AVESTA Overview: December 9 - 20

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

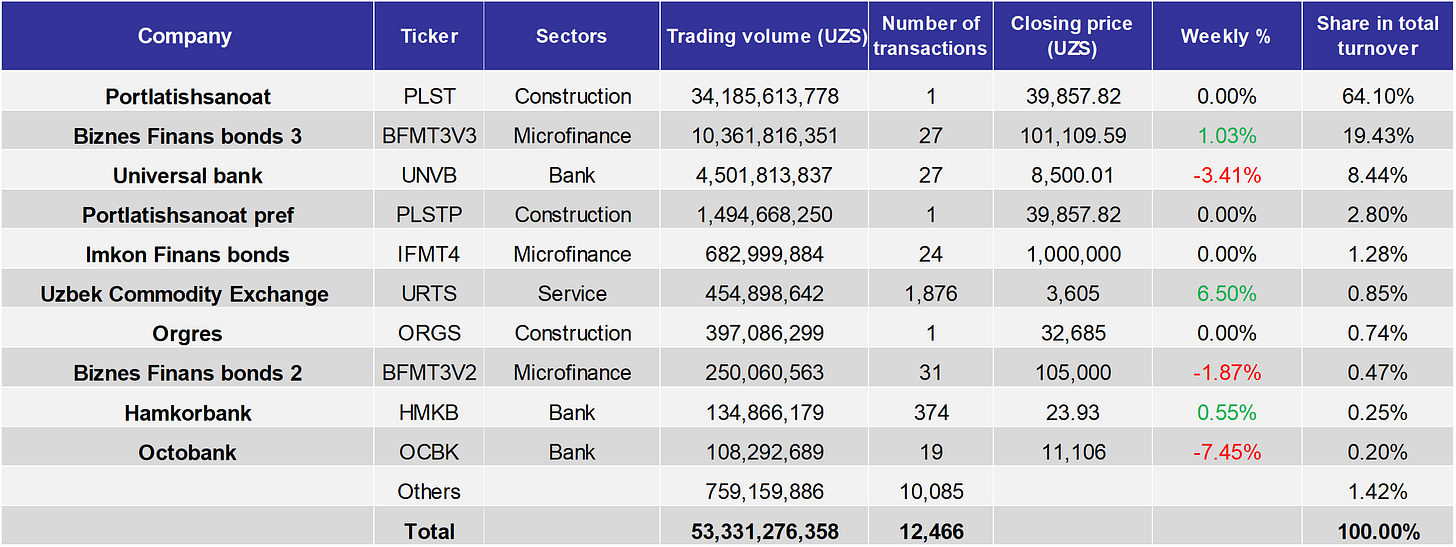

Throughout the period, trading volume on the Tashkent Stock Exchange reached 53.3bln UZS. The total number of securities traded stood at 72, seven lower than the previous period.

Transactions with recently listed shares of Portlatishsanoat JSC (PLST, PLSTP) constituted over half of the turnover this week. The deal volume equaled 35.7bln UZS at 39,857.82 UZS per share for both ordinary and preferred shares of the company. BFMT3V3 comprised almost a fifth of the total volume, this is the third bond issuance by Business Finance Microfinance Company LLC for 30bln UZS with a maturity of three years at 27%. UNVB accounted for nearly 8.4% of the total volume, with transactions related to the Chairman of the Board of the company, Mr. Irchaev Anvar, increasing his equity stake in the company to 12.13% at 5,000 UZS per share. Together, M&A deals comprised 67.6% of the turnover.

In terms of price movements, URTS recorded the highest increase in closing price, rising by 6.5%, while OCBK experienced the highest decline, dropping by 7.5%.

Over the two weeks, AVEX experienced a decrease of 6%.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Uzbekistan’s debt to Russia increased by $41.3mln in 2023;

ACWA Power to construct two photovoltaic power plants with total capacity of 1GW in the Samarkand and a 334 MW battery system in the Tashkent region;

In 9M2024, insurance market grew by 18.6% y-o-y, reaching 7trln UZS;

Foreign reserves in November decreased by 3.9% from $43.1bln to $41.5bln, including $623mln decline in gold;

The delivery market in Uzbekistan will grow by 10-15% annually;

Central Bank kept the key rate at 13.5%;

Uzbekistan proposes prolonging EU's GSP+ for another ten years and broadening the list of duty-free exports;

Uzum plans to attract $300mln in second funding round in 2Q2025 to fuel faster growth before its eventual IPO;

Government will continue subsidizing gas and electricity prices in 2025-2027;

Amount of state fees for issuing licenses in the crypto asset market has been approved;

ADB to support the provision of high-quality preschool education through PPP projects;

Grand Pharm to open logistics hub in Tashkent region;

Uzbekistan sent its block trade to Brazil through middle corridor for the first time;

Afghanistan to extend electricity import agreement with Uzbekistan until 2025;

South Korean KORAIL to develop a feasibility study for the Tashkent-Samarkand high-speed railway project;

Share of renewable energy in total electricity generation is planned to increase up to 54% by 2030;

TBC Uzbekistan to launch TBC Business - first fully digital banking service for SMEs and individual entrepreneurs;

Uzbekistan’s universities enter prestigious QS and Times Higher Education (THE) rankings for the first time;

Vietnamese ROX Group interested in implementing projects related to housing construction and development of recreational tourism in Uzbekistan;

Azerbaijani entrepreneur to construct Sea Breeze Uzbekistan international tourism center on the shore of Charvak reservoir;

Uzbekistan approved licensing rules for online gambling and lotteries;

Uzbekistan intends to attract $2bln in foreign investment for light industry in 2025;

President launched construction of six new energy infrastructure facilities with a total capacity of 2.5 GW. Share of renewable energy in total electricity generation reached 16%.