AVESTA Overview: October 27 - November 7

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the period, the Tashkent Stock Exchange recorded a total turnover of 230.2bln UZS across 15,250 transactions. The bond market demonstrated particularly strong activity, comprising 85.5% of total turnover, with the majority representing newly issued securities during the reporting period.

The Makesense bond (UZUMN2B2) led the market, contributing 64.6% of total turnover with a trading volume of 148.7bln UZS across 24 transactions. This bond was issued as 4,000 unsecured corporate bonds at 24% annual interest, totaling 400bln UZS. Biznes Finans (BFMT3V4), another newly issued bond, registered a trading volume of 25bln UZS across 421 transactions, representing 10.9% of total turnover. The Agat Credit bond (ACMT1B3) recorded 22.9bln UZS in trading volume from 310 transactions, accounting for 9.9% of turnover. This issue comprises 400,000 corporate bonds with a total nominal value of 40bln UZS.

Stocks comprised the remaining 14.5% of total turnover. Yo’lreftrans led the equity segment with an 8.1% share of total turnover, generating 18.6bln UZS in trading volume across 121 transactions. Elektrqishloqqurilish (EQQU) recorded a trading volume of 10.2bln UZS, representing 4.4% of total turnover. The remaining stocks comprised minimal shares of less than 1% of total turnover each.

Significant price movements were observed during the period. Janubsanoatmontaj (JASM) experienced the largest increase, gaining 56.3%, followed by Yo’lreftrans (YRFS) with a 33% increase. Conversely, Qizilqumsement (QZSM) saw a notable price decline of 15.4%.

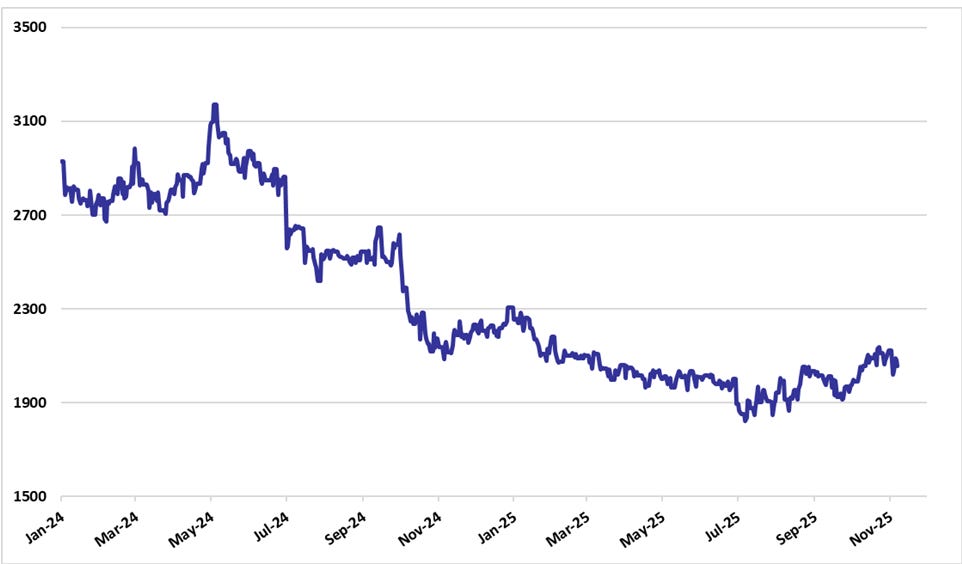

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

MK Leasing LLC approved issuance of 500,000 corporate bonds with a total value of 50bln UZS (100,000 UZS per bond) via public offering. The issue was registered on 27 October 2025;

Makesense LLC approved listing of its securities on regulated financial markets, with registration confirmed by the Tashkent Republican Stock Exchange;

Tadbirkorlikni rivojlantirish kompaniyasi JSC approved acquisition of a 15% stake in Invest Finance Bank JSC (INFB);

Shohrud JSC (SHRD) approved a €2.1mln loan from Biznesni Rivojlantirish Banki JSC (BRBN) to finance raw materials for expanding alcoholic beverage production, secured by a 42bln UZS insurance policy and a corporate guarantee from Jondor Sharob Savdo LLC;

Zirabuloq Paxta Tozalash JSC approved voluntary liquidation and appointed a termination commission under a shareholder resolution dated 31 October 2025;

