AVESTA Overview: October 28 - November 8

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

Throughout the period, trading volume on the Tashkent Stock Exchange reached 85.7bln UZS. The total number of securities traded stood at 76, four more than the previous period.

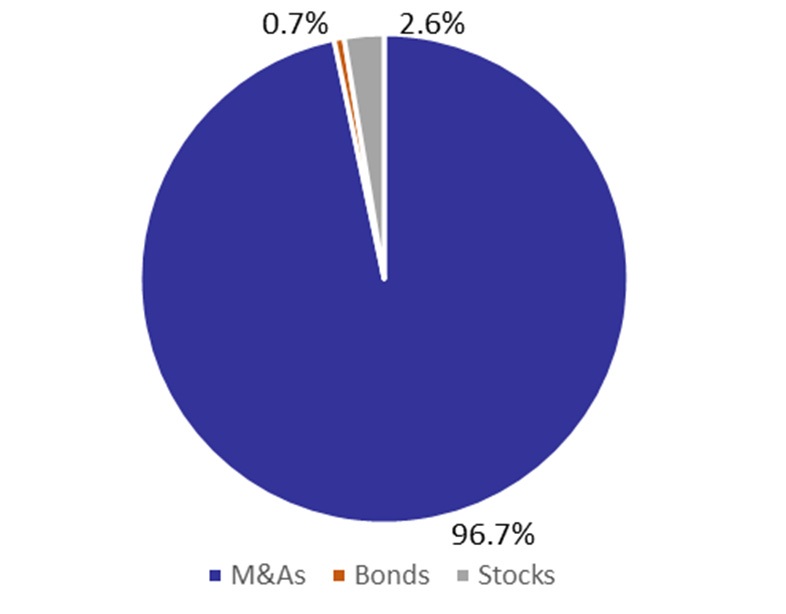

M&A transactions, as usual, significantly contributed to the total volume, making up 96.7% of the turnover on the stock exchange. One of the largest trades involved UNVB shares, amounting to nearly 66bln UZS at 5,000 UZS per share, contributing 77% to the total volume. This was followed by trades with BTRL, totaling 14.5bln UZS at 36,903 UZS per share, contributing another 17%. Other M&A transactions included trades with JASM, BUPD, and METQ. Excluding the impact of significant one-time deals, bonds contributed almost 20% of the turnover, while stock trades made up the rest.

The highest price increases were seen with BTRL (+20.0%), UZMT (+11.3%), BFT3V2 (+6.0%), and URTS (+3.1%). On the other hand, a decrease was observed with UNVB and UZMK by 6.6% and 0.9%, respectively.

Over the two weeks, AVEX experienced a slight decrease of 0.3%.

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Central Bank kept the key rate at 13.5%;

Total volume of remittances to Uzbekistan increased by over a third up to $11.3bln in 9M2024;

IFC to provide $240mln to support ACWA Power's renewable energy projects in Uzbekistan;

Inflation in October reached 0.84% or 10.24% y-o-y;

A unified platform for electricity trading in Central Asia might be created;

IMF updated the real GDP growth projections for Uzbekistan at 5.6% for 2024 and 5.7% for 2025;

Total turnover at UzRTSB JSC (URTS) increased by 15.1% and reached 118.3trln UZS during 9M2024;

Mikrokreditbank JSCB (MKBA) to receive $10mln from KazakhExport to support SME business;

EBRD to allocate $54.6mln to Voltalia for the construction of a 100MW greenfield solar photovoltaic plant;

Foreign trade turnover for 9M2024 increased by 7.7% y-o-y and reached $48bln;

South Korea to build waste recycling plant for $6.2mln in Jizzakh region;

Average salary in Uzbekistan amounted to 5.15mln UZS, an increase of 16.4% y-o-y;

Yandex Uzbekistan to acquire part of Express24 assets, companies will create a unified technological platform for food delivery;

FEZ Navoi launched the first hydrogen peroxide plant in Central Asia. The capacity of the facility is 30k tons per year;

Foreign reserves increased by 4.9% from $41.2bln to $43.1bln, including $1.5bln increase in gold;

TBC Bank Uzbekistan's net profit reached $12mln, increasing by 2.3 times in 9M2024. The loan portfolio of the bank more than doubled ($460mln) and deposits volume equaled $314mln (+66.7%);

VEON to launch AI-Powered Super App Hambi in Uzbekistan;

Companies from China and UAE to build solid waste incinerators for $1.3bln. Over 4.7mln tons of waste will be processed annually;

Over the last five years, $4.3bln was invested in electricity generation. Transfer of electric power distribution to investors based on PPP is estimated to attract $4bln for their modernization;

Portlatishsanoat JSC (PLST, PLSTP) was included in the official Tashkent Stock Exchange listing from November 5th;

In 9M2024, FDI increased by 1.6 times reaching $8bln;

Kseng Solar to construct two ground solar projects totaling 17.6MW in Uzbekistan;

TBC Uzbekistan to launch its flagship debit card product.