AVESTA Overview: December 9 - 19

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

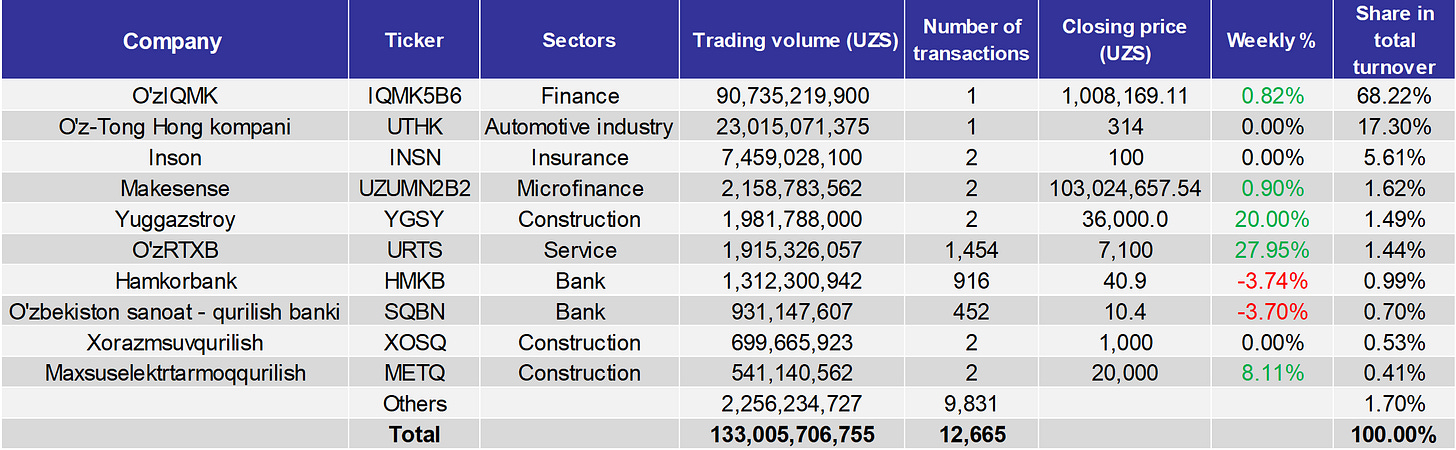

During the period, the Tashkent Stock Exchange recorded a total turnover of 133bln UZS across 12,665 transactions.

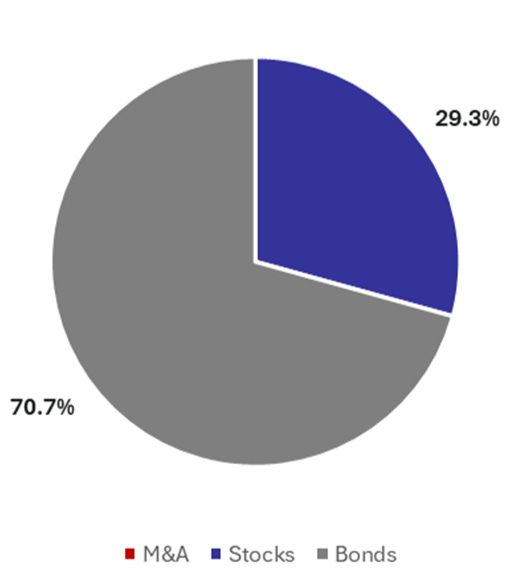

Bonds accounted for 70.7% of total turnover. O’zIQMK (IQMK5B6) dominated with a massive 68.2% share of total turnover, recording 90.7bln UZS in trading volume from a single transaction. Makesense (UZUMN2B2) generated 2.2bln UZS in trading volume across 2 transactions, representing 1.6% of total turnover. The remaining 0.9% was distributed among other bonds outside the top 10 by trading volume.

