AVESTA Overview: June 24 - July 5

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

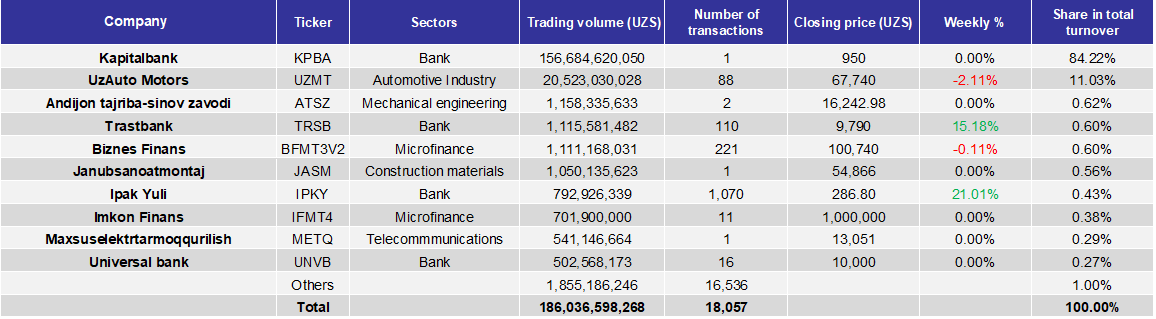

During the given period, trading on the Tashkent Stock Exchange amounted to 186bln UZS, which is 23.9 times higher than the previous period. This difference in volumes is due to an M&A transaction with KPBA shares for 156.7bln UZS at 950 UZS per share which accounted for 86.5% of the turnover. Other M&A deals included ATSZ for 1.2bln UZS at 16,242.98 UZS per share, JASM for 1.1bln UZS at 54,866 UZS per share and METQ for 541.1mln UZS at 13,051 UZS per share. The number of securities traded totaled 84, ten more than the previous period.

Excluding the effect of KPBA and ATSZ deals, UZMT was the biggest contributor accounting for 72.8% of the turnover. Bond transactions contributed to 6.4% of the volume, while previous period their presence was much higher comprising 20.2% of the total volume.

IPKY and TRSB saw their closing prices rise by 21.01% and 15.18%, respectively. Conversely, UZMT (-2.11%) and BFMT3V2 (-0.11%) prices declined. The prices of remaining securities in the top 10 by volume remained unchanged.

AVEX decreased by 8.8% during these two weeks.

Turnover breakdown (June 24 – July 5, 2024)

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

Seasonal deflation in June reached 0.24% or 10.6% y-o-y inflation;

Almalyk Mining JSC (AGMK) to invest $15bln to double the copper production;

Chinese MingYuan to build $1.2bln technology park in Jizzakh region;

Czech Nymwag to build a factory for production of 2,000 wagons per year;

Canadian Condor Energies to initiate multi-well workover campaign for eight gas-condensate fields it operates in Uzbekistan;

Agency for Strategic Development proposed to construct a shopping mall for $60mln in Tashkent region;

Uzbekistan plans to lift price caps on medical products and over-the-counter drugs introduced in 2017;

Korea Western Power (KOWEPO) has initiated a significant greenhouse gas reduction project in Uzbekistan, expected to cut approximately 120K tons of greenhouse gas emissions over the next decade;

Chinese Shiyan Zhenke Industrial Technology to produce special equipment in Fergana for $40mln;

IFC to provide a sustainability-linked loan of $250mln to Coca-Cola Icecek and its subsidiaries in Uzbekistan, Tajikistan and Iraq;

Spain is exploring the possibility of hiring workers from Uzbekistan to address labor shortages of around 700k in its construction sector;

OVERVIEWS&P assigned Navoi Mining JSC (NGMK) BB- rating with Stable outlook;

Fitch assigned Kapitalbank JSCB (KPBA) B rating with Stable outlook;

S&P Global upgraded Kapitalbank's JSCB (KPBA) rating from B to B+ with a Stable outlook;

National Bank of Uzbekistan JSC (NBU) placed bonds on London Stock Exchange in two tranches totaling $411mln:

- 5-year maturity USD-denominated bonds for $300mln;

- 3-year maturity UZS-denominated bonds for 1.4trln UZS ($111bln).