AVESTA Overview: November 27- December 8, 2023

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the trading period, the Tashkent Stock Exchange saw a trading volume of 8.62bln UZS, indicating an increase of 41.4% compared to the previous two weeks. The total number of traded securities was 88, two less than the previous period.

More than half of the turnover was generated by a single bond transaction of HKIL3, contributing 57.7% to the overall volume. EQQU accounted for 11.2% of the turnover, while OHSM contributed 4.4%. Interestingly, the prices of these top three securities remained unchanged throughout the period.

UZTLP entered the top ranking, securing the fourth position; however, it experienced a decline of 46.43% in its closing price.

Among the liquid stocks, HMKB, UZMK, and QZSM saw a slight increase in their closing prices. On the other hand, URTS, BFMT3V2, and UZMT experienced a moderate decline in their closing prices.

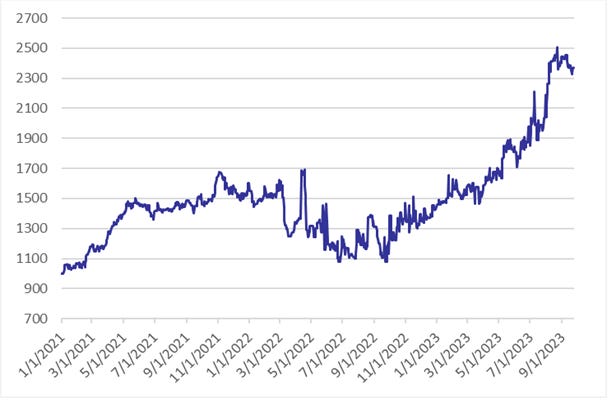

AVEX increased by 0.2% during these two weeks.

AVESTA EQUITY INDEX (AVEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

ECONOMICS

In October, Uzbekistan sold 11 tons of gold, which makes it the largest seller of gold in the world;

Uzbekistan's venture capital attracted $4mln in 1H2023, marking a six times y-o-y growth;

ADB to provide $100mln to support small and medium-sized businesses;

Germany to provide 9mln EUR for the development of the "green" industry of Uzbekistan;

EBRD to provide $45mln to Ipak Yuli Bank JSCB (IPKY), including a $20mln UZS-denominated loan from GEFF Uzbekistan II facility to improve access to green and climate technologies, and $25mln under trade finance program;

$50mln will be allocated for the construction of two tourist zones in the Kashkadarya region;

Inflation in November reached 1.1% or 8.8% y-o-y;

WB to provide $50mln for the "Digital inclusion" initiative aimed at developing the digital economy and IT skills of young people in rural and remote areas until 2029;

Uzbekistan Textile Association (UzTextile) delegation will visit the UK to promote Uzbekistan's growing textile sector;

OVERVIEW

S&P stopped monitoring the rating of UCG (controlling shareholder of three cement plants in Uzbekistan) at the B+ level due to insufficient disclosure of information;

S&P affirmed the B+ rating of Almalyk Mining JSC (AGMK) with a Stable forecast;

S&P first downgraded the rating of Uzbekneftegaz JSC (UZNG) from BB- to B+ then revised the outlook from Stable to Negative;

S&P affirmed Uzbekistan's BB-/B foreign and local currency sovereign credit ratings; The outlook remains Stable;

Uzkabel JSC (ex;UZKB) announced the date of an EGM to approve the decision to purchase the stake in Hayat Power Cable Systems JV LLC;

Toshkent Mexanika Zavodi JSC (former TAPOiCh) approved the decision to sell the stake in Steel Property Construction LLC, which is one of the leading producers of sandwich panels in Uzbekistan; The company also approved the decision to increase state share by accepting 3.71he land plot from UzSAMA;

UzRTSB JSC (URTS) approved the decision to increase the limit for sponsorship expenses from 15 to 20bln UZS.