AVESTA Overview: November 24 - December 5

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

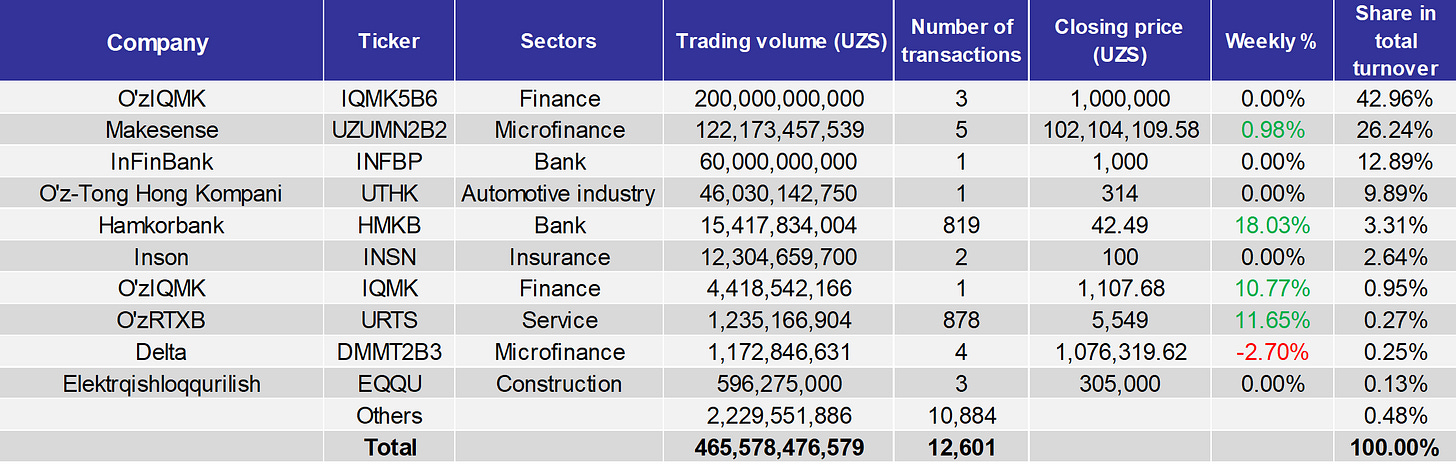

During the period, the Tashkent Stock Exchange recorded a total turnover of 465.6bln UZS across 12,601 transactions.

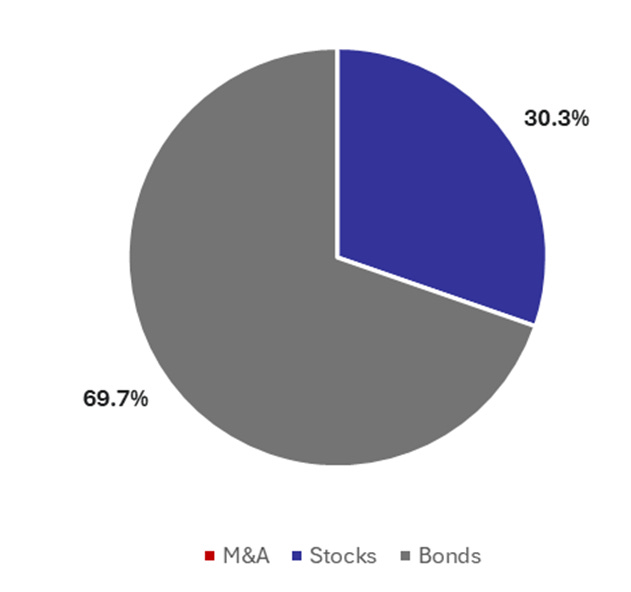

Bonds accounted for 69.7% of total turnover. O’zIQMK (IQMK5B6) led the market with 200bln UZS in trading volume from 3 transactions, representing nearly 43% of total turnover and successfully placing its entire bond issuance. Makesense (UZUMN2B2) recorded 122.2bln UZS in trading volume across 5 transactions, capturing 26.2% of total turnover. Delta (DMMT2B3) accounted for 1.2bln UZS in trading volume, representing 0.3% of total turnover.

Stocks comprised 30.3% of total turnover. InFinBank (INFBP) recorded the highest trading volume in the equity market at 60bln UZS, representing 12.9% of total turnover. O’z-Tong Hong Kompani (UTHK) followed with 46bln UZS in trading volume, accounting for 9.9% of total turnover. Hamkorbank (HMKB) generated 15.4bln UZS in trading volume, equal to 3.3% of total turnover, while Inson (INSN) recorded 12.3bln UZS, representing 2.6% of total turnover. Remaining stocks held minimal shares of less than 1% each.

