AVESTA Overview: November 13-24, 2023

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the trading period, the Tashkent Stock Exchange saw a trading volume of 6.13bln UZS, marking a 48.6% decrease from the previous two weeks. The total number of traded securities increased by five, reaching a total of 88.

The majority of the trading volume came from transactions involving IMKF3 and HKIL3 bonds, contributing 18.12% and 16.9%, respectively. Another bond issuance by Biznes Finans is also in TOP-5, so in general corporate bonds covered more than 2.5bln UZS turnover, which is relatively high compared to previous periods. Next in the table were EQQU and HMKB, representing 15.58% and 10.34% of the total volume.

HMKB's closing price rebounded with an 11.52% increase, recovering from a drop to 52 UZS, returning to 57.99 UZS. OCBK’s (ex. RBQB) price fell by 23.2% and UZMK’s price declined to 6,000 UZS, down by 5.51%, despite the relatively good financial reporting and positive process of new workshop.

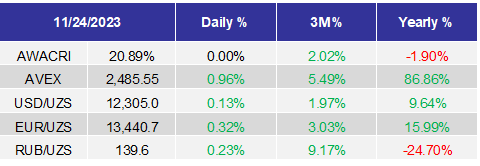

AVEX increased by 2% during these two weeks.

AVESTA EQUITY INDEX (AVEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

Banking NPL reached 3.6% as of November 1st, 2023, including an average of 4% for state-owned banks and 2.8% for private;

The 43rd session of the UNESCO General Conference will be held in Samarkand in 2025;

In October, the number of real estate transactions decreased by 10% compared to the previous month and by 6.7% y-o-y;

Export increased by 29.1% up to $20.47bln, including 2.3 times growth in gold export up to $6.87bln, while the non-gold export increased by just 5.6% in 10M2023. Import increased by 22.7% up to $30.5bln with almost 1.5 times growth in equipment import up to $11.7bln;

The production of coal in the Surkhandarya region may be increased four times up to 2mln tonnes;

Uzbekistan is in 23rd place in the World for the cheapest internet connection;

Namangan region administration discussed the possibility of attraction of $1bln funding from Deutsche Bank and Euler Hermes;

OVERVIEWUzRTSB JSC (RTS) to deposit 100 bln UZS inTrastbank JSCB (TRSB) under 18% interest rate;

Uzbekistan Currency Exchange as a shareholder approved the first issuance of the shares of the National Clearing Center JSC;

Mr.Tursunov Iskandar Baxtinurovich increased his share in Octobank JSCB (OCBK) up to 93.46%;

Tashkent Stock Exchange announced the change of the tickers due to the change in the name of the "Qishloq Qurilish Bank" to the "Biznesni Rivojlantirish Banki"- BRBN (ex.KKBN); Correspondingly, preferred shares of the company renamed to BRBNP (ex. KKBNP);

Fitch affirms BB- rating with Stable outlook for UzAuto Motors JSC (UZMT);

WB published the Country Climate and Development Report 2023 for Uzbekistan. Green exports could bring an additional $2bln, while the full cancellation of energy subsidies could add up to 5% GDP growth in the transition process.