AVESTA Overview: December 23 - January 4

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

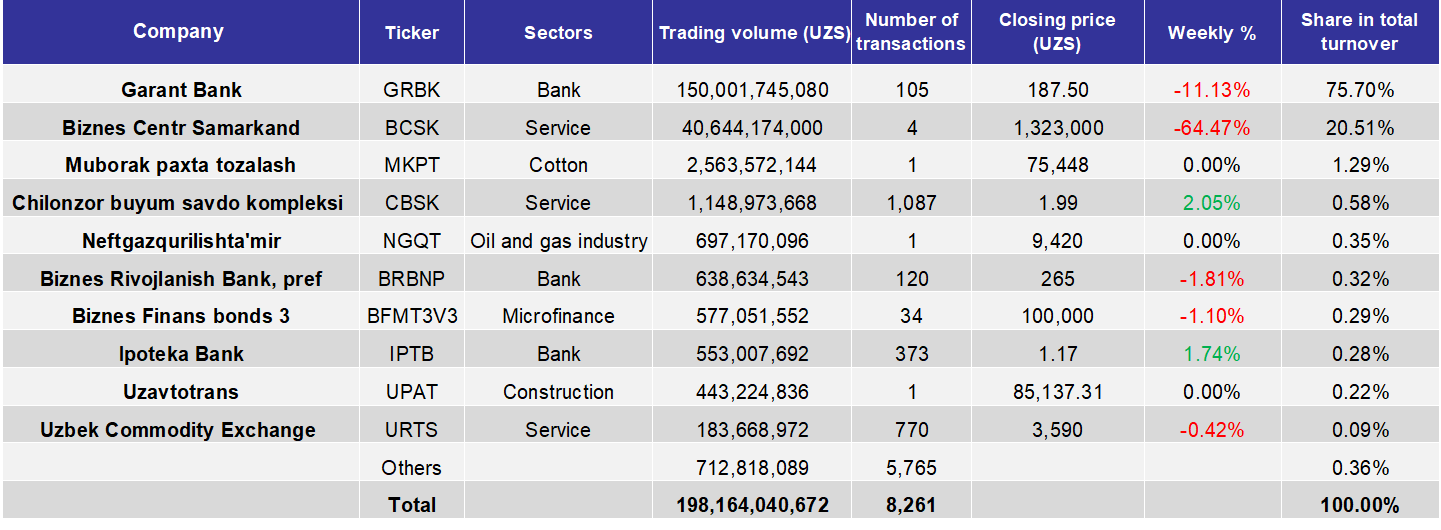

Throughout the period, trading volume on the Tashkent Stock Exchange reached 198.2bln UZS, which is 3.7 times higher than the previous period. The total number of securities traded stood at 80, eight higher than the last period.

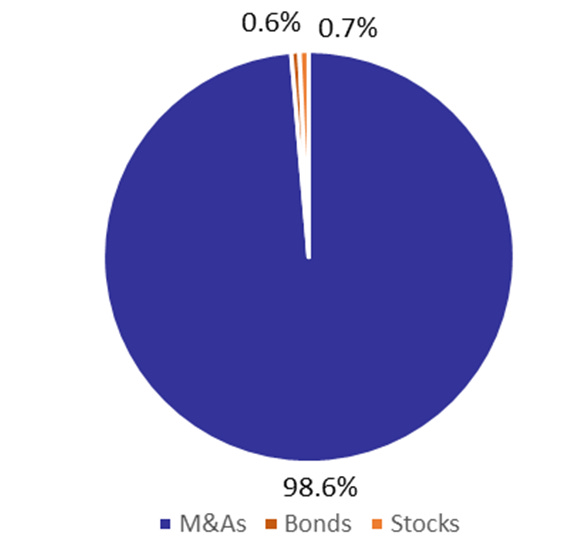

As per usual, most of the turnover is contributed by M&A transactions. Garant Bank (GRBK) accounted for most of the turnover, the company issued additional shares worth 150bln UZS. BSCK, MKPT, NGQT and UPAT are other examples of such transactions, together accounting for 98.6% of the turnover this period.

In terms of price movements, closing prices of CBSK and IPTB, increased by 2.1% and 1.7%, respectively. Conversely, BRBNP and URTS saw their prices decline by 1.8% and 0.4% over the given period.

AVEX (Avesta Equity Index) increased by 2.8% over these two weeks.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Alif to attract $20mln from US based Accial Capital;

Uzbekistan’s gas exports to China increased by 27.1% in 11M2024;

Number of tourists visiting Uzbekistan reached 7.3mln in 11M2024;

Uzbekistan and Kuwait to launch direct flights in 2025 and set a visa-free regime;

EBRD to allocate $66.4mln to National Electric Grid for the construction of 230 km high-voltage transmission line;

In 11M2024, Uzbekistan's fruits and vegetables exports reached $1.4bln, marking a 30% y-o-y increase;

Number of private healthcare institutions in Uzbekistan exceeded 9,000;

Uzbekneftegaz JSC (UZNG) projects a decline in gas production down to 26.5bln cubic meters;

In 10M2024, Uzbekistan exported hot pepper worth $7.2mln;

TBC Uzbekistan secured $37mln in a new funding round from its parent company, TBC Group, to enhance its digital presence in Uzbekistan by developing AI and tech products;

Toshkentdonmahsulotlari JSC (TKDM, TKDMP) included into official listing of the Tashkent Stock Exchange starting from December 23rd;

Inflation reached 1% for December and 9.8% for 2024;

In 2025, it is planned to build cloud data centers in three regions of Uzbekistan. 1,600 post offices will introduce pick-up points for delivery of marketplace goods and open a digital sorting center with funds from the EBRD;

UzSAMA agreed to sell a 100% equity stake in Uz-Koram Kompani LLC to Centrum Aviation FZCO (UAE) for $24mln. The buyer agreed to maintain the core business of enterprise for at least 10 years;

OPEC Fund to provide 70mln EUR to support key reforms in energy, agriculture, and social inclusion in Uzbekistan

Bagdoddonmahsulotlari JSC (BDDM, BDDMP) included into official listing of the Tashkent Stock Exchange starting from December 20th;

TBC Bank Uzbekistan JSCB placed 128bln UZS corporate bonds issue at the local market. The transaction was facilitated by Avesta Investment Group and TBC Capital;

Foreign trade turnover in 11M2024 increased by 3.6% and amounted to $59.4bln including a 3.0% increase in imports, up to $35.1bln and a 4.4% increase in exports up to $24.2bln;

In 11M2024, gas extraction dropped by 4.7% y-o-y and oil production declined by 7.3% y-o-y;

Banking NPL in November reached 4.3%, including 4.1% for state-owned banks and 4.6% for private.