AVESTA Overview: November 10 - 21

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

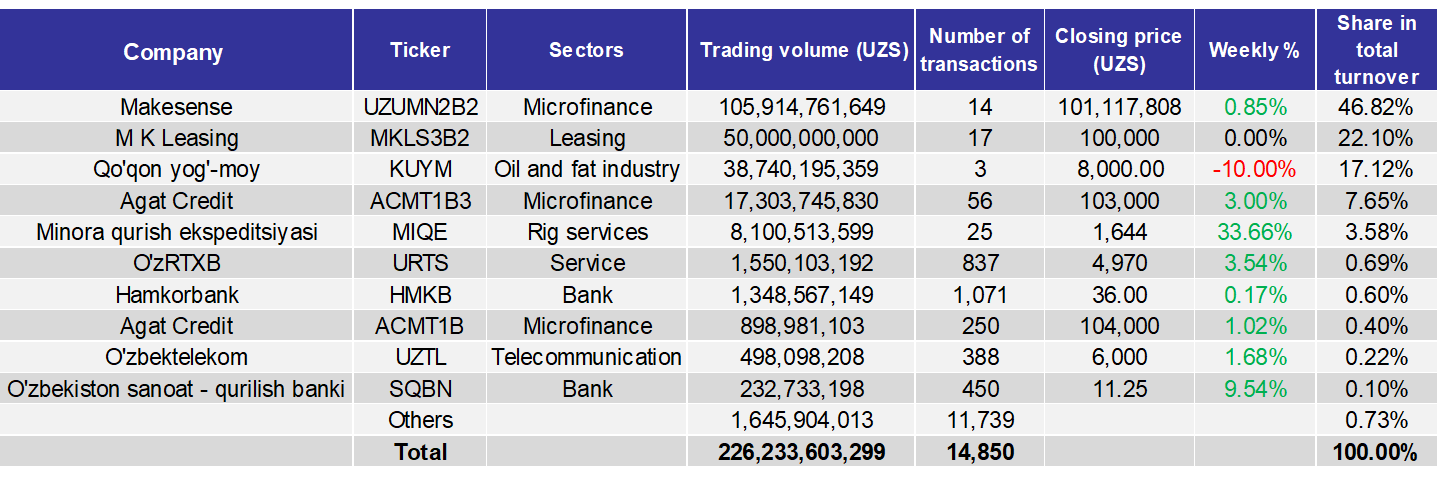

During the period, the Tashkent Stock Exchange recorded a total turnover of 226.2bln UZS across 14,850 transactions.

The bond segment accounted for 77.2% of total turnover. Makesense (UZUMN2B2) led the segment with 105.9bln UZS in trading volume across 14 transactions, capturing 46.8% of total turnover. M K Leasing (MKLS3B2) was next with 50bln UZS from 17 transactions, equal to 22.1% of total turnover. Agat Credit (ACMT1B3) contributed 17.3bln UZS in trading volume, representing a 7.7% share. Another Agat Credit bond (ACMT1B) recorded 899mln UZS in volume, comprising 0.4% of total turnover.

The stock segment comprised 22.8% of total turnover. Qo’qon yog’-moy (KUYM) held a 17.1% share, trading 38.7bln UZS. Minora qurish ekspeditsiyasi (MIQE) followed with 8.1bln UZS, or 3.6% of total turnover. The remaining stocks registered minimal shares below 1%.

Among the top ten by trading volume, only Qo’qon yog’-moy recorded a weekly price decline of 10%. M K Leasing bonds remained flat. All other securities posted gains, with Minora qurish ekspeditsiyasi (MIQE) recording the strongest performance at 33.7%.