Stocks represented 29.3% of total turnover. O’z-Tong Hong kompani (UTHK) led with a 17.3% share, registering 23bln UZS in trading volume. Inson (INSN) recorded 7.4bln UZS and Yuggazstroy (YGSY) nearly 2bln UZS in trading volume, accounting for 5.6% and 1.5% of total turnover, respectively. O’zRTXB (URTS) posted the highest number of deals for the period at 1,454, totaling 1.9bln UZS in trading volume. Hamkorbank (HMKB) followed with 916 deals, generating 1.3bln UZS in trading volume. O’zbekiston sanoat-qurilish banki (SQBN) recorded 931.1mln UZS, Xorazmsuvqurilish (XOSQ) 699.7mln UZS, and Maxsuselektrtarmoqqurilish (METQ) 541.1mln UZS, each with less than 1% share of total turnover.

Price movements showed that Hamkorbank (HMKB) and O’zbekiston sanoat-qurilish banki (SQBN) both declined approximately 3.7%. O’zRTXB (URTS) posted the strongest gain at nearly 28%, followed by Yuggazstroy with a 20% increase and Maxsuselektrtarmoqqurilish (METQ) with an 8.1% rise. Among bonds, O’zIQMK (IQMK5B6) and Makesense (UZUMN2B2) increased 0.8% and 0.9%, respectively.

