AVESTA Overview: July 21 - August 1

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

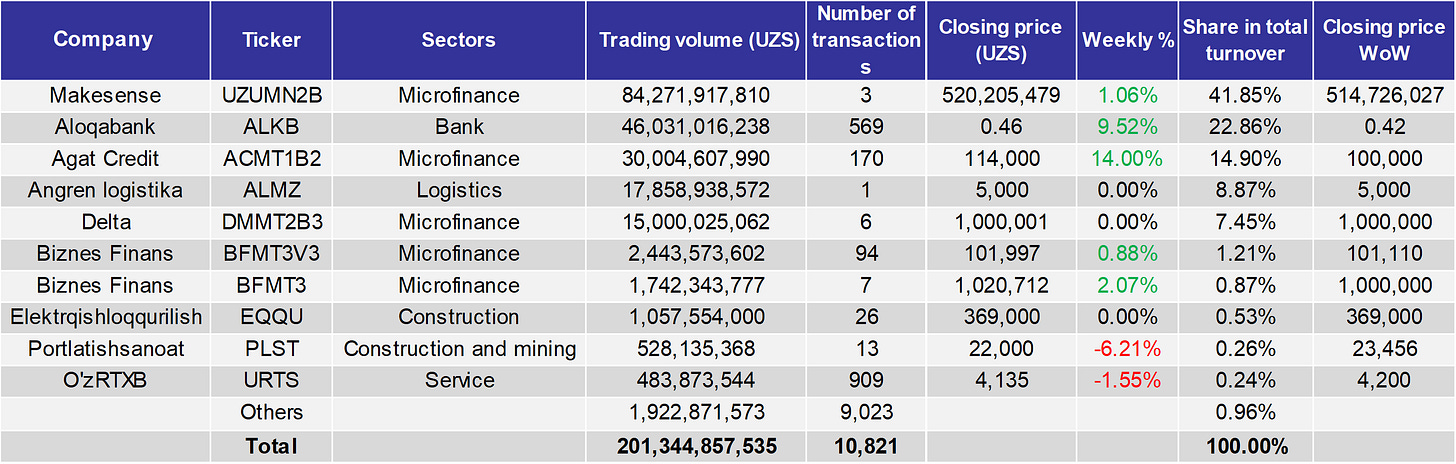

During the week, turnover on the Tashkent Stock Exchange reached 201.3bln UZS, while the number of transactions accounted for 10,821.

