AVESTA Overview: December 29 - January 9

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

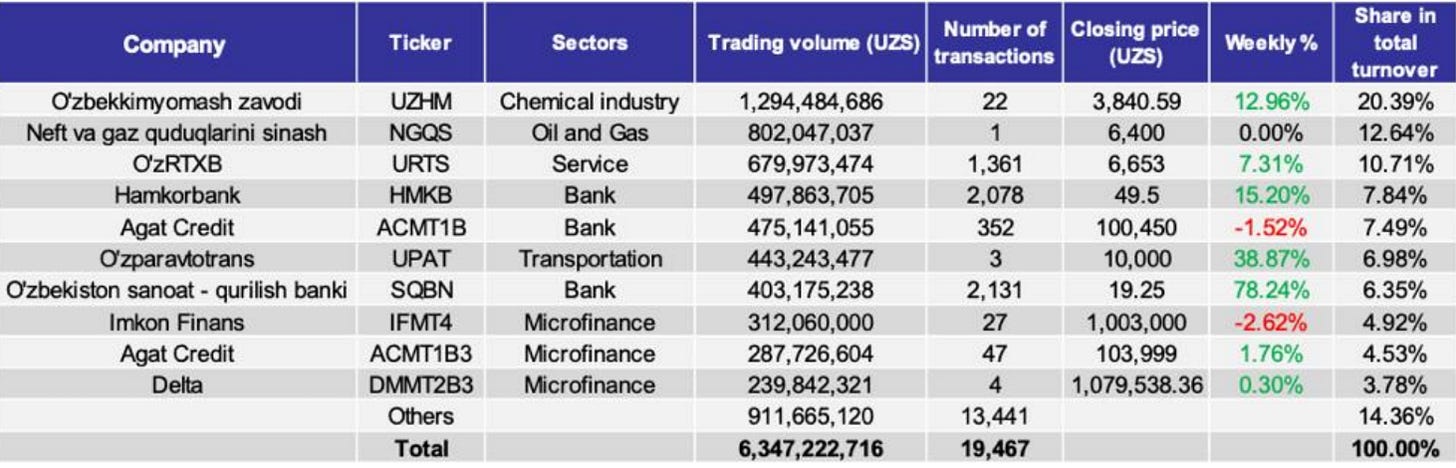

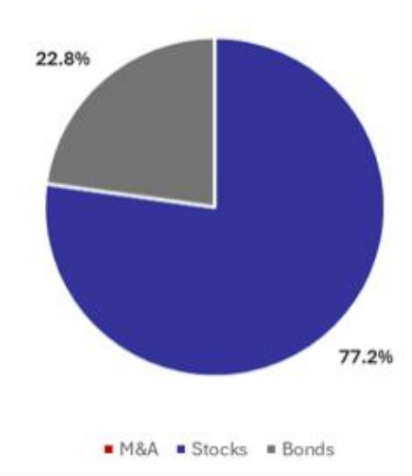

During the period, the Tashkent Stock Exchange recorded a total turnover of 6.3 bln UZS across 19,467 transactions. Stocks accounted for 77.2% of total turnover.

O’zbekkimyomash zavodi (UZHM) dominated the equity market with 1.3 bln UZS in trading volume, representing 20.4% of total turnover. Neft va gaz quduqlarini sinash (NGQS) followed with 12.6%, totaling 802 mln UZS in trading volume.

O’zRTXB (URTS) held 10.7% of total turnover. Hamkorbank (HMKB), with the second-largest number of transactions, accounted for 7.8% of total turnover, while O’zparavtotrans (UPAT) accounted for nearly 7%. O’zbekiston sanoat-qurilish banki (SQBN), with the highest number of transactions during the period, accounted for 6.4% of total turnover, totaling 403.2 mln UZS. The bond segment represented 22.8% of total turnover. Agat Credit bonds (ACMT1B and ACMT1B3) collectively registered 12% of total turnover, with 475.1 mln UZS and 287.7 mln UZS in trading volumes respectively. Imkon Finans (IFMT4) held 4.9% of total turnover, equaling 312.1 mln UZS, while Delta (DMMT2B3) registered 239.8 mln UZS, representing 3.8% of total turnover. Price analysis revealed that Imkon Finans (IFMT4) declined 2.6%. While one Agat Credit bond (ACMT1B) declined 1.5%, another Agat Credit bond (ACMT1B3) increased 1.8%. The most notable price increase was shown by O'zbekiston sanoat-qurilish banki (SQBN) at 78.2%, rising from 10.8 UZS to 19.3 UZS per share, followed by O'zparavtotrans (UPAT) at 38.9%. Hamkorbank's price increased by 15.2%, from 42.97 UZS to 49.5 UZS per share.

