AVESTA Overview: January 8 - 19

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

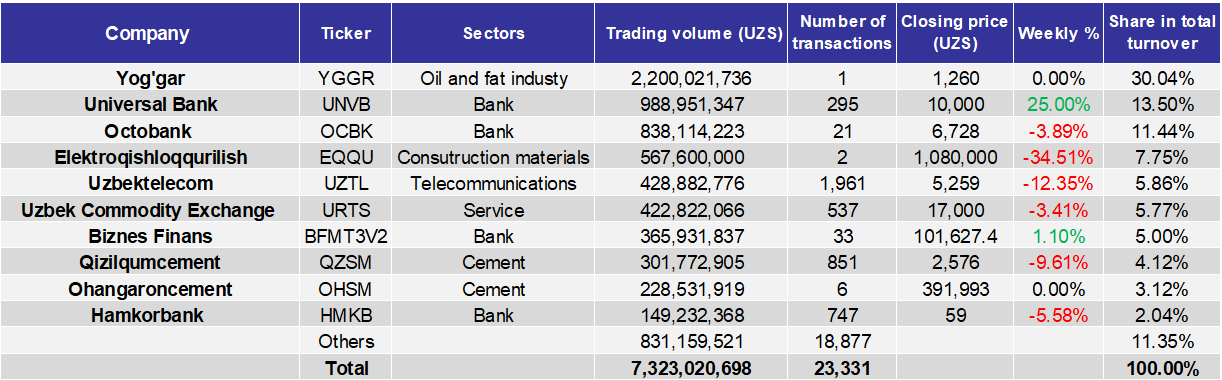

TASHKENT STOCK EXCHANGE

During the given trading period, trading on the Tashkent Stock Exchange reached 7.3bln UZS, which is 2.3 times lower compared to the previous two weeks. The total number of traded securities decreased by two, amounting to 91.

Nearly a third of the trading volume was contributed by YGGR with one transaction at a price of 9,270.08 UZS per share. UNVB contributed 13.5% to the total trading volume, and its closing price increased by 25% during the period. OCBK accounted for 11.4% of the total turnover.

EQQU contributed 7.8% with two transactions, however, its stock price declined by almost 35%. UZTL retained its position at the top by volume list contributing nearly 5.9% to the turnover, but its price by the end of the given period closed at 5,259 UZS, reflecting a 12.6% decline. Similarly, QZSM and HMKB closing prices also decreased by 9.6% and 5.6%, respectively.

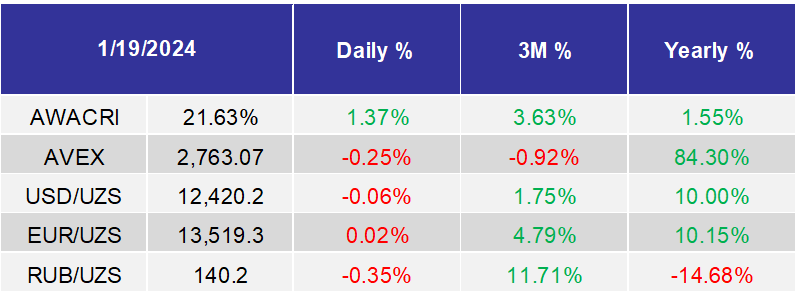

AVEX decreased by 1.6% during these two weeks.

