AVESTA Overview: May 13 - 24

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the given period, trading on the Tashkent Stock Exchange amounted to nearly 26bln UZS, marking a 17.8% decline compared to the previous two weeks. This decrease in trading activity was primarily driven by the high presence of transactions involving HMBK1 debut discounted bonds and M&A deals in both periods. M&A transactions involving MATA shares for 1.5bln UZS ranging from 17,918.91 to 20,400 UZS per share and UPAT shares for 776.5mln UZS at 9,120 UZS per share took place this period. However, these transactions accounted for only 8.8% of the total turnover, as the majority of the trading volume (80.2%) was dominated by HMBK1 bonds with three deals worth 20.8bln UZS.

Collectively, all of the mentioned deals contributed to 89% of the total turnover during this two-week period. Similarly, in the previous period, several notable M&A transactions were executed, involving UZPN (2.6bln UZS at 3,367 UZS), MKPT (2.6bln UZS at 75,448 UZS), UGSR (600mln UZS at 4,298 UZS), BUPD (355.7mln UZS at 13,137 UZS), and OCBK shares, as well as, deals with HMBK1 bonds which together contributed 82.4% to the turnover.

Excluding the impact of the M&A and HMBK1 bond transactions, the trading volume increased only by 1.6%. The number of securities traded totaled 82, two more than the previous period.

Among the top 10 by volume securities, UNVB (-15.6%), UZMK (-10.6%) and URTS (-6.3%) closing prices saw the highest decline. Conversely, the share prices of MATA, UZTL, and HMBK1 saw increases of 13.9%, 9.0%, and 1.2%, respectively.

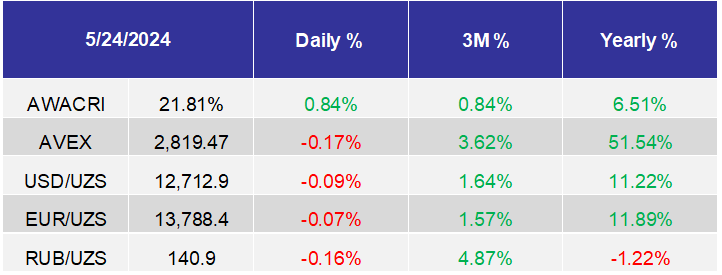

AVEX decreased by 5.6% during these two weeks.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

National Bank of Uzbekistan JSC (NBU) to receive 114mln EUR financing from Standard Chartered and Multilateral Investment Guarantee Agency of the World Bank Group (MIGA). The loan will be used to support the development of SMEs in Uzbekistan;

Coca-Cola to build fifth plant in Uzbekistan;

Trading volume on currency exchange declined by 2.7% to $5.8bln in 1Q2024;

Passenger car sales decreased in April by 35.3% y-o-y;

Chinese Universal Energy to construct two wind farms with a total capacity of 500MW in the Samarkand and Jizzakh regions;

Masdar attracted $159mln for the construction of power plant with a capacity of 250MW in the Bukhara region;

EBRD to provide $14mln loan to Star Group, leading FMCG distributor in Uzbekistan. Funds will be allocated for the working capital and CapEx;

EBRD to provide $20mln to Ipak Yuli Bank JSCB (IPKY), including $10mln for SME lending, and $10mln for YiB program;

IFC to invest $5mln in Sturgeon Capital to support technology startups in the Central Asian region;

IMF increased its forecasts of the GDP growth of Uzbekistan to 5.4% in 2024 and 5.5% in 2025. Inflation is expected to reach 11.7% this year and decrease to 8.7% in 2025;

1.51mln (+2.1%) foreign citizens visited Uzbekistan in 1Q2024;

ADB will support projects in Uzbekistan worth $3.5bln in 2025-2027;

Car plates sales at UzRTSB (URTS) increased by 3.2 time and reached 212bln UZS in 1Q2024;

Nebras Power and Sojitz to build a wind farm with a total capacity of 1GW in the Navoi region;

Cement production reached 4.8mln tons in 4M2024;

Foreign trade turnover increased by 5.9% and reached $20.9bln including a 9.0% increase in exports, up to $8.5bln and a 3.9% increase in imports, up to $12.4bln in 4M2024;

Voltalia to construct a 126MW Sarimay Solar power plant to which a 50MW/100MWh battery energy storage system (BESS) and a new 500MW/100MWh battery complex will be added;

OVERVIEWIn 4M2024, Almalyk Mining JSC (AGMK) exports decreased by 26.7% and reached $177.7mln, including 15,653 tons of copper (-17.8%) and 9,372 tons of zinc (-13.4%) products;

EBRD to provide $15mln to Davr Bank JSCB for the MSME lending under the CA YiB program;

On May 21, 2024, Uzbekistan placed another notable Eurobonds issue for $1.5bln equivalent. For the first time the issuance was done in three currencies:

- 7-year maturity USD-denominated bonds for $600mln at 6.9% coupon (subscription formed for $3bln);

- 3-year maturity EUR-denominated SDG bonds for 600mln EUR at 5.375% (2bln EUR);

- 3-year maturity UZS-denominated bonds for 3trln UZS at 16.625% (4trln UZS).