During the period, Hamkorbank (HMKB) shares posted the strongest gains, rising 18%, followed by O’zRTXB (URTS) at 11.7% and O’zIQMK (IQMK) ordinary shares at 10.8%. The Makesense bond (UZUMN2B2) appreciated nearly 1%, while the Delta bond (DMMT2B3) declined 2.7%.

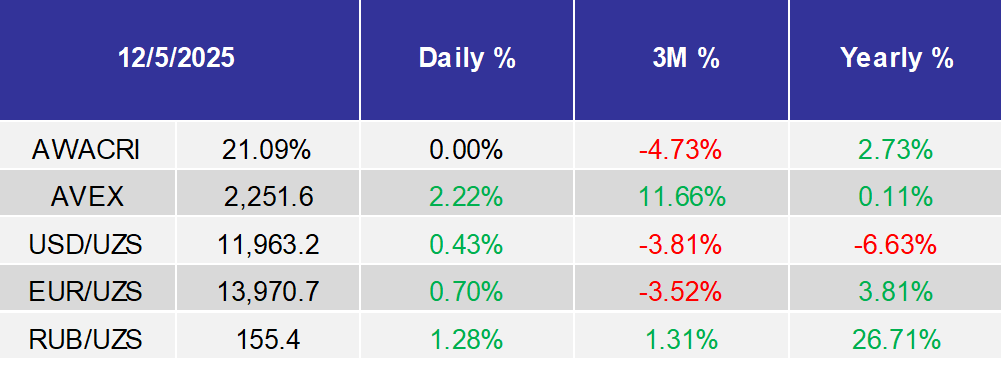

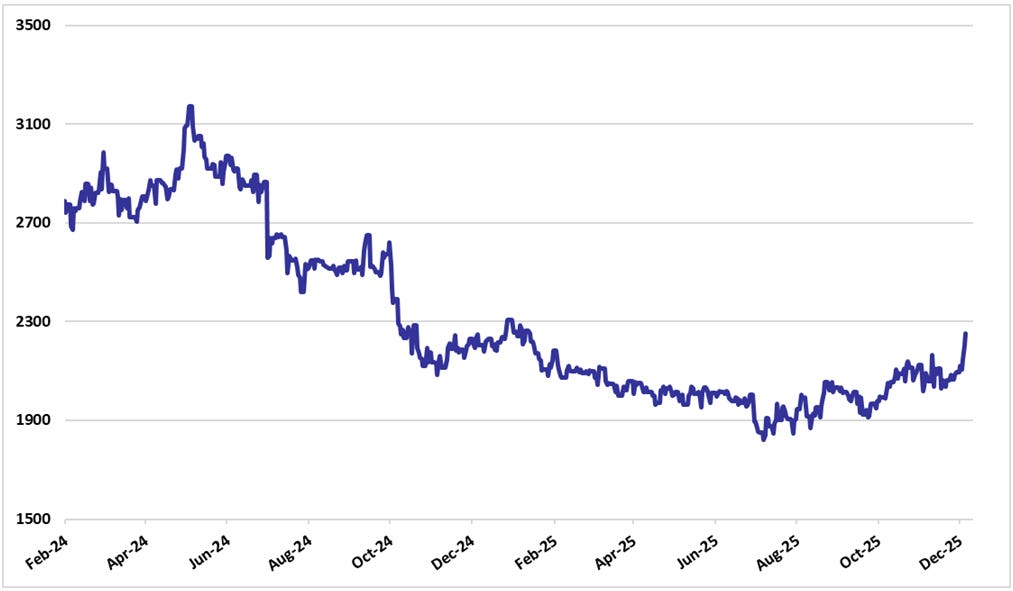

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

AGAT CREDIT JSC corporate bonds will accrue 2,378.08 UZS per bond, equal to 2.37% of par value; payments are scheduled between 22 Nov and 5 Dec 2025 in cash;

O‘zbekiston Ipotekani Qayta Moliyalashtirish Kompaniyasi (O’zIQMK) JSC created subsidiary UMRC SPV LLC with 100% ownership;

Tadbirkorlikni Rivojlantirish Kompaniyasi JSC acquired 100% of Biznesni Kafolatlash Milliy Kompaniyasi JSC, equal to 100mln ordinary shares worth 100bln UZS;

Biznes Finans Mikromoliya Tashkiloti LLC approved issuance of 100,000 corporate bonds with par value 100,000 UZS each, totaling 10bln UZS, at 27% annual coupon; maturity set at 720 days, coupon payments every 30 days, redemption at par on day 721;

