AVESTA Overview: July 7 - 18

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

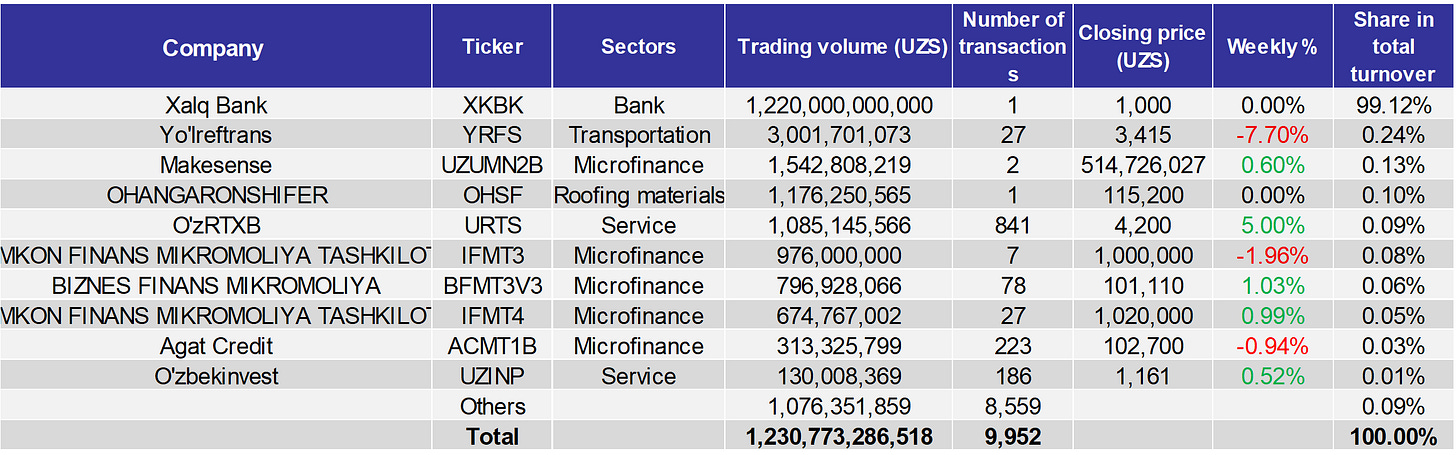

During the week, turnover on the Tashkent Stock Exchange reached 1.23trln UZS, by 40% lower than the previous period, while the number of transactions accounted for 9,952 and remain stable.

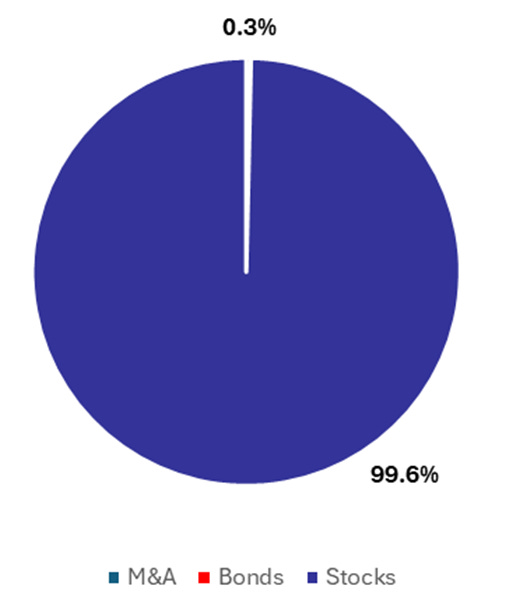

In this period, stocks accounted 99.6% of the total turnover, primarily due to Xalq Bank (XKBK) which represented 99.1% of the total turnover, totaling 1.2trln UZS trading volume. Yo’lreftrans (YRFS) followed, however at much smaller scale of over 3bln UZS, with 27 transactions, and the total turnover of around 0.2%. Other listed stock securities held comparatively minimal shares in the overall trading volume.

Bonds compromised only 0.3% of the total turnover, all of which originating from the microfinance sector. Top 3 in the list, Makesense (UZUMN2B) contributed over 0.1% of the total turnover, leading the bond segment. Other significant contributors from the microfinance sector included Imkon Finans Mikromoliya Tashkiloti bonds (IFMT3 and IFMT4) collectively representing approximately 0.1%, Biznes Finans Mikromoliya (BFMT3V3) and Agat Credit (ACMT1B), both below 0.1%.

An analysis of weekly price changes reveals that 50% of the top 10 listed companies experienced increase in their w-o-w prices. O’zRTXB (URTS) recorded the highest appreciation in share value, rising by 5%, to 4,200 UZS. Biznes Finans Mikromoliya (BFMT3V3) followed with around 1% increase, moving from 100,074 to 101,110 UZS per share. Makesense (UZUMN2B) saw a slight increase in its weekly percentage change of around 0.6% led to a 3,082,192 UZS increase in its w-o-w closing price. Yo'lreftrans (YRFS) recorded the most substantial decline, with its shares dropping by 7.7%, to 3,415 UZS.

