AVESTA Overview: February 3 - 14

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the period, trading volume on the Tashkent Stock Exchange reached 29.7bln UZS, nearly three times higher than the previous period. A total of 75 securities were traded, six fewer than in the prior two weeks. M&A transactions accounted for approximately 90% of the turnover.

YRFS represented 58.3% of the turnover this period, with a 17.3bln UZS deal. YGYM made up 28.6% of trades with an 8.4bln UZS deal at 2,407.94 UZS per share. Another M&A transaction involved ordinary and preferred shares of Portlatishsanoat JSC, totaling 897mln UZS at 39,858 UZS per share, contributing an additional 3% to the turnover. HMKB and URTS were also actively traded during this period, securing spots in the top 5 by volume and accounting for 6.1% of the turnover.

Over the two weeks, URTS’s closing price rose by 1.2%, from 3,498 to 3,540 UZS. In contrast, HMKB and UZMK closing prices fell by 10.4% and 9.7%, respectively.

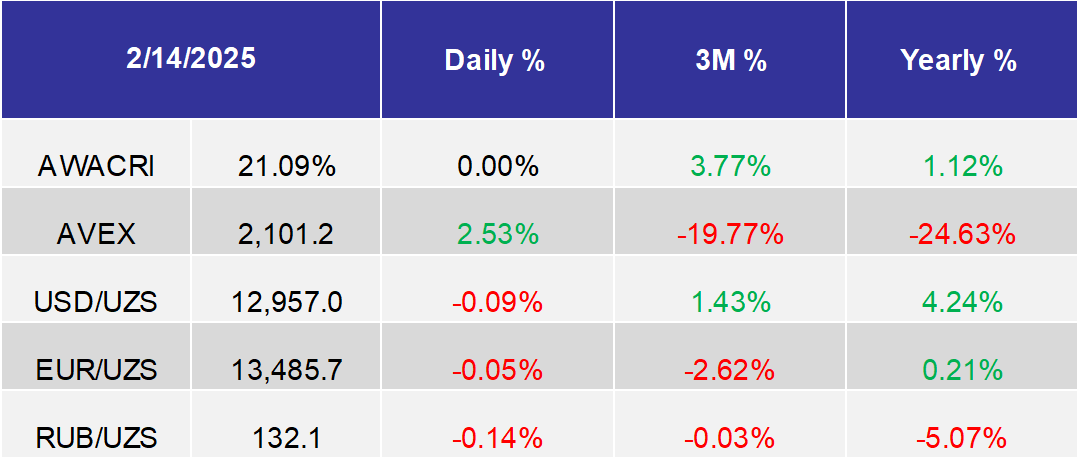

AVEX (Avesta Equity Index) decreased by 4.6% over the two-week period.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

TBC Uzbekistan doubled its loan portfolio and increased its net profit by 91% up to 514bln UZS in 2024;

President discussed nuclear energy sector development in Uzbekistan. Construction of small nuclear power in Jizzakh region will be implemented by Russian Rosatom;

Number of real estate transactions decreased by 2.2%, reaching 329k units in 2024;

In 2024, the volume of consumer and car loans decreased by more than half. Consumer loans dropped from 40.1trln UZS to 18.5trln UZS, while car loans fell from 36.6trln UZS to 17.1trln UZS;

In 2024, Uzbekistan's GDP reached 1.45 quadrillion UZS and grew by 6.5%, with GDP per capita at 39.1mln UZS;

Volume of microloans borrowed by citizens reached 45.8trln UZS in 2024, marking a 59.4% increase compared to 2023;

In 2024, Uzbekistan exported persimmons worth $57mln;

Foreign reserves in January increased by 4.2% from $41.2bln to $42.9bln, including $3bln increase in gold;

Uzbekistan plans to increase its fruit and vegetable exports to Russia to $1bln by 2030;

In 2024, volume of the unobserved economy reached 505.7trln UZS (approx. $40bln). Informal economy reached 383.6trln UZS (26.4% of GDP), while shadow economy amounted to 122trln UZS (8.4% of GDP);

Inflation in January reached 0.7% or 9.9% y-o-y;

Poverty rate in Uzbekistan decreased from 11% to 8.9% in 2024. Real income of population increased by 10.7%, reaching an average of 2.1mln UZS per capita per month;

Kvarts JSC (KVTS) to receive a 60bln UZS credit line from Asakabank JSCB, structured as a revolving multiproduct facility, including a short-term loan and recourse factoring, to support working capital needs.;

SQB JSCB (SQBN) obtained ESG rating from Sustainable Fitch%;

Uzmetkombinat JSC (UZMK) has announced the establishing of Bekobod DRI Plant LLC with a 25% stake in it. Additionally, Uzmetkombinat JSC (UZMK) holds a 49% stake in the PRO FARRO JV LLC;

Navoi Mining JSC (NGMK) received an ESG rating from Sustainable Fitch;

Indian Larsen & Toubro to build data center with capacity of 10MW in Uzbekistan;

In December, average interest rate on loans in local currency amounted to 23.4%. Interest rate for short-term loans reached 21.3% (-2%) and 24.4% (+0.9%) for long-term loans;

Georgian Reformatics to provide Uzbekistan with expert support in developing a tourism development strategy until 2040;

Number of tourists visiting Uzbekistan reached 8.2mln (+24.2%) in 2024.