AVESTA Overview: July 8 - 19

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the given period, trading on the Tashkent Stock Exchange amounted to 2.9bln UZS, which is 63 times lower than the previous period. This difference in volumes is due to an M&A transaction involving KPBA shares, which accounted for 86.5% of the previous period's turnover, totaling 156.7bln UZS at a price of 950 UZS per share. However, there were no M&A transactions during the current period, leading to a substantial decrease in overall trading volumes. Excluding the impact of M&As, the turnover still decreased by 10.7 times compared to the previous period. The number of securities traded totaled 77, seven less than the previous period.

Bonds continue to contribute significantly to the turnover on the exchange, with BFMT3V2 and IFMT4 together accounting for 46.5% of the total volume. Among stocks, UZMK, URTS, and IPKY were the top contributors, each accounting for approximately 8% of the turnover.

The closing price of IPKY declined by almost 29%. Conversely, UZMK experienced a price decline of 6.9%, while the price of URTS declined by 1.2%.

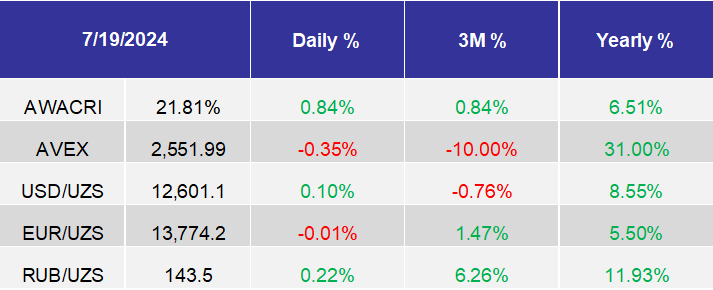

AVEX decreased by 3.3% during these two weeks.

Turnover breakdown (July 8 – 19, 2024)

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

In 1H2024, 3.5mln+ foreign tourists visited Uzbekistan, indicating an increase by 415k or 13% compared to 2023;

Uzbek-Iranian Petrochemical cluster 'Petrochem' near Bukhara to launch production in autumn and produce goods worth $240mln annually;

Foreign reserves decreased from $36.6bln to $36.3bln, reflecting an 0.8% decline. However, there is a 0.3mln ounces increase in the physical gold reserves reaching up to 11.7mln ounces or $27.3bln;

Almalyk Mining JSC (AGMK) exports decreased by 21.8% and reached $283.3mln, including 23,760 tons of copper (-20.8%) and 12,702 tons of zinc (-27.6%) products in 1H2024;

Fitch affirms Xalq Bank JSCB with BB-

Banking NPL in June reached 4.0%, including 4.4% for state-owned banks and 3.3% for private.

The Asian Development Bank (ADB) to provide Uzbekistan with a $100mln loan to modernize 230 perinatal medical centers;

Largest logistic hub in Samarkand, "Samarkand-Logopark" with the area of over 40k sq.m. to open in 2025;

Japan Bank for International Cooperation (JBIC) will invest in a portfolio of joint initiatives worth over $3.7bln in Uzbekistan;

China's Henan to invest $400mln in developing coal mines in Uzbekistan;

TBC Bank Uzbekistan attracted $38.2mln from EBRD, IFC and its parent company to introduce new financial products;

Delivery automation startup, Delever, to attract $100.000 from Aloqa Ventures;

OVERVIEWFitch assigned Navoi Mining JSC (NGMK) BB- rating with Stable outlook;

Fitch Ratings has affirmed Uzbekistan’s Microcreditbank at a ‘BB-’ rating with a stable outlook;

Biokimyo JSC (BIOK) attracting the 24.5bln UZS loan from Ipak Yuli Bank JSCB (IPKY) under the collateral of the main productional buildings;

TBC Bank JSCB established a 100% subsidiary Qulay Insurance LLC with an initial capital of 22bln UZS. It is expected, that the company will apply for a life insurance license;

Kogon yog-ekstraksiya zavodi JSC (KYEZ, KYEZP) was delisted from the Tashkent Stock Exchange from July 17th, 2024.