AVESTA Overview: March 17 - 28

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

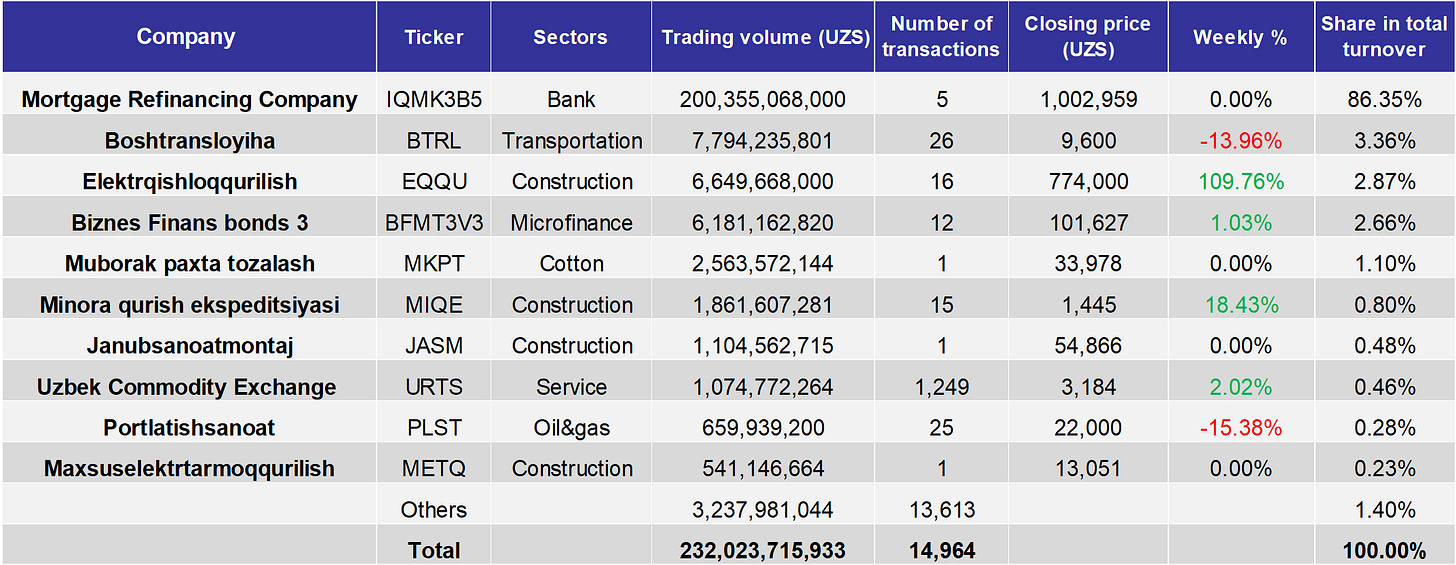

During the period, trading volume on the Tashkent Stock Exchange reached 232bln UZS with 81 securities traded—one more than in the previous two weeks.

This period, the top 10 securities by trading volume mainly consisted of M&A and bond transactions with URTS being the only stock to make the list. The largest contributor to turnover was the recently listed bonds from the Mortgage Refinancing Company of Uzbekistan (IQMK3B5), which accounted for 86.4% of total trading volume. These bonds were issued through a closed subscription involving the Deposit Guarantee Fund, Freedom Finance LLC, Uzbekinvest JSC, and several state-owned banks, totaling 200bln UZS at an 18% rate with a three-year maturity.

In M&A activity, EQQU transferred 5.13% of its equity stake at 774,000 UZS per share (compared to a market price of 369,000 UZS, which has stayed at this level since last June) in a 6.5bln UZS transaction. Other M&A transactions involved BTRL, MKPT, MIQE, JASM, PLST, and METQ. Excluding the impact of IQMK3B5 transaction, M&A deals collectively contributed nearly 67% of the total turnover.

Bond trading on the main platform remained active, making up 20.7% of turnover, with BFMT3V3 alone seeing 6.2bln UZS in trade volume. Meanwhile, URTS stood out among stocks, with 1bln UZS in trades and a price increase of 2.02%, rising from 3,121 to 3,184 UZS per share.

AVEX (Avesta Equity Index) slightly increased by 0.1% over the two-week period.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Foreign trade turnover for January-February 2025 reached $10.8bln, up 9.9% y-o-y. Exports rose to $4.6bln (+27.7%), while imports slightly declined to $6.2bln (-0.6%);

Banking NPL in February remained at 4.5%, unchanged from January, with state-owned banks at 4.6% and private banks at 4.3%;

ITFC has signed a $20mln agreement with Trustbank JSCB (TRSB), aimed at supporting SMEs, women-led businesses, green financing initiatives, and food security programs. This deal is part of a $600mln framework agreement between Uzbekistan and ITFC, bringing Trustbank JSCB’s (TRSB) total financing from ITFC to $44mln;

UAE-based Metito to develop new projects in the water sector, including a $90mln sewage treatment plant construction project in Namangan;

Uzbekistan's gross agricultural output increased by 18.5% from 2019 to 2024, reaching 444.6trln UZS, with an average annual growth rate of 3.5%. This level of agricultural production surpasses the combined output of Kazakhstan, Tajikistan, and Kyrgyzstan;

China's Menoble will invest $10mln to establish Central Asia’s largest agricultural machinery plant in Uzbekistan, accelerating the modernization of the agricultural sector;

Chinese investors will invest $1bln to build incineration plants in six regions of Uzbekistan. Project companies will be established in each region, and the electricity generated will be sold to Uzenergosotish SOE, which was created to manage unified electricity purchases and sales;

In January-February, 1.3mln foreigners visited Uzbekistan, including 361.2k tourists, marking a 37.1% y-o-y increase;

Uzbekistan Airports JSC to issue debut eurobonds for $100mln by the end of the year;

NavoiUranium SOE to export uranium worth €9mln to France via Russia;

According to the National Statistics Committee of Uzbekistan, the country exported gas worth $42mln in January-February 2025, marking a y-o-y growth of 57.3%;

Quva don mahsulotlari JSC will increase its capital by issuing additional shares, using funds from the State Agricultural Support Fund to settle its debt to Uzdonmahsulot JSC. The company’s charter sets the maximum number of authorized shares at 150mln shares with a nominal value of 390 UZS;

Hamkorbank JSCB (HMKB) has opened a credit line for Elektrqishloqqurilish JSC (EQQU) to issue bank guarantees of up to 50 bln UZS for participation in tenders for power transmission line construction;

Makesense LLC has amended its corporate bond issuance decision, increasing the number of bonds from 300 to 600 while maintaining the total issuance volume at 300bln UZS under open subscription;

Uzagroleasing JSC (UZAL) will issue 250mln shares with a nominal value of 2,535 UZS, totaling 633.75bln UZS. Additionally, a previously issued UFFR loan of $50mln (625.4bln UZS) will be used to increase the company’s charter capital. These funds will be allocated to the UFRD as payment for newly issued shares.