AVESTA Overview: May 12 - 23

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the period, trading volume on the Tashkent Stock Exchange totaled 33.2bln UZS, with 85 securities traded — three more than the previous period, signaling a modest uptick in activity.

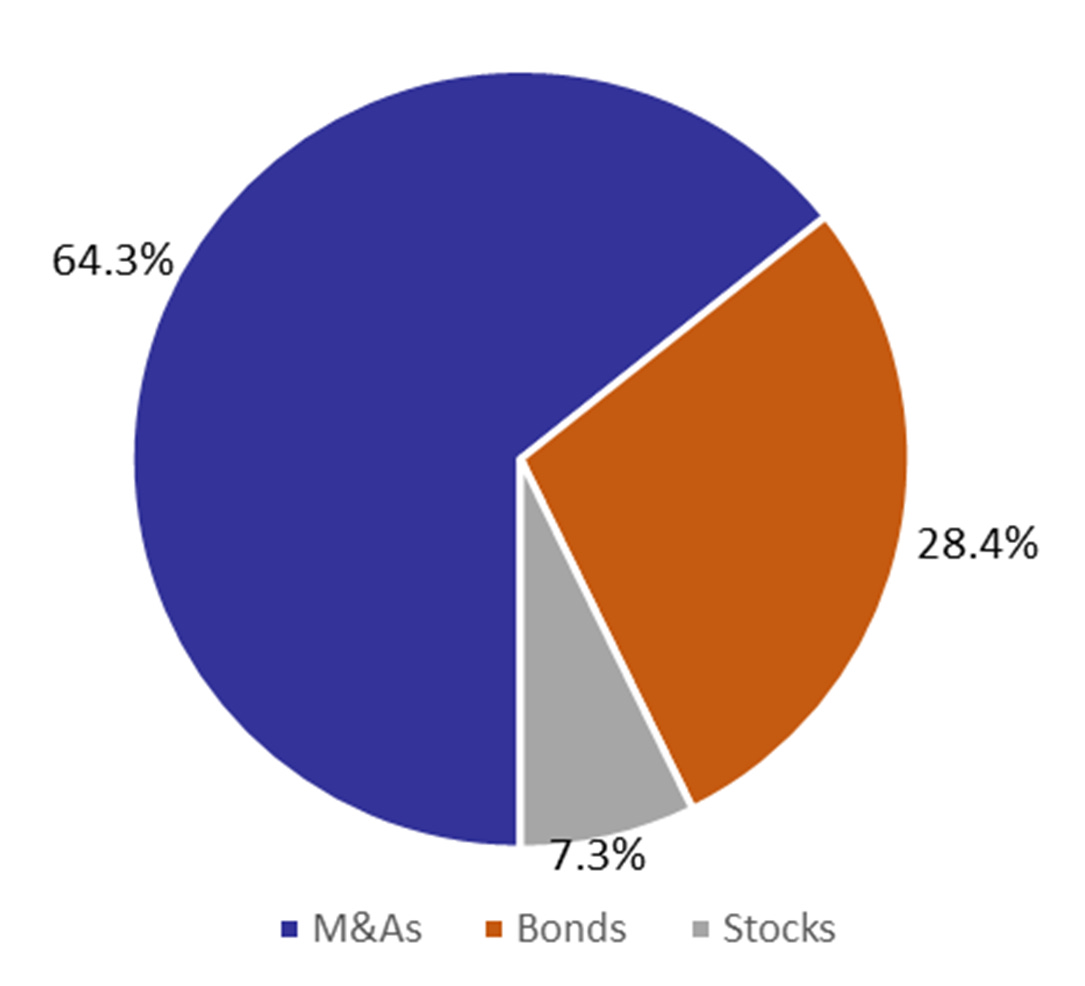

The market was again led by M&A activity, with INSN shares dominating turnover. A strategic equity transfer at the nominal 100 UZS per share accounted for 18.3bln UZS, over half the total volume, highlighting the continuing role of non-market transactions in shaping weekly figures.

Bonds remained a key driver, making up nearly a third of turnover. ACMT1B led with 12.6%, followed by DMMT2B (9.7%), UZUMN2B (4.8%), while BFMT3V3 and IFMT4 added just under 1% each. Among stocks, only URTS and HMKB from the blue-chip segment entered the top 10 by volume. URTS saw 1.2bln UZS in trades across 652 transactions, while HMKB, despite its low price, generated solid interest with 395 transactions totaling 287.6mln UZS.

On the price front, HMKB was the week's outperformer, rising 8.2% from 23.01 UZS to 24.9 UZS per share. On the downside, IFMT4 posted the sharpest decline, falling 8.1%, while UNVB dipped 1.1% to 8,601 UZS, continuing its mild correction from recent highs.

The AVEX (Avesta Equity Index) rose 3.6% over the two-week period.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

ANORBANK signed agreement with ICD for $10mln financing line. Funds to support socially significant and cost-effective private sector projects;

Uzbekistan plans 30-day visa-free entry for US citizens, in hopes of increasing tourism. The government aims to attract 15.8mln foreign tourists and raise tourism service exports to $4bln;

Average ROI on residential real estate falls an estimated 21.6% over last year. Moreover, Square Meters became 2.4% cheaper;

Uzbekistan exported $5.48bln of gold in January-April, with $1.91bln in April alone. Export increased by 35% up to $11.88bln, including 19.2% non-gold export growth up to $6.4bln, while the import increased by just 2.9% up to $12.7bln;

World Bank approved $200mln soft loan to modernize Uzbek irrigation infrastructure. Funds will be used to concrete canals, construct hydraulic structures, and implement flow meters and SCADA systems

Hungarian OTP Bank Group, which acquired Ipoteka Bank JSCB in 2023, intends to establish a joint company in the field of car loans in Uzbekistan;

World Bank approved $35mln soft loan to improve geodata availability in Uzbekistan. Uzbek government to contribute another $5.7mln;

Tax code introduces separate fees for beer and tobacco product retailing. Businesses will be able to trade beer and cigarettes on notice. Moreover, tax deductions when purchasing digital marking scanners are extended until January 1, 2027. The amount of the deduction will be up to 1.5mln UZS per device;

Uzbekistan introduces a 30-day visa-free regime for citizens of Bahrain, Kuwait and Oman;

The volume of international money transfers in Uzbekistan rose by 32% in Q1-2025, reaching $3.3bln. International transfers are estimated to increase by 15-18% this year, 5% higher than prior predictions;

Hungarian OTP Bank Group, which acquired Ipoteka Bank JSCB in 2023, intends to establish a joint company in the field of car loans in Uzbekistan;

World Bank approved $35mln soft loan to improve geodata availability in Uzbekistan. Uzbek government to contribute another $5.7mln;

Tax code introduces separate fees for beer and tobacco product retailing. Businesses will be able to trade beer and cigarettes on notice. Moreover, tax deductions when purchasing digital marking scanners are extended until January 1, 2027. The amount of the deduction will be up to 1.5mln UZS per device;

Uzbekistan introduces a 30-day visa-free regime for citizens of Bahrain, Kuwait and Oman;

The volume of international money transfers in Uzbekistan rose by 32% in Q1-2025, reaching $3.3bln. International transfers are estimated to increase by 15-18% this year, 5% higher than prior predictions;