AVESTA Overview: October 16-27, 2023

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

Throughout the given period, the trading volume on the Tashkent Stock Exchange reached approximately 6.6bln UZS, marking a decrease of 66.6% compared to the previous period. The number of securities traded increased by five, totaling 92 types.

The majority of the top 10 traded securities saw substantial trading volumes due to M&A activities and privatization processes. Among them, RBQB and URGK accounted for a significant portion of the total trading volume. RBQB represented 20.6% of the volume, driven by a large deal valued at 1.37bln UZS, with a nominal price of 1,000 UZS per share. URGK contributed 19.01% of the volume through a deal worth 1.27bln UZS, at 22,523 UZS per share as part of the company's privatization process. TBMZ secured the third position by volume with two deals worth 884.77mln UZS (5,150 UZS per share).

During this period, BMAG experienced a price increase of 15.3%. HMKB and BFMT3V2 also saw a slight increase of 6.03% and 0.81% respectively. Conversely, RBKB witnessed a decline of 20.45%. TBMZ and URTS went down by 6.36% and 2.8% respectively. Other securities listed in the top 10 table did not experience any price changes, mainly due to one-time transactions (in the case of URGK, EQQU, and OHSM).

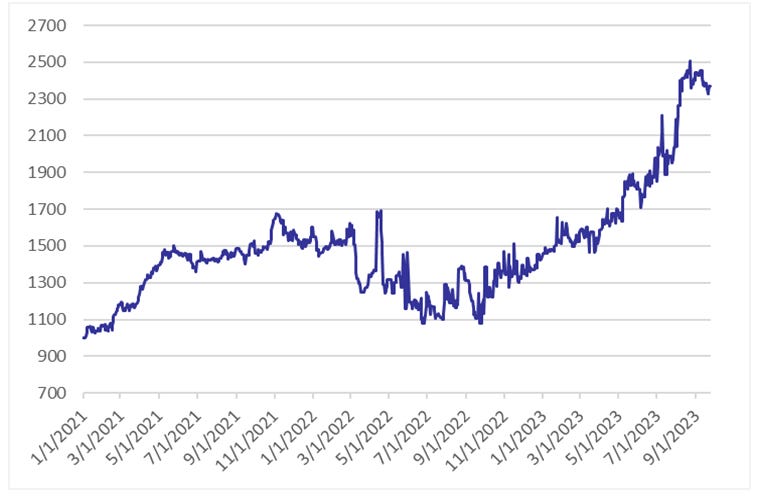

AVEX saw a slight decline of 0.5% over the last two weeks.

AVESTA EQUITY INDEX (AVEX)

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

OVERVIEW

Uzbektelecom JSC (UZTL) announced a new share issue of 2% of its shares from the authorized capital (5,542,046 ordinary shares) through open subscription.

Agrobank JSCB (AGBA) preparing the Eurobonds issue next week.

Hamkorbank JSCB (HMKB) attracted a $35mln loan from JICA.

Mssrs.Sharipov Tokhir Mirakhimovich and Parpiev Dilmuradjon Batyrovich increased their stakes in Trastbank JSCB (TRSB) by 9.64%) (up to 21.9%) and 10.84% respectively;

Buxoroneftgazparmalash JSC (BNGP) resumed the privatization of a 51.27% stake in the company. The starting price of the package is 55.90 bln UZS, at the rate of 23,972.06 UZS per share.

Avesta Investment Group is a leading investment banking, securities, and investment management firm in Uzbekistan, with operations in all Central Asian countries.