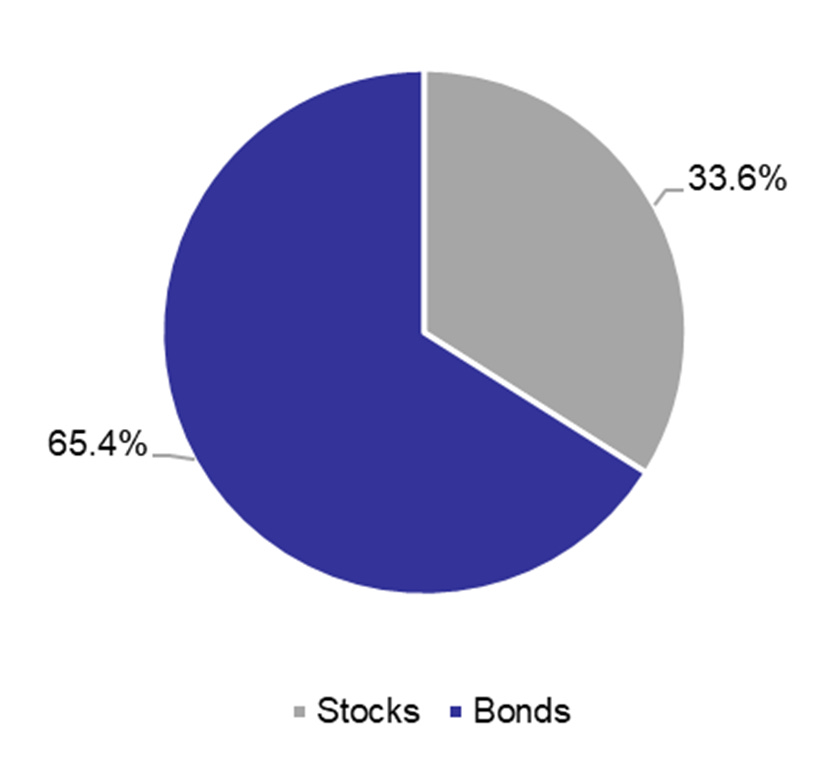

In this period, stocks accounted for about 33% of the total turnover. Aloqabank (ALKB) was the primary contributor, representing 22.9% of the total turnover with a trading volume of over 46bln UZS. Angren logistika (ALMZ) was the second-largest contributor from this segment, trading over 17.9bln UZS in a single transaction, and its turnover accounted for 8.9% of the total market. Other listed stock securities had comparatively minimal shares in the overall trading volume.

Bonds, all originating from the microfinance sector, comprised about 67% of the total turnover. The leading bond was from Makesense (UZUMN2B), which contributed 41.9% of the total market turnover, totaling 84.3bln trading volume. Other significant contributors from the microfinance sector included Agat Credit (ACMT1B2) and Delta (DMMT2B3), which collectively represented over 22% of the total turnover. During the period, they issued 45bln UZS in bonds with 28% annual coupon rate.

An analysis of weekly price changes reveals that four of the listed companies experienced an increase in their w-o-w prices. Agat Credit (ACMT1B2) recorded the highest appreciation in value, with its shares rising by 14% to 114,000 UZS. Aloqabank (ALKB) followed with a 2.2% increase, moving to 0.46 UZS per share. The most substantial decline was recorded by Biznes Finans (BRBN), with its shares dropping by 16% to 80 UZS.

