AVESTA Overview: March 4 - 15

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the given period, trading on the Tashkent Stock Exchange reached 54.2bln UZS, which is nearly four times more compared to the previous two weeks. The sharp increase in volumes is due to the three transactions involving METQ shares, which were sold for 5.03bln UZS at 7,121 UZS per share, TBMZ shares sold for 3bln UZS at 5,200 UZS per share, and BNGA shares sold for 2.74bln UZS at 11,110 UZS per share in the previous period. These three transactions accounted for 74.6% of the total turnover.

Similarly, in this period, 94% of the turnover comprised the deals with UNVB shares for 50.9bln UZS at 5,000 UZS. The transaction likely took place as part of the companies’ Chairman of the Board Mr. Anvar Irchaev further increasing his equity stake in the company, as previously, he increased his share in the company from 4.99% to 5.11% at 8,000 UZS per share 2.5bln UZS.

Excluding the impact of the aforementioned transactions, the trading volume actually decreased by 11.4%. The total number of traded securities increased by one, resulting in a total of 88 securities traded.

Only BFMT3V2 and EQQU closing prices saw an increase of 1.03% and 1.63%, respectively. The remaining securities’ closing price from the top 10 list declined. BIOK and URTS closing prices saw the sharpest decline of 20% and 12.6%, respectively.

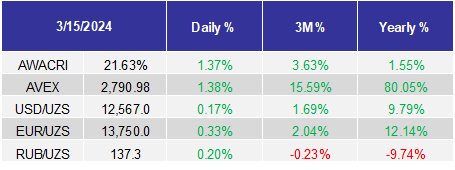

AVEX decreased by 4.4% during these two weeks.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

Uzbekistan to build a chemicals plant for $10bln in Khorezm region;

EBRD to provide 15mln EUR to Eurasia Bottlers, a leading producer of energy drinks in Uzbekistan to finance a 32.7mln EUR expansion project;

Rosatom considering the construction of small nuclear power plants in Uzbekistan;

French Voltalia to build 100MW solar power plant in Khorezm region;

Petroleum Technology Group acquired UNG Petro, a chain of 78 gas stations previously owned by Uzbekneftegaz JSC (UZNG);

Hamkorbank JSCB (HMKB) approved the decision to issue 50bln UZS debut discount corporate bonds with maturity of one year and expected return of 22%;

Egyptian company Arab Nihol Investors may build а $100mln tourist complex in the Samarkand region;

Fitch revised the outlook for Uzmetkombinat JSC (UZMK) rating while confirming their estimations about the normalization of margins in 2024 and a significant decrease in leverage level in 2025-2026 after the launch of the new CRC;

Inflation in February reached 0.32% or 8.35% y-o-y;

The Central Bank kept the key rate at 14%;

Navoi Uranium JSC and China Nuclear Uranium to jointly mine and process uranium in Jantuar and Madanli deposits in Navoi region;

Alif's unique user base reached 897k (+58%) in 2023. The number of payment app users alone increased by 169% and reached 1.2mln users;

The cost of supplying Russian gas to Uzbekistan is much cheaper than to Turkey and China at $160 per 1,000 cubic meters in 2023;

Chinese Shenzhen Neptune Logistics to build transport and logistics center in Uzbekistan for $10-$15mln;

Foreign reserves decreased from $32.4bln to $32.2bln and physical gold reserves by 0.3mln ounces to 11.9mln ounces in February;

UNDP reports the reduction in poverty rate in Uzbekistan from 24% in 2000 to 11.5% in 2022;

USAID plans to provide $17.7mln over five years to the Business Support Project;

Uzbek-Russian JV Gazli Gas Storage refuses ownership links to sanctioned individuals following the news that a 60% stake in the company was transferred to Hong Kong-based Daxon Holding Limited;

ACWA Power to build a 500 MW wind power plant in Karakalpakstan and a 300 MW wind power plant in the Bukhara region;

OVERVIEWEBRD and Hamkorbank JCB (HMKB) provided $1.1mln to Multimodal Trans Terminal company under the RSF facility project;

EBRD provided $20mln to Ipotekabank JSCB (IPTB) under GEFF Uzbekistan II and WiB programs;

Uzbekleasing International JSC attracted another loan from EBRD for $6mln for three years;

Uzbekleasing International JSC attracted additional funding from ICD for $5mln;

Gross Insurance JSC approved the increase of equity by 35.2bln UZS by private placement of shares to Mr.Axmedjanov Farrux Baxramovich;

Uzum Bank JSCB approved the issue of an additional 150bln UZS share to Continent Arm Investments LLC, owned by Uzum Holding LTD;

Yangi Bank JSCB registered 150bln UZS share issue;

Buxoroneftegazparmalash JSC (BNGP) announced 272 UZS per shares dividends for 2023FY;

Anorbank JSCB provided 4.4bln UZS loan to Kapital Sugurta JSC (KASU);

Fitch assigned B rating to Inson Insurance JSC with Stable outlook.