AVESTA Overview: March 18 - 29

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

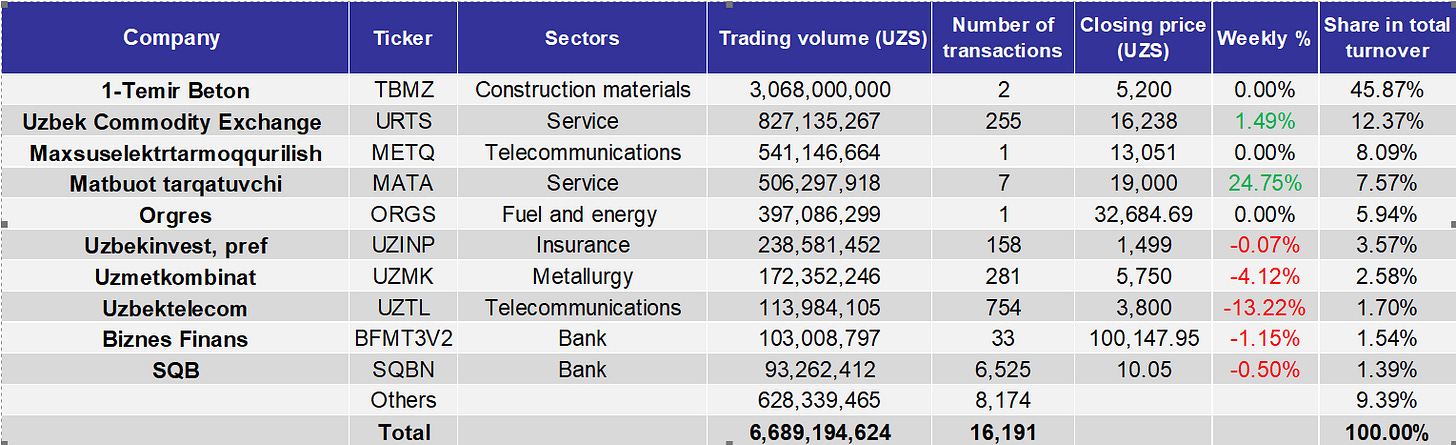

TASHKENT STOCK EXCHANGE

During the given period, trading on the Tashkent Stock Exchange reached 6.7bln UZS, which is 7.6 times less compared to the previous two weeks. The sharp decrease in volumes is due to the transactions with UNVB shares which comprised 94% of the turnover in the previous period. The total deal volume amounted to 50.9bln UZS at 5,000 UZS per share. The transaction likely took place as part of the company’s Chairman of the Board Mr. Anvar Irchaev further increasing his equity stake in the company, as previously, he increased his share in the company from 4.99% to 5.11% at 8,000 UZS per share for 2.5bln UZS.

Similarly, in this period half of the turnover was contributed by two transactions with TBMZ shares for 3.1bln UZS at 5,200 UZS per share. Excluding the impact of the aforementioned transactions, the trading volume increased by 11.2%. The total number of traded securities decreased by one, resulting in a total of 87 securities traded.

Only MATA and URTS closing prices saw an increase of 24.8% and 1.5%, respectively. UZTL and UZMK closing prices saw the sharpest decline of 13.2% and 4.1%, respectively. The remaining securities’ closing prices from the top 10 list declined or remained unchanged.

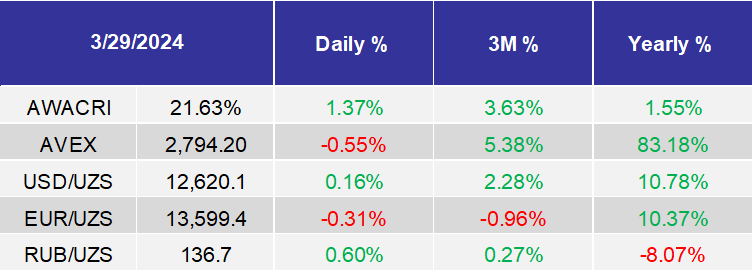

AVEX increased by 0.1% during these two weeks.