Imkon Finans Mikromoliya Tashkiloti JSC set income payments on corporate bonds at 23,013.7 UZS per bond, equal to 2.3% of par value;

O‘zbekekspertiza JSC repurchased 23,323 ordinary shares from 8 shareholders at 78,986 UZS each, totaling 1.842bln UZS; meanwhile, the proposal to allocate 10bln UZS for construction of a modern Exhibition Center in “Yangi Namangan” was deferred pending instructions from the State Assets Agency;

Gidromaxsusqurilish JSC disclosed that O‘zbekgidroenergo JSC acquired 227,329 shares, equal to 97.44% of its charter capital (valued at 9.999bln UZS);

O‘zbekiston Ipotekani Qayta Moliyalashtirish Kompaniyasi (O’zIQMK) JSC corporate bonds are set at a nominal value of 1,000,000 UZS per bond, with a total issuance of 200,000 bonds (200bln UZS). Bonds carry a 5‑year maturity, with a coupon rate not exceeding 17.5% annually, payable quarterly (20 periods). Early redemption is not envisaged except in cases of reorganization, liquidation, or invalid issuance;

Makesense LLC corporate bonds will accrue income of 30,821,917.81 UZS per bond, equal to 6.16% of par value; payments are scheduled between 24 Nov and 1 Dec 2025 in cash;

Saxovat Broyler JSC disclosed that Servolux SB LLC acquired 186,792,933,629 shares, equal to 51% of its charter capital (valued at 44.83bln UZS);

Simurg JSC disclosed that shareholder Igor Vladimirovich Nenashev acquired 1,335,188 shares, equal to 97.12% of its charter capital (valued at 667.59bln UZS);

Delta Mikromoliya Tashkiloti LLC corporate bonds will pay income of 21,369.86 UZS per bond (2.14% of par value, payable 23 Nov - 3 Dec 2025 in cash) and 23,013.70 UZS per bond (2.30% of par value, payable 22 Nov - 2 Dec 2025 in cash);

O‘zbekiston Ipotekani Qayta Moliyalashtirish Kompaniyasi (O‘zIQMK) JSC concluded a related‑party credit agreement with Agrobank JSCB on 18 Nov 2025 for 85.2blnUZS;

UzMRC JSC (IQMK) securities were officially listed for trading on the Tashkent Stock Exchange on 5 December 2025, and the company concluded an affiliated‑party transaction with O‘zsanoatqurilishbank JSCB (SQBN) on 3 December 2025 under a term deposit agreement worth 50bln UZS;

Samarqand Konserva JSC concluded a major transaction with Biznesni Rivojlantirish Bank JSCB (BRBN), pledging assets under a collateral agreement valued at 31.5bln UZS (274.4% of net assets) and obtaining a credit agreement valued at 19.35bln UZS (168.5% of net assets);

Prestige Insurance JSC obtained a license for voluntary life insurance from the National Agency for Perspective Projects of Uzbekistan, with license issued 25 Nov 2025 (No. 1181185), and registered on 1 Dec 2025;

Asia Insurance JSC’s shareholder VIVETEKS LLC acquired 20.49% of the company’s charter capital;

Contact Finance LLC corporate bonds will pay income of 1,726.03 UZS per bond, equal to 1.73% of par value; payments are scheduled between 23 Nov and 2 Dec 2025 via non‑cash transfers;

O‘zmilliybank JSCB declared dividends on ordinary shares at 28.49 UZS per share;

Temiryolekspress JSC approved reorganization by merger with Temir Yo‘l Ekspress LLC, increasing charter capital proportionally to the merged entity’s equity, issuing 100 uncertificated ordinary shares at 1,000 UZS par value (total 100,000 UZS) via closed subscription to Uzbekistan Railways JSC, and mandating state registration of the merger and additional share issue;

Tadbirkorlikni rivojlantirish kompaniyasi JSC acquired a 19% stake in Invest Finance Bank JSCB (INFB);

Invest Finance Bank JSC (InFinBank) disclosed dividend payments total 62bln UZS accrued and fully paid to shareholders, with no outstanding debt; payout period ran from 22 Sep to 21 Nov 2025;

Indorama Kokand Fertilizers and Chemicals JSC approved a major transaction to obtain a $70mln loan from Uzsanoatqurilish Bank JSCB (SQBN) at an average 3M SOFR + 2.5% rate for five years, and elected Ram Kishor Laddha to the Supervisory Board for three years replacing Rahul Singh;

UzAuto Motors JSC (UZMT) allocated 1.26trln UZS to dividend payments for 9M 2025 results, setting 4,642 UZS per share to be paid via the Central Securities Depository.