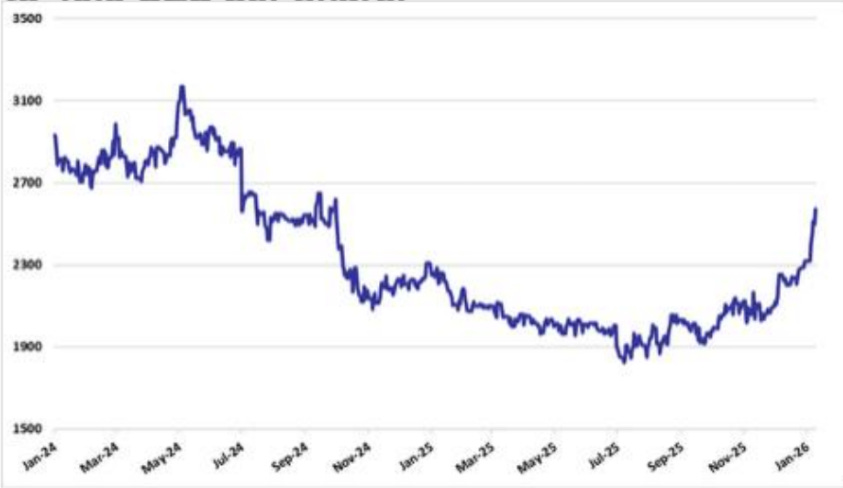

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

AGAT Credit JSC corporate bonds will accrue 2,378.08 UZS per bond, equal to 2.37% of par value; payments are scheduled between 22 November and 5 December 2025 in cash.

Agat Credit JSC MFO disclosed issuance of 400,000 corporate bonds with nominal value of 100,000 UZS each, totaling 40 bln UZS, registered on 30 December 2025.

Paxtakor Paxta Tozalash JSC approved transfer of assets, including 13.25% stake in Mirzachul Tikuvchilik Majmuasi LLC, 0.39% stake in Baraka Paxta Teks LLC, and 2,453 shares of Agrobank JSCB, to Jizzakhpaxtasanot JSC to settle creditor obligations.

InFinBank JSC (INFB) disclosed acquisition by a shareholder of a block of shares constituting 20% or more of its charter capital, and updated its list of affiliated persons, registering Tadbirkorlikni rivojlantirish kompaniyasi JSC as an affiliated company holding 300,000,000 preferred shares.

Delta Mikromoliya Tashkiloti LLC disclosed reorganization by transformation, with state registration of the new entity completed on 30 December 2025.

UZBAT JSC disclosed a related-party transaction with BRITISH AMERICAN SHARED SERVICES (GSD) LIMITED for provision of general business services totaling 4.38 bln UZS.

Makesense LLC corporate bonds will accrue income of 30,821,917.81 UZS per bond, equal to 6.16% of par value; payments are scheduled between 24 November and 1 December 2025 in cash.

O’zsanoatqurilishbank JSCB (SQBN) disclosed acquisition by a shareholder of a block of shares constituting 20% or more of the total charter capital.

Uchtepa Paxta Tozalash JSC (UTPT) approved transfer of assets, including 8.25% stake in Mirzachul Tikuvchilik Majmuasi LLC, 0.44% stake in Baraka Paxta Teks LLC, and 600 Agrobank JSCB shares, to Jizzakhpaxtasanot JSC to settle creditor obligations.

KDB Bank Uzbekistan JSC purchased government bonds from the Central Bank of Uzbekistan totaling 2.1 trln UZS.

Navoiy kon-metallurgiya kombinati (NKMK) JSC updated its list of affiliated persons, registering Antonov Evgeniy Aleksandrovich.

Kapital Sug’urta JSC (KASU) disclosed a related-party insurance transaction with Anorbank JSC totaling 50 bln UZS.

Asia Insurance JSC shareholder VIVETEKS LLC acquired 20.49% of the company’s charter capital.

Hamkorbank JSCB (HMKB) disclosed a major transaction with the EBRD totaling $100 mln (1.21 trln UZS) to finance micro, small, and medium enterprises, including $30 mln for green economy projects.

Renesans mikromoliya tashkiloti JSC disclosed a major credit agreement with Xalq Banki JSCB totaling 30 bln UZS (44.88% of net assets).

Makesense JSC approved acquisition of 100% stake in ARHAT GRAVURE LLC for 3 bln UZS, resulting in indirect ownership of 100% in subsidiary TEZCOIN MFO LLC.

Makesense LLC approved issuance of 1,000 registered interest-bearing corporate bonds in uncertificated form, each with nominal value of 300 mln UZS, totaling 300 bln UZS, to be placed via closed subscription with 22% annual coupon.