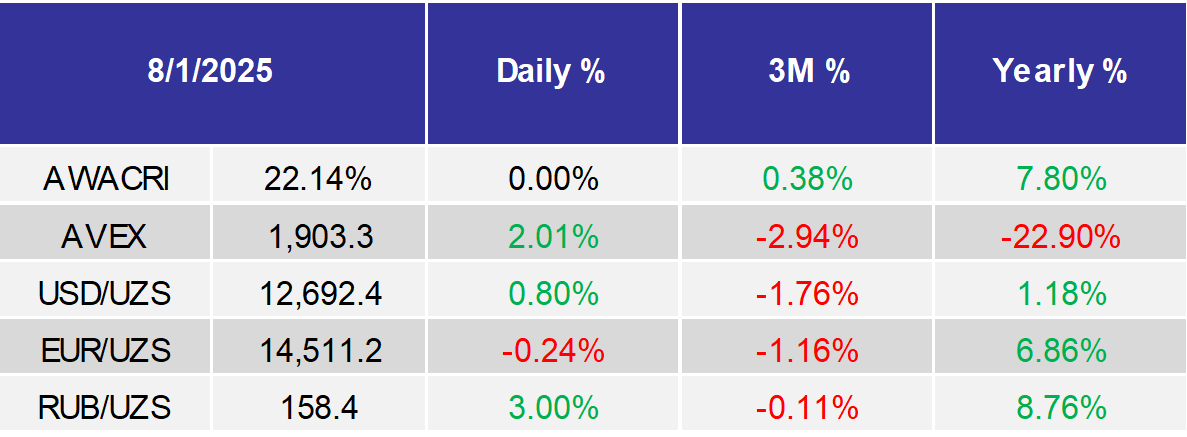

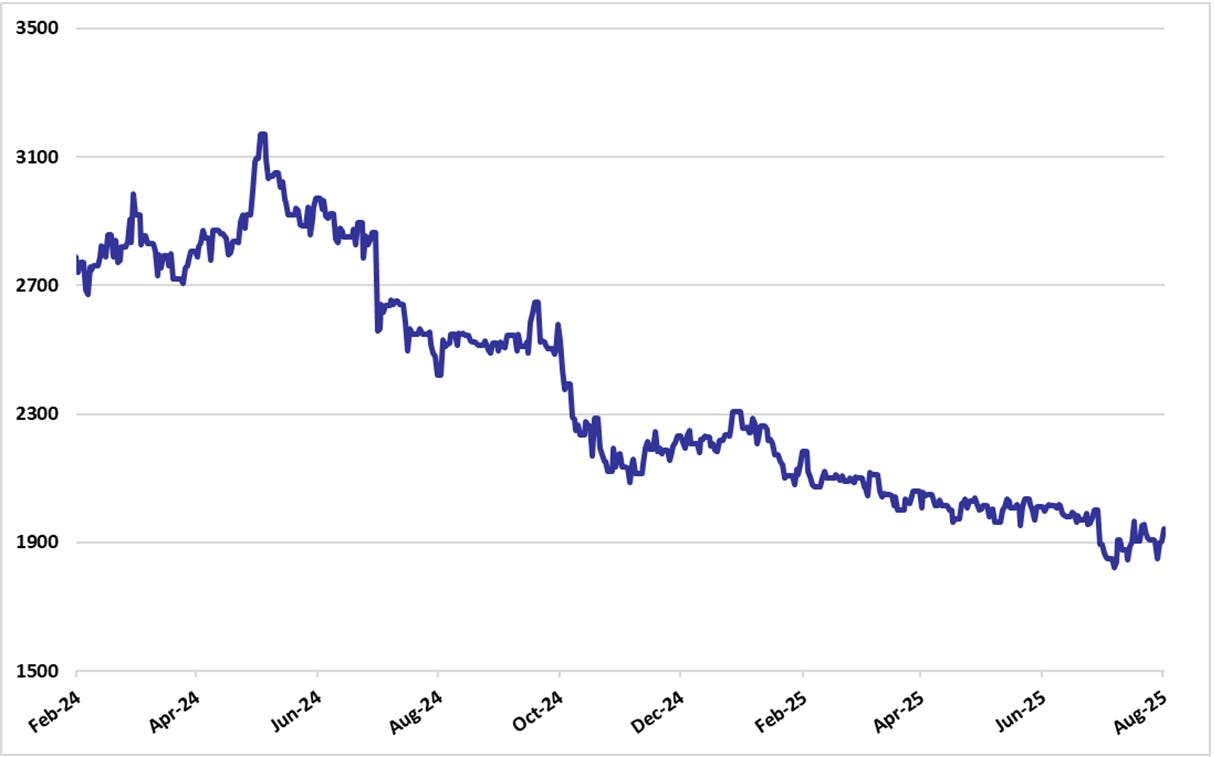

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

TBC Bank JSC signed a $58.95mln agreement with Space International JSC (Georgia) to expand licensed services, approved on 24 July 2025 by the Supervisory Board, and representing 28.64% of net assets;

Hayot Bank JSC issued 10 deposit certificates at 500mln UZS each via open subscription, totaling 5bln UZS;

To‘raqo‘rg‘on Paxta Tozalash JSC ceased operations effective 31 July 2025, following a shareholder resolution; creditor claims will be accepted until 30 September;

AVO Bank JSC updated its list of affiliated parties on 1 August 2025, adding board member Ondrej Grich;

Ipak Yo‘li JSCB (IPKY) announced on 31 July 2025 the creation of Ipak Yuli Technologies LLC (100% owned) and reaffirmed full ownership of Osiyo Sarmoya Depo LLC;

Payme JSC signed a 30bln UZS loan agreement with affiliated entity TBC FIN Service LLC

Agat Credit LLC unanimously approved its transformation into a Joint Stock Company (JSC), set a charter capital of 73.7bln UZS and appointed Anton Dmitriev as General Director;

Shareholders of Kapital Sugurta JSC (KASU) approved a dividend payout of 0.0006 UZS per preferred share, with no payments on ordinary shares.