AVESTA Overview: September 1-15, 2023

Bi-weekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

During the reporting period, the Tashkent Stock Exchange recorded one of the lowest trading volumes - almost 2.7bln UZS, which is 3.3 times lower than the trading volume of the previous period. 81 types of securities were actively traded on the exchange, but turnover was minimal due to low M&A activity. Among the participants in the overall result, EQQU stood out with just 71 transactions, accounting for more than 33.7% of the total volume. It is followed by UQEQ, whose share was 14.8%. OHSM and UZMT also made significant contributions - 6.9% and 6% respectively.

The stock whose closing price rose the most was UQEQ with a notable 27.6% gain to close at 14,600.

URTS and UZMT also showed a slight increase in closing prices, showing an increase of 1.8% and 1.5%, respectively.

On the other hand, KSCM experienced a significant decline of 16% to close at 226,666, while UZMK and HMKB posted declines of 8.7% and 5.7% respectively.

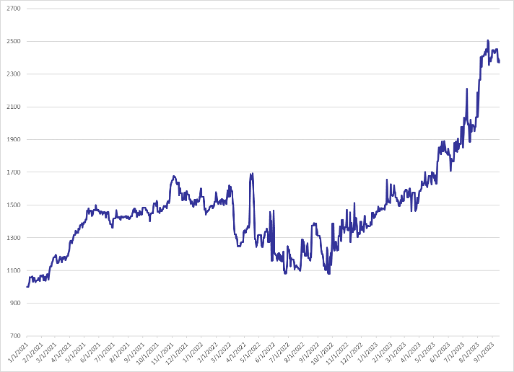

AVESTA EQUITY INDEX (AVEX)

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

OVERVIEW

The government us investing into Agrobank JSCB (AGBA) an additional 350bln UZS at 1,168 UZS per share. Notable, that market price is 580 UZS per share.

Foreign reserves decreased by almost $1bln down to $32.7bln. Physical gold reserves increased by 0.3mln ounces up to 12.1mln ounces.

The Central Bank kept the key rate at 14%.

The Central Bank limited the share of auto car loans for banks to 25% of the total portfolio. Banks have to comply with this criterion within a year. This can negatively affect the profitability of top retail banks, which were active in this segment and derived a large portion of their profits from it.

The number of real estate deals in August broke the record since 2020 and increased by 6% y-o-y.

Mortgage Refinancing Company JSC approved (https://openinfo.uz/ru/facts/74485/) the decision to place corporate bonds under the private placement procedure.

Uzbekistan agreed on restructuring of $1bln debt to UzKorGas - a 50/50 joint venture between Uzbekneftegaz JSC (UZNG) and Korean companies for natural gas.

Biznes Centr Samarqand JSC (BCSK) is included in the official listing of the Tashkent Stock Exchange.

Uzbektelecom JSC (UZTL) increased (https://openinfo.uz/ru/facts/74584/) its stake in Aloqabank JSCB (ALKB) up to 22.03%.

Supervisory Board of Trastbank JSCB (TRSB) recommended (https://openinfo.uz/ru/facts/74562/) to pay 1,462 UZS divs for 1H2023.

Mr.Alexander Veksler consolidated (https://openinfo.uz/ru/facts/74507/) 100% of Seal Mag JSC.

Mr.Iskandar Tursunov announced (https://openinfo.uz/ru/facts/74260/) the offer to minorities of Ravnaq Bank JSCB (RBQB) at 1,000 UZS per share to consolidate their shares.

Asia Alliance Group JV LLC became (https://openinfo.uz/ru/facts/74232/) the owner of 77.3% of the equity of Asia Alliance Bank JSCB.

75% stake in Uzcard transferred to IMC-Capital. Recently the company was privatized and owned by 4 individuals.

Avesta Investment Group is a leading investment banking, securities, and investment management firm in Uzbekistan, with operations in all Central Asian countries.