AVESTA Overview: December 25 - January 6

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

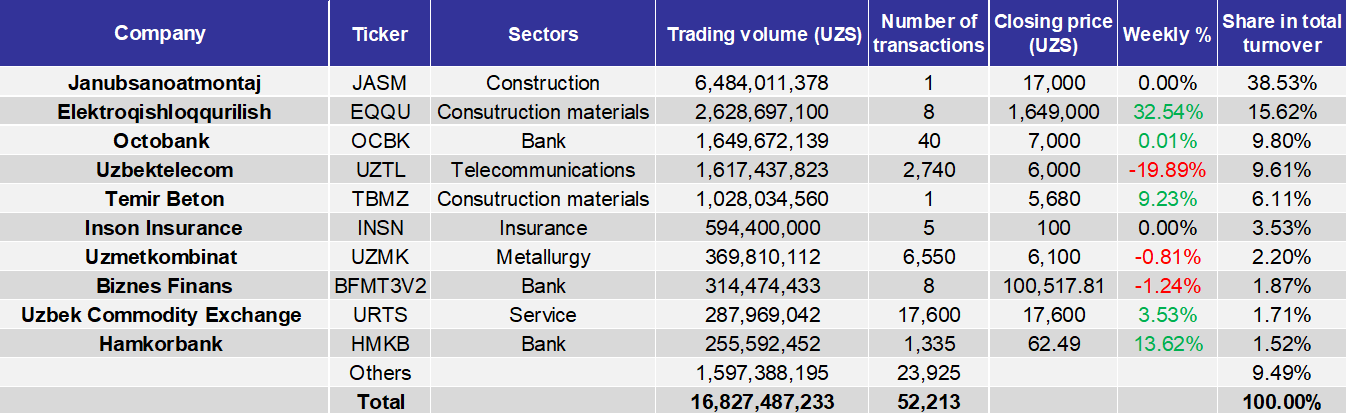

During the given trading period, trading on the Tashkent Stock Exchange reached 16.8bln UZS, which is 58.7% lower compared to the previous two weeks (excluding QQBK transaction). The total number of traded securities was 93, nine less than in the previous period.

The majority of the trading volume was contributed by JASM, accounting for 38.6% of the total with one transaction at 54,866.02 UZS per share. EQQU contributed 15.7% to the total volume, and its closing price increased by 32.5%. OCBK accounted for 9.8% of the turnover.

Recently listed UZTL, retained its position in the top list, however, its price by the end of the given period closed at the IPO price of 6,000 UZS, representing a decline of almost 20%, while HMKB’s price rose by 13.6% during the period from 55 UZS to 62.49 UZS.

AVEX increased by 11.4% during these two weeks.

AVESTA EQUITY INDEX (AVEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

UzSAMA entered into an active privatization process of multiple enterprises. On December 28th four flour-milling plants were privatized. 51% share of Galla-Alteg JSC was sold for 82blnUZS. 51.84% share in Buxorodonmahsulotlari JSC was sold for 59bln UZS. 51.8% share of Dunyo-M JSC was sold for 82.2bln UZS and 94.2% of Xovos Don Mahsulotlari JSC was sold for 40bln UZS. P/E and P/B multiples as well as other details are presented in the table below.

Additionally, a 51.48% stake in Uzbekiston Shampani JSC (Uzbekistan Champagne) was sold for 72bln UZS to Euro Pack LLC, a glass and plastic bottle producer on January 5th. According to the latest available reporting (1Q2023), the company was valued at 8.8xBV or 103,412 UZS per share. The latest traded price in December 2017 was 22,000 UZS per share. The investor is obliged to invest $18.5mln into modernization, start of cognac spirit alcohol and oak barrels production, launching a restaurant and wine tourism center, as well as a winery in the Parkent district of Tashkent region.

UzSAMA agreed to sell 100% in two companies, one in "Sardoba temir yol agrosanoat majmuasi" LLC (greenhouses complex with 3.6he of land) for 83.7bln UZS in installment to Mukumov Shavkat Komiljonovich and another in "Meva sharbat ilmiy eksperimental vinochilik" LLC (old wine and alcohol production facility with 6he of land) for 40.45bln UZS in installment to Central Terminal LLC. Also, it sold 87.47% stake in leading electric grid design and project company UzEnergoEngineering JSC to UzbekEnergoTa'mir JSC for 44bln UZS.

FINANCIAL NEWS

ECONOMICS

Inflation in 2023 reached 8.8%;

Banking NPL in November reached 3.8%, including 4.2% for state-owned banks and 2.9% for private;

ACWA Power to receive a $140mln loan from the EBRD for the construction of a 200 MW photovoltaic power plant and a 500 MWh energy storage system in the Tashkent region;

Exports revenue from dried fruits reached $43mln in 8M2023, a 50% increase y-o-y;

Gas exports reached $509.4mln in 11M2023, which is half the amount exported in 11M2022;

Coal production in 11M2023 reached 5,731.4k tons, a 19.1% y-o-y increase. In November, 614.3k tons of coal were produced;

EBRD to provide a $34mln loan to Volatila's SPV (Sarimay Solar FE LLC) for the construction of a 100MW solar photovoltaic power plant in Khorezm region, with a total project cost of $84mln;

President approved the state budget for 2024 with a GDP at $105bln and a growth rate of 5.6-5.8%, an inflation rate of 8-10%, and a budget deficit of 4% of GDP;

Car production in 11M2023 increased by 25.9% and reached 355k units;

Vodka (-23.2%) and wine (-29.6%) production decreased in 11M2023, while beer (+20.4%) and tobacco (+12%) increased;

OVERVIEW

Uzkabel JSC rejected the offer to purchase a 25% stake in Hayat Power Cable Systems LLC JV for over 50bln UZS from UzSAMA. This deal was supposed to consolidate the 75% stake of the company in the hands of Uzkabel and its major shareholder;

UzAutoSanoat-Leasing LLC was privatized by LUX BUILDING STAR LLC for 69.6bln UZS;

Ipoteka bank JSCB (IPTB) registered the new shares issue for 844.63bln UZS (approx.$68.4mln), which is placed privately to OTP Bank;

Usvenor LLC became the owner of 96.97% of INGO-Uzbekistan Insurance JSC and offered other minorities to purchase their shares at 1,390 UZS per share;

Chirchik qishloq xo'jaligi texnikasi zavodi JSC (Chirchik agricultural equipment plant) became the owner of 70.1% stake in BA Chirchik Metall LLC. At the same time, another subsidiary of the company, Chirchik Steel Service LLC, which is located at the same address, was liquidated;

Uz-Tong-Hong JSC attracted 30.85bln UZS loan from Asakabank JSCB.