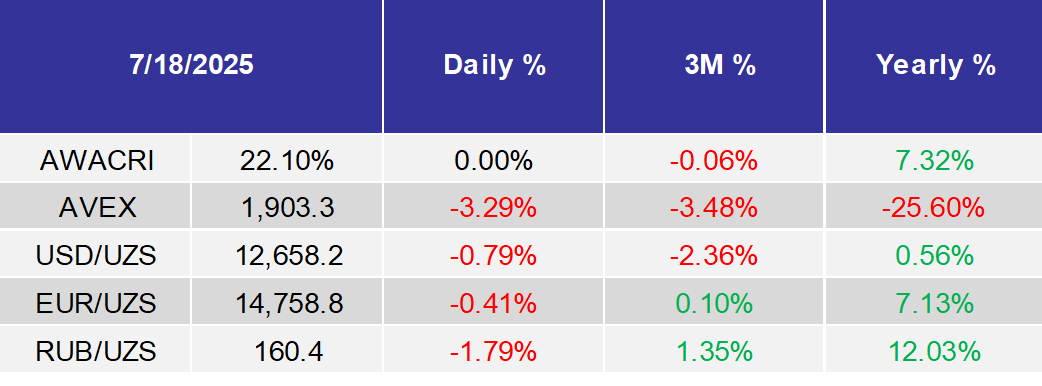

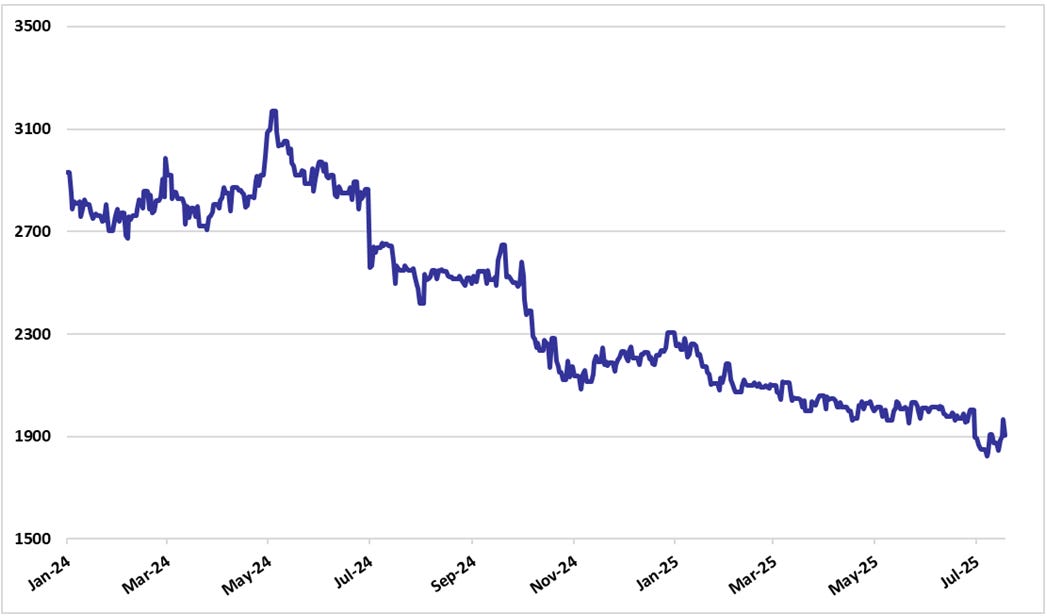

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

O‘zmetkombinat JSC (UZMK) signed a €6.7mln credit agreement with the NBU for a 12-month loan;

Agat Credit LLC registered 30bln UZS corporate bonds issue with 1 year maturity and 28% interest paid on monthly basis

Uzauto Motors Powertrain JSC approved 2024 dividends—0.4469 UZS per share for ordinary shares; no payments on preferred shares or bonds;

O‘zmetkombinat JSC (UZMK) will pay 300 UZS per preferred share for 2025, no dividends for ordinary shares;

O‘zsanoatqurilishbank JSCB (SQBN) will pay dividends of 4.37 UZS per preferred share for 2024FY; no payments on ordinary shares;

O‘zbektelekom JSC (UZTL) will pay dividends of 76.3 UZS per ordinary share and 288.5 UZS per preferred share for 2024FY;

Ipak Yo‘li Bank JSICB (IPKY) will pay 0.152 UZS share dividends on both ordinary and preferred shares;

Future Open Technology Group issued a 100bln UZS (https://new.openinfo.uz/facts/21/14958) loan to affiliated party Mr.Tashpulov Sh.A.;

DELTA MIKROMOLIYA TASHKILOTI (DMMT2B) issued 15bln in corporate bonds, 2 years maturity with 28% annual coupon payable on the monthly basis;

Gulamov Bexzod Shuxratovich acquired a 43.51% stake in MULTIPAY AJ;

TBC Bank JSB signed a $10mln credit agreement with its affiliate TBC Bank Group PLC;

NBU Invest Group LLC handed over the stakes in NBU Green House Dream LLC and Kattakurgan Business Services LLC. According to a state register, the 100% stake in the first company is now controlled by Ko'hna Khorazm Agro Eksport LLC, and in the second by UzSAMA;

Biokimyo JSC (BIOK) will pay 1,000 UZS dividends per ordinary share;