AVESTA Overview: June 23 - July 4

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

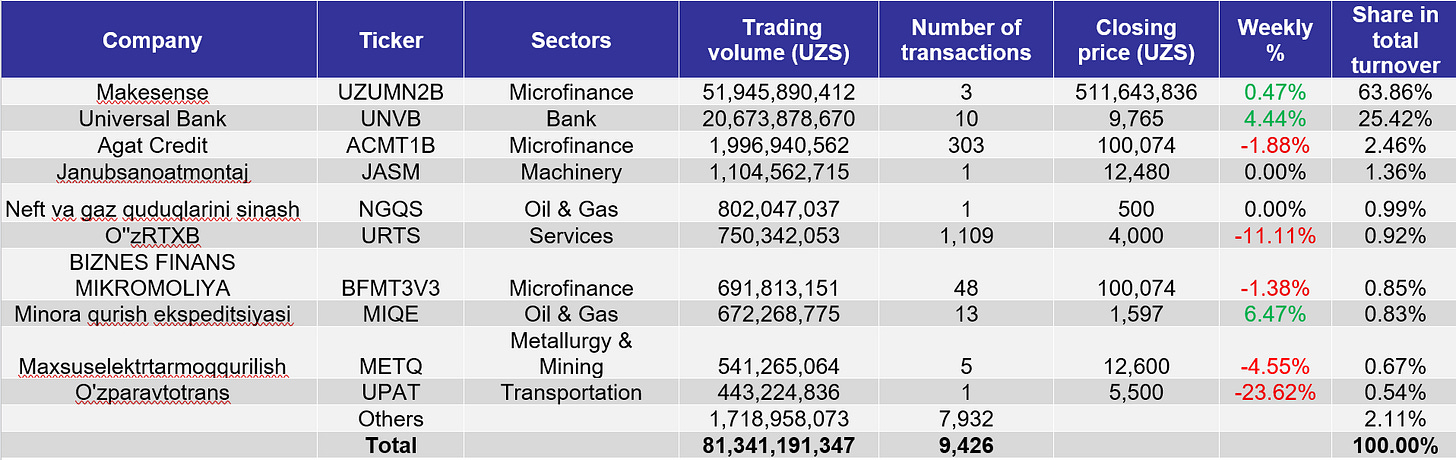

Total trading volume on the Tashkent Stock Exchange during the period reached 81.3bln UZS, with 9,426 deals made. Most of the activity came from a small group of companies. Universal Bank (UNVB) had the highest trading value among stocks and its price increased by 4.4%. Minora qurish ekspeditsiyasi (MIQE) rose by 6.5%, and Janubsanoatmontaj (JASM) traded flat at 12,480 UZS per share. In contrast, O‘zparavtotrans (UPAT) dropped by 23.6%, though this was based on only one deal.

Other notable names included O‘zRTXB (URTS), which had the most transactions — over 1,100 — despite falling by 11.1%. Maxsuselektrtarmoqqurilish (METQ) decreased by 4.6%, while Neft va gaz quduqlarini sinash (NGQS) and BIZNES FINANS MIKROMOLIYA (BFMT3V3) remained stable. Trading volumes were relatively low across the board, and price movements were mostly tied to isolated transactions.

Bond trading was focused mainly on microfinance companies. Makesense (UZUMN2B) made up 63.9% of total turnover, with three trades totaling 51.9bln UZS. Agat Credit (ACMT1B) followed with over 300 trades and 2.0bln UZS in volume. Bond prices stayed mostly unchanged throughout the period.