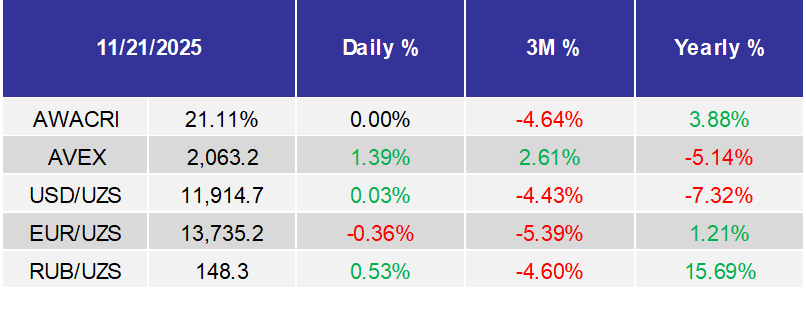

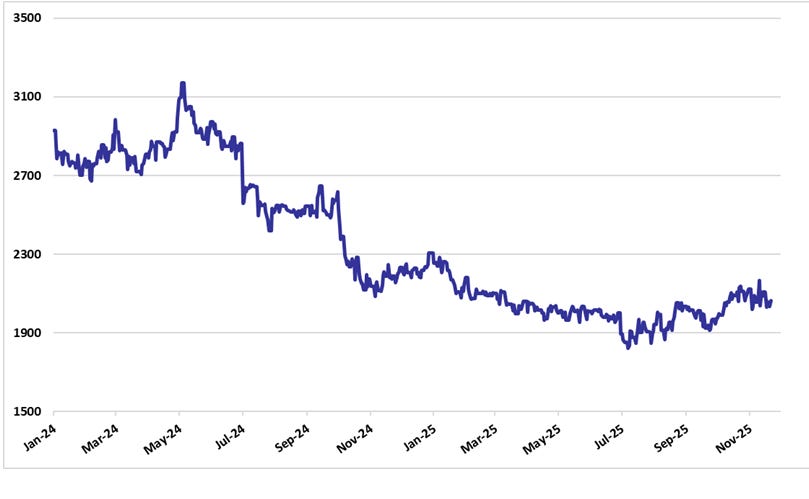

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Mikrokreditbank JSCB (MCBA) approved meeting regulations and terminating early the mandate of independent Supervisory Board member Giorgi Otarovich Paresishvili;

Xorazmpaxtasanoat JSC approved meeting regulations and vote commission composition, authorizing voluntary liquidation of the company;

O‘zmetkombinat JSC (UZMK) concluded credit agreement with affiliated entity National Bank for Foreign Economic Activity of Uzbekistan for €25mln, 12‑month term;

Uzbekistan Airports JSC declared dividend of 0.87 UZS per ordinary share (0.87% nominal), with no payout on preferred.

Milliy Kliring Markazi JSC approved placing 5.5bln UZS of temporary funds on a one‑year deposit at Uzum Bank at 20% annual interest, effective November 14, 2025;

Tayanch Mikromoliya Banki JSC changed its name from Tayyab Finance Mikromoliya Tashkiloti JSC following shareholder approval and registration of amendments on November 6, 2025;

O‘zbekiston Metallurgiya Kombinati JSC (UZMK) signed a 72.6bln UZS spot contract with affiliated Li Da Metal Technology LLC to supply 10,000 t of steel billets;

O‘zbekiston Respublikasi Milliy Investitsiya Jamg‘armasi JSC approved increase of authorized shares from 3.64trn to 8.64trn units, adoption of new charter edition, and mandating Franklin Templeton Asset Management LLC as trustee manager to register amendments and execute related measures;

O’zbekiston Ipotekani Qayta Moliyalashtirish Kompaniyasi JSC (UzMRC) issued 200,000 corporate bonds with a total value of 200bln UZS, registered on November 20, 2025, each bond having a nominal value of 1mln UZS, placed through open subscription;

KDB Bank Uzbekistan disclosed a major transaction with the CBU involving a 1.5trln UZS bond purchase;

Milliy banklararo protsessing markazi JSC signed a loan agreement with Asterium LLC on November 19, 2025 for 200bln UZS;

Norin paxta tozalash JSC decided on voluntary liquidation, appointed a liquidation commission, set creditor claim procedures and asset distribution rules October 22, 2025;

Mingbuloq paxta tozalash JSC decided on voluntary liquidation, appointed a liquidation commission, set creditor claim procedures, and approved related expenses effective October 7, 2025;