AVESTA Overview: July 21 - 25

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

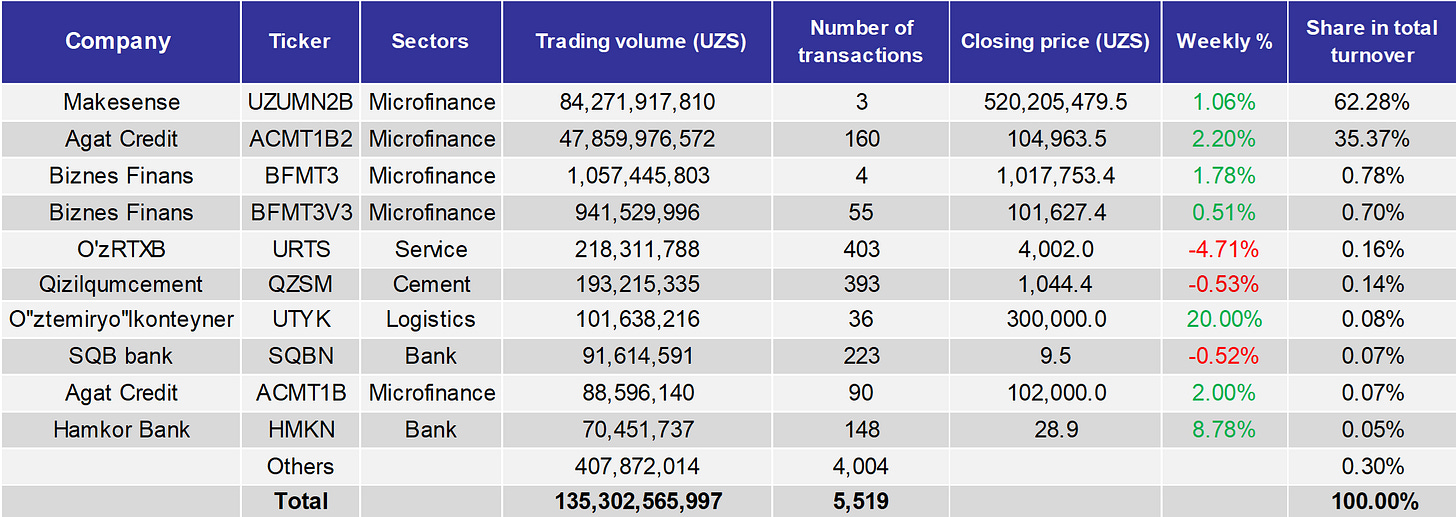

TASHKENT STOCK EXCHANGE

The total trading volume on the Tashkent Stock Exchange for the week reached 135.3 bln UZS across 5,519 transactions. Leading the market was Makesense (UZUMN2B), which accounted for 84.3 bln UZS through three large block deals. The stock added 1.06%, closing at 520,205,479.5 UZS.

Agat Credit (ACMT1B2) ranked second with 47.9 bln UZS in turnover, gaining 2.20% to 104,963.50 UZS. Its first line, ACMT1B, also showed solid growth, advancing 2.00% to 102,000 UZS with 88.6 mln UZS traded.

Biznes Finans (BFMT3) recorded 1.06 bln UZS in trades and rose 1.78% to 1,017,753.42 UZS. Its third line, BFMT3V3, added 0.51% to 101,627.40 UZS on a volume of 941.5 mln UZS.

Among notable movers, OʻzRTXB (URTS) fell 4.71% to 4,002.00 UZS with 218.3 mln UZS in weekly turnover, while Qizilqumcement (QZSM) edged down 0.53% to 1,044.40 UZS. In contrast, O‘ztеmiryo‘lkonteyner (UTYK) surged 20.00%, reaching 300,000 UZS on 101.6 mln UZS traded.

In the banking sector, SQB Bank (SQBN) slipped 0.52% to 9.50 UZS, whereas Hamkor Bank (HMKN) jumped 8.78% to 28.87 UZS, finishing as one of the week’s strongest performers with 70.5 mln UZS in trades.

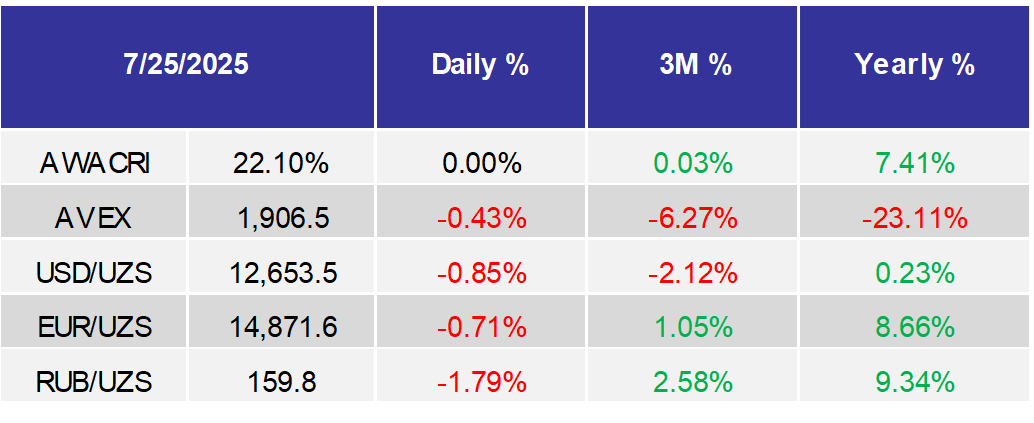

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Avesta Investment Group named “Uzbekistan’s Best Investment Bank” at Euromoney Awards for Excellence 2025.

Chinese company Baibuting Group has launched a $1.8bln green energy project in Ahangaran. The first phase includes the construction of two 240 MW solar power units, with future stages adding wind, hydro, and biomass energy to reach a total capacity of 2 GW.

Uzbekistan’s real estate market grew by 10.6% in the first half of 2025, with 136,500 housing units sold, according to the Center for Economic Research and Reforms. Despite higher transaction volumes, average secondary housing prices fell by 4.8% year-on-year, with Tashkent showing the sharpest decline.IMF:

In the 1H2025, over 1,800 foreign-invested companies were established in Uzbekistan, with China, Russia, and Turkey leading investor nations—most active in trade, industry, and construction.

Uzbekistan’s 1H2025 GDP rose 7.2%, inflation eased to 4.2%, income growth slowed to 9.5%, and exports surged 29.2%.

In June 2025, average rent in Tashkent was $8.1/m²—down 2.6% y-o-y, with Mirabad highest at $10.8/m² and Bektimir lowest at $5.6/m².

Kazakhstan's Halyk Bank agreed to purchase 49% shares of Click, Uzbekistan's largest fintech, for combination of cash and 49% in its Uzbek subsidiary, Tenge Bank.

Agat Credit and Delta issued 45 bln UZS in bonds with 28% annual yield, now trading on the Tashkent Stock Exchange.

A modern tourism cluster will be built along the Aydar-Arnasay lake system as part of $662mln in regional investments transforming Jizzakh into a key hub for agriculture, industry, and innovation.

In 1H2025, Uzbekistan became a net electricity exporter for the second time since 2020, earning $100.6mln from exports and importing just $65.3mln.