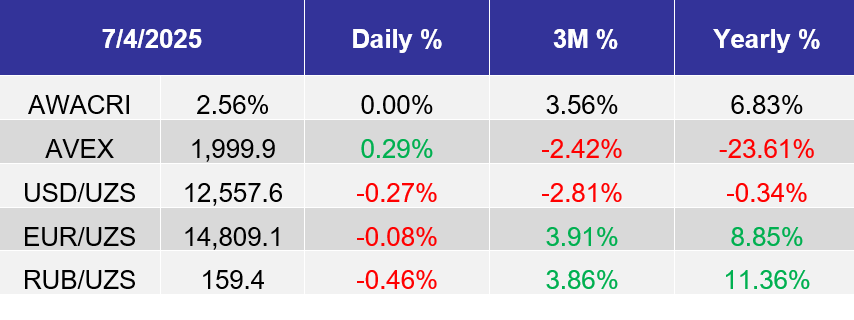

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

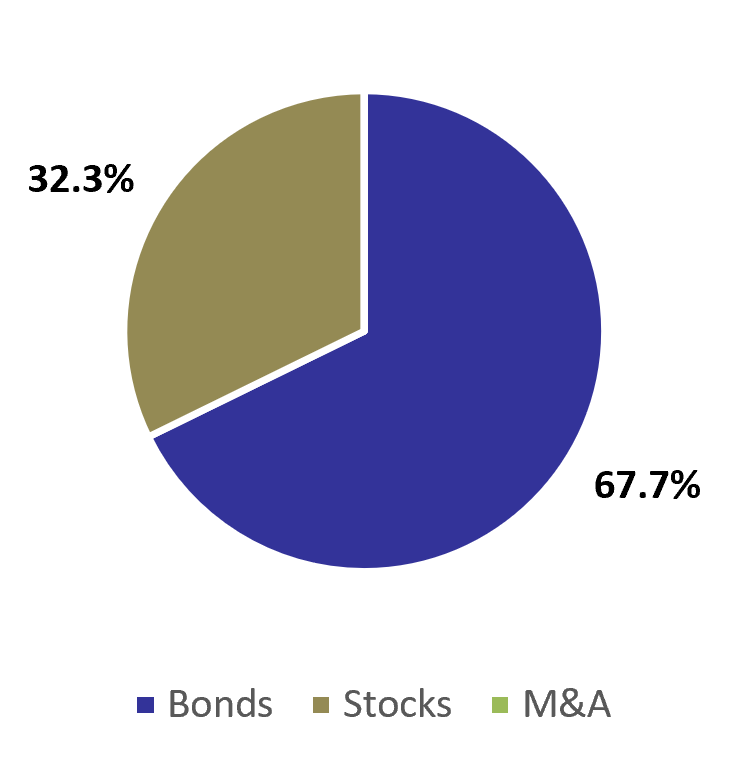

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

NavoiyUran SE places 5-year USD-denominated $300mln Eurobond at record-low coupon of 6.70% on LSE with $1.3bln oversubscription, which enabled to decrease the rate from the initial level of 7.250-7.375%.

Following the upgrade of sovereign rating, Fitch upgrades to BB the ratings of the three state-owned banks: NBU, SQB (SQBN) and Asakabank.

AIIB is considering to provide Uzbekistan with $71.1mln loan to upgrade rural roads in Khorezm and Karakalpakstan.

IMF: Uzbekistan’s PPP portfolio grows to $31bln, but fiscal risks remain elevated

Renesans Microfinance signed a 15bln UZS loan agreement with affiliated firm Renesans Credit;

Hamkorbank (HMKB) signed a 15bln UZS loan deal with affiliated firm Hamkormazlizing;

Renesans Microfinance signed a 24.1bln UZS loan agreement with affiliated firm Orient Capital Management, with a 14-month term at 27% interest;Renesans Mikromoliya Tashkiloti JSC obtained a 10bln UZS loan from Universal Bank JSCB (UNVB);

Trade turnover of Central Asian states with China is growing, which will reach $100bln this year according to estimations.

China Eximbank signs $500mln deal to finance Uzbek telecom infrastructure.

TBC Bank Uzbekistan JSCB attracted $12.5mln from the Dutch Triple Jump.

WB to provide $150mln to support development of hydro power systems.Tashkent.

IT Park Ventures invested over $1.56mln in five Uzbek startups.

Gold made up 44% of Uzbekistan’s exports in early 2025, totaling $6.5bln—up 54.8% y-o-y.