bln UZS at 1,000 UZS per share accounted for more than half of the trading volume. Other M&A transactions included CIMA shares valued at 903.3mln UZS at 44,449 UZS per share and MATA shares worth 313.6mln UZS at 17,000 UZS per share. Together, these transactions contributed to 67.9% of the total turnover. Bonds accounted for 7.8% of the volume during the period. Among stocks, URTS was the most actively traded, contributing 12.9% to the turnover over the two weeks.

Most securities in the top 10 by volume list saw their closing prices rise, with QZSM (+29.1%), UZMK (+14.3%), and URTS (+11.5%) experiencing double-digit growth in their closing prices.

AVEX increased by 0.8% during these two weeks.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Foreign trade turnover in 7M2024 grew by 5.3% and reached $36.8bln including a 10.1% increase in imports, up to $22bln and a 1.1% decline in exports, down to $14.8bln;

The owner of Perfectum Mobile announced partnership with Vodafone. Nokia was chosen as the equipment supplier. New investments in the amount of $250mln are expected, out of which $100mln is provided by the Finnish export credit agency;

Trade and investment deals worth $2.5bln were signed between Afghanistan and Uzbekistan;

Chinese Shangdong Aipurui Steel Plate Co. Ltd. to construct a metalworking plant in Fergana for $120mln;

Malaysian Sunview Group considering the construction of a solar power station in Fergana with a 200MW capacity worth $150mln;

Nearly 4.2mln (+15.3%) tourists visited Uzbekistan in 7M2024;

Import turnover of Uzbekistan in 7M2024 amounted to $22bln (+10.1% y-o-y);

The average monthly mortgage payment reached almost 3mln UZS;

BMB Holding launched a new agribusiness facility in the Jizzakh region worth $36mln;

Kazakh Kaspi.kz plans to participate in the privatization tender for the HUMO payment system operator;

In 7M2024 coal production reached 3.4mln tons, a 12.4% y-o-y increase;

In 7M2024, Uzbekistan imported gas worth $983.7mln, which is a 4.9 times y-o-y increase;

Banking NPL in July increased from 4.0% to 4.2%, 4.4% for state-owned banks and 3.7% for private;

Indian Avee Broilers considering poultry meat production for $43mln;

OVERVIEWNavoi Mining JSC attracted $150mln loan from MUFG;

TBC UZ attracted $25mln loan facility from the BlueOrchard;

Fitch affirms Uzbekistan's BB- rating with Stable outlook;

Tashgiprogor JSC (TGPR) was included in the official Tashkent Stock Exchange listing from August 22nd

Hamkorbank JSCB (HMKB) attracted a $100mln equivalent credit line from FMO to support SME business;

93-Maxsus Trest JSC (MXUS) was included in the official Tashkent Stock Exchange listing from August 19th;

Uzbekneftegaz JSC (UZNG) capitalized almost a 1trln UZS into a charter capital of the company.