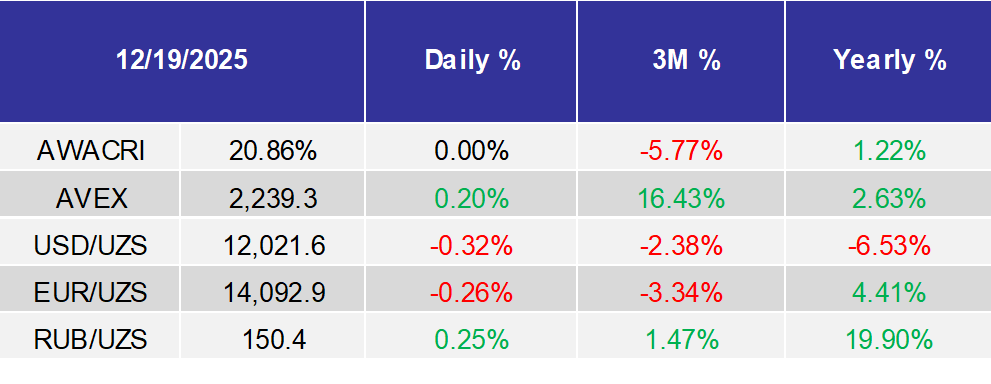

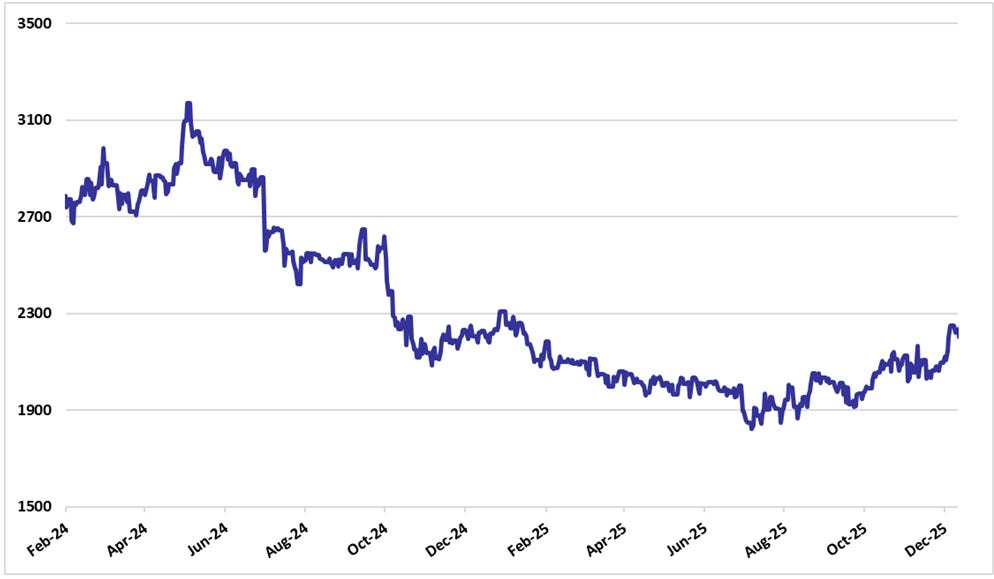

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Elektrqishloqqurilish JSC (EQQU) approved a major 50bln UZS guarantee line with Hamkorbank JSCB (HMKB), secured by company real estate;

Goodwill Capital JSC reported a one‑time reduction of assets exceeding 10%, with quarter‑end assets at 30,800,868.72 UZS thousand, and announced dividend payments of 17,860,584.57 UZS to shareholders;

UZBAT JSC JV approved annulment of 86 shares, reduced charter capital to 5,668,918,330 UZS, set dividends at 14,203 UZS per share payable Dec 11 2025-Feb 9 2026;

Bektemir-Spirt Eksperimental Zavodi JSC concluded a major factoring deal with Garant Bank JSC worth 20bln UZS, equal to 28.36% of its net assets;

Renesans Mikromoliya Tashkiloti JSC concluded a major credit agreement with Enabling Microfinance Fund AGmvK worth 24bln UZS, equal to 35.9% of its net assets;

Agro Finans Lizing JSC was acquired by Leader Finance Capital LLC for 1,442,314,525 UZS, giving it 99.92% ownership and full control;

AVO Bank JSC issued 10 deposit certificates with a total value of 500bln UZS (each at 50bln UZS nominal), the issuance was registered on December 4 2025

IT Unisoft Group JSC approved termination of activities under its Central Bank license №56 with voluntary return, adopted a new version of its charter, and confirmed the business plan for 2026;

OʻzIQMK JSC (IQMK) approved issuance of 200,000 corporate bonds with a total value of 200bln UZS (nominal 1mln UZS each);

Renesans Mikromoliya Tashkiloti JSC disclosed a major credit agreement with Grameen Crédit Agricole Fund, valued at 14.2bln UZS and equal to 21.25% of its net assets;

O’zIQMK JSC (IQMK) disclosed that its securities are listed for trading on the Republican Stock Exchange “Toshkent”;

KDB Bank O’zbekiston JSC disclosed a major transaction with CBU involving the purchase of bonds valued at 2.1trln UZS, equal to more than 10% of its assets;

Qo’shkopir Paxta Tozalash JSC and Xonqa Paxta Tozalash JSC approved the liquidation commission’s report, the transfer of long‑unsold assets, shares, and receivables to Horazmpaxtasanoat JSC;

O’zIQMK JSC disclosed a credit agreement with O’zmilliybank JSC, valued at 50bln UZS (for refinancing the mortgage portfolio), representing 9.95% of the bank’s equity stake in the issuer;

Suvsanoatmash JSC approved a new organizational structure. The decision included selling the company’s buildings and 500 fixed assets via the E‑auction platform, noting that production activity has ceased;

O’zbekiston Respublikasi Milliy Investitsiya Jamg’armasi JSC disclosed changes in its list of affiliated persons, adding Uzpromstroybank (SQBN) JSC (holding 30% of ordinary shares);

Contact Finance LLC annulled prior bond‑issuance resolutions and authorized a new 10bln UZS insured bond program (100k bonds, 25% coupon, 1,080‑day maturity);

O’zRTXB JSC (URTS) extended a 100bln UZS term deposit with Trustbank PJSB, equal to 18.84% of net assets;

TBC Bank JSCB approved a credit agreement with affiliated entity TBC Bank Group PLC (London) for $20mln.