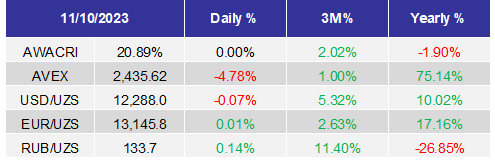

AVESTA Overview: October 30-November 10, 2023

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the trading period, the Tashkent Stock Exchange experienced a trading volume of 11.91bln UZS, which was 1.8 times higher than the previous two weeks. A total of 83 types of securities were traded, which was nine less.

The majority of the trading volume was contributed by UZMT, accounting for 22%. YGGR represented 18.5% of the volume, driven by a privatization deal worth 2.2bln UZS for 9,270.08 UZS per share, marking the first transaction since the listing of YGGR on the stock exchange in 2020. UGSR made up 15.9% of the volume through a single transaction worth 2.12bln UZS which is a part of privatization process, with shares priced at 4,298 UZS per share.

HMKB's closing price decreased by 25.71%. Other stocks in the top 10 list also saw a downward trend in their stock prices, except for UZMT, whose price increased by 1.28%. AVEX decreased by 6.9% during the two weeks

AVESTA EQUITY INDEX (AVEX)

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

OVERVIEW

Foreign reserves increased from $31 to $32.9bln, including $0.9bln in gold, while the physical amount decreased by 0.3mln ounces.

Eight intergovernmental agreements were signed during the state visit of President Macron to Samarkand;

The China-Kyrgyzstan-Uzbekistan railway will be built but remains short of a few billion dollars;

One of the priorities for electricity sector development will be the improvement of the grid to decrease losses from 12% to 8% by 2026;

Gazprom considering projects in oil and gas supply, production, and transportation, as well as in the field of geological exploration and production of hydrocarbons in Uzbekistan;

Inflation in October reached 1.04% or 8.98% y-o-y;

Qatar and Uzbekistan intend to implement projects in the energy sector, metallurgy, textile industry, animal husbandry, etc.

Real income of population increased by 3.5% in 9M2023;

$180mln attracted into geological survey projects in 2023;

The Central Bank made currency interventions for $2bln during the 3Q2023;

The government plans to separate the regional drinking water supply and sewer systems into JSCs and privatize these companies;

Uzbekistan exported $411.7mln worth of gas in 9M2023, which is 47.2% less than in 9M2022. In September, the export of natural gas amounted to $ 33.8mln.

Solar panel imports to Uzbekistan increased by more than 20 times in 9M2023. The total value of imported panels amounted to $427.1k and 98.3% of it came from China.

Textile export reached $2.3bln in 9M2023.

Avesta Investment Group is a leading investment banking, securities, and investment management firm in Uzbekistan, with operations in all Central Asian countries.