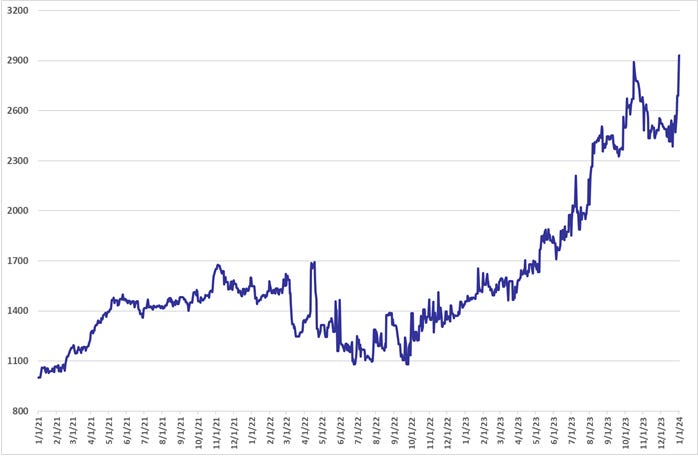

AVESTA EQUITY INDEX (AVEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

Uzbekistan plans to increase GDP by 6% up to $100bln in 2024;

A new TIR transport corridor connecting China and Uzbekistan has been activated;

Number of tourists who visited Uzbekistan increased by 26.9% in 2023;

WB estimates the GDP growth in 2023 in Uzbekistan at 5.5%, as well as the forecast for 2024 and 2025;

Cotton and textile clusters association signed an important agreement to improve working conditions in the industry;

In December, foreign reserves increased from $32.9bln to $34.6bln, including $0.9bln in gold, while the physical amount increased by 0.3mln ounces;

Asia Alliance Bank attracted a $4.5mln loan in the national currency from Symbiotics Investments. The loan was provided through the issuance of bonds and will be used to finance SMEs in Uzbekistan;

Car sales increased by 18% with 1.69mln vehicles sold in 2023. New passenger car sales reached 379k units (+33%). Imports of passenger cars rose by 2.2 times, totaling $1.56bln, partly due to reduced customs duties. Sales of EVs rose by 4.3 times with 25.7k units sold;

Trade volume between Uzbekistan and Afghanistan reached $266mln in 2023, 6.04 times increase compared to 2022;

Uzbek citizens will be able to enter the UAE without a visa for up to 30 days starting from February 16;

Singapore-based Wilmar International plans to build a $100mln plant near Tashkent, serving as a distribution hub for exporting flour, feed, and vegetable oils to the Middle East, Central Asia, and other countries;

The damage of the "shadow" economy on GDP amounted to 135trln UZS and on the state budget to 30trln UZS.

Copper processing to be increased up to 140k tons this year and up to 150k tons in 2025;

Santander, a Spanish bank, is considering entering the Uzbek market and allocating $500mln to finance investment projects in the country;

OVERVIEWCotton Grain Logistiks LLC became the owner of a 51% share in G'alla-Alteg JSC;

51% share in Buxoroneftegazparmalsh JSC (BNGP) was auctioned for 39.9bln UZS or 17,140.15 UZS per share. According to the latest available reporting company was valued at 0.99xBV and 14.7xP/E;

A 25% share in Maxsuselektrtarmoqqurilish JSC (METQ) was auctioned for 6.65bln UZS or 13,051 UZS per share. According to the latest available reporting company was valued at 1.42xBV and 32.1xP/E;

UzSAMA agreed to sell a 100% share in To'raqo'rg'on mexanika zavodi LLC with 10.97he of land to Elit Savdo LLC for 13.84bln UZS;

UzSAMA agreed to sell a 53.68% stake in Ishlab chiqarish tijorat markazi LLC with 0.47he of land to Ofelos Solution LLC for 14.2bln UZS;

Mr.Tursonov I.B. increased his share in Octobank JSCB (OCBK) up to 97.26%;

Humo Sugurta JSC decided to sell a 90.05% share in Milk Soft LLC for at least 87.7bln UZS;

Delta Global Dynamics LLC announced the offer to purchase shares from minorities of Qoqon Biokimyo JSC (QQBK) at 3,575 UZS per share.

NAPP suspended Kapital Sugurta JSC's (KASU) license for 10 days and imposed a fine in the amount of 162mln UZS;

UzAuto Korea JSC became the owner of a 24% stake in Uz-Dong Won Ko JSC;

Fitch affirms BB- rating with Stable outlook for Uzbekistan's Thermal Power Plants JSC (TPP);