Uychi Paxta Tozalash JSC approved voluntary liquidation, appointed a termination commission, and confirmed inventory, debt write-offs, and interim balance sheet totaling 18.74bln UZS in net assets as of 1 October 2025;

Qumqo‘rg‘on Paxta Tozalash JSC approved merger with Sherobod Paxta Tozalash JSC and authorized asset transfer, inventory, and shareholder buyback procedures;

Toshkent Index ETF JSC approved voluntary liquidation due to business infeasibility;

Imkon Finans mikromoliya tashkiloti JSC (IMKF3) declared income of 23,013.7 UZS per corporate bond (2.3% of face value) for the period ending 1 October 2025, with payments scheduled from 27 October to 5 November 2025 via non-cash settlement;

Portlatishsanoat JSC (PLST) acquired a warehouse in Bukhara region from Redd Dynamics LLC for 5.9bln UZS, representing 45% of its net assets;

Ellikqal’a Paxta Tozalash JSC resolved to cease operations effective 22 Apr 2026, with creditor claims accepted until 22 Dec 2025;

O‘zbekinvest Hayot JSC extended its fifth share placement period from 30 to 90 days and approved amendments to its issuance resolution;

Milliy Investitsiya Jamg‘armasi JSC updated its list of affiliated parties, adding O`zbekgidroenergo JSC;

O‘zbekinvest JSC updated its executive and supervisory board composition, appointing new members from Franklin Templeton, BancTrust, SynFiny Advisors, and Uzbek government agencies;

Milliy banklararo protsessing markazi JSC issued a 79.4bln UZS loan to its affiliate Humotech LLC, representing 100% ownership by the issuer;

Andijon Mexanika Zavodi JSC approved asset-backed debt transfer measures under a 2023 credit agreement involving O‘zbekiston Temir Yo‘llari JSC and the National Bank of Foreign Economic Activity JSC;

AVO Bank JSCB approved the issuance of 500bln UZS in deposit certificates with a 22% annual rate, 3-year maturity, and legal-entity-only circulation, including non-residents;

O’zsanoatqurilishbank JSCB (SQBN) disclosed a 30% stake acquisition by the Ministry of Economy and Finance of Uzbekistan, totaling 73,088,556,755 UZS in shares;

Ohongoron Sement MS JSC disclosed that its 500.2bln UZS ordinary share issuance was annulled due to 100% placement failure;

Hamkorbank JSCB (HMKB) disclosed dividend payments totaling 161.66bln UZS for 2024, fully paid via the Central Securities Depository

Agat Credit JSC registered a 40bln UZS corporate bond issue on 23 Oct 2025, with 400,000 securities at 100,000 UZS par;

Portlatishsanoat JSC (PLST) approved a 100mln share increase in authorized capital and the auction sale of three real estate assets valued at 50.7bln UZS;

UzAssets Investment Company JSC terminated the powers of First Deputy CEO Adamas Ilkyavichyus effective 31 Oct 2025, following expiration of his contract;

Biznes Finans Mikromoliya Tashkiloti LLC disclosed income accruals on corporate bonds at 2,219.18 UZS per bond (2.22% of face value), payable in cash from 3 to 14 Nov 2025;

Agat Credit JSC MFO disclosed income accruals on corporate bonds at 2,383.56 UZS per bond (2.38% of face value), payable in cash from 1 to 14 Nov 2025;

Invest Finance Bank JSCB (INFB) established a new subsidiary: Flash Money Finance Mikromoliya tashkiloti LLC, located in Tashkent. The bank holds a 100% stake;

O’zenergota’minlash JSC disclosed a 97.99% stake acquisition by O’zbekenergota’mir JSC, totaling 4,714,950 shares valued at 9.43trln UZS;

Mitan paxta tozalash JSC will cease operations effective 3 May 2026, following a shareholder resolution dated 25 Oct 2025. Creditor claims will be accepted until 3 Dec 2025;

Norin paxta tozalash JSC will cease operations effective 22 Oct 2025, following a shareholder resolution disclosed on 31 Oct 2025. Creditor claims will be accepted until 31 Dec 2025;

Uch-tepa paxta tozalash JSC (UTPT) will cease operations effective 31 Oct 2025. Creditor claims will be accepted until 31 Dec 2025.