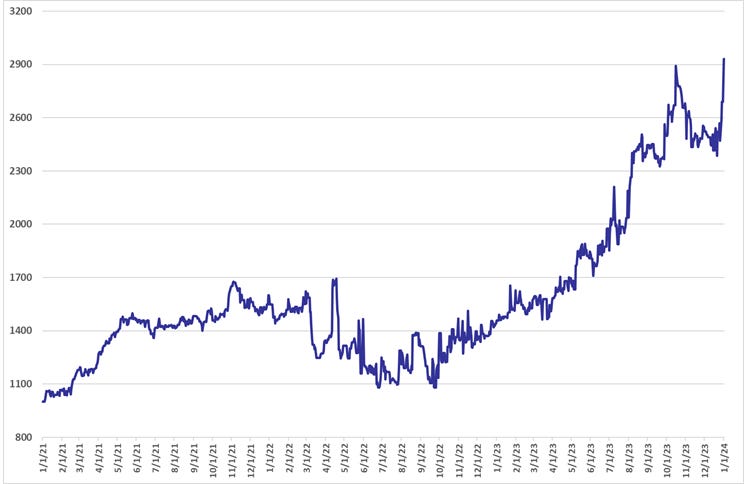

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

Uzbekistan to build a chemicals plant for $10bln in Khorezm region;

Gold production by Navoi Mining JSC increased by 25% from 2016 to 2023;

Uzbekistan plans to increase annual production capacity of the BYD electric automobiles plant from 50 to 500k cars;

Uzbekistan plans to triple the natural gas import from Russia in 2024;

CITIC Construction plans to participate in the toll road construction projects in Uzbekistan;

Modern gold rush for private gold digging started in Uzbekistan;

China's largest overseas investment in a single-unit electrochemical energy storage project officially broke ground in Angren;

Chinese Cnood Asia to invest $325mln into a new textile plant in Namangan;

My Freighter cargo airline received the third Boeing 767;

China Mining Energy Group plans to invest $200mln into copper production in the Namangan region;

Government approved the indexation of the pension to CPI rates;

Uzum ecosystem attracted $114mln, becoming the first unicorn technology company in Uzbekistan with an estimated valuation of $1.16bln;

Sturgeon Capital announced a strategic partnership with SBI Ventures Asset to jointly develop business interests in the Central Asian region, with a focus on FinTech and Uzbekistan;

MFO's loan book almost doubled in 2023;

Fixed monthly license payments for crypto exchanges and crypto-shops increased;

Microfinance banks – a new type of licensed banks, will be limited from international payments and correspondent bank operations;

Privatisation of SQB (SQBN) and Asakabank JSCBs may be prolonged to 2025;

China State Railway Group Co., Ltd may be attracted to the Uzbekistan-Kyrgyzstan-China railroad project as a BOT operator;

President launched three energy generation projects worth $1.1bn with 1.23MW capacity in the Namangan region;

Kyrgyzstan and Uzbekistan JV to receive $50mln investment from UzAuto Motors and manufacture 10,000 cars in the first year;

OVERVIEWSolutions Lab JSC (SOLA) registered additional shares issue for 20bln UZS;

Andijankabel JSC attracted 15.24bln UZS loan from Trastbank JSCB (TRSB) under the collateral of productional facility and equipment;

Kafolat Insurance JSC (KFLT) approved the share issue for 45bln UZS directly placed to Genesis Innovations LLC and distribution of 52.2bln UZS of net profit as dividends (97.8% distribution ratio) for 0.58 UZS per ordinary shares and 0.25 UZS per preferred share. Genesis Innovations LLC is the controlling shareholder of the company;

Mortgage Refinancing Company JSC attracted 398.6bln UZS for 20 years from MoEF to refinance the portfolio of mortgage loans;

Akhangarancement JSC (ex.OHSM) announced the EGM for April 9th, 2024 with an agenda to delist the company from the Tashkent Stock Exchange.