AVESTA Overview: September 15 - 26

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

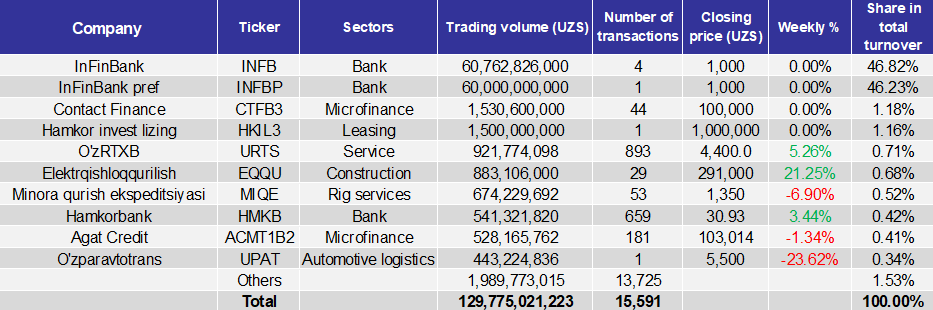

During the period, the Tashkent Stock Exchange recorded a total turnover of 129.8bln UZS across 15,591 transactions. The market was overwhelmingly dominated by InFinBank stocks.

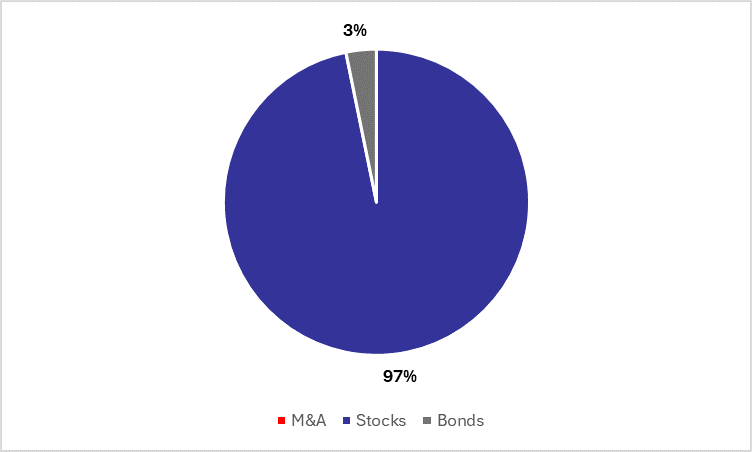

Stocks accounted for 97% of the total turnover. Within the segment, a significant 93% of the total turnover belonged to InFinBank stocks (INFB and INFBP). Specifically, INFB led with a trading volume of 60.8bln UZS, followed by INFBP with 60bln UZS. Other issuers contributed marginally, each below 1% of turnover. O‘zRTXB (URTS) represented 0.7% of turnover from 893 trades totaling 921.8mln UZS, while Elektrqishloqqurilish (EQQU) posted a nearly similar share with 883.1mln UZS in trading volume.

The bond segment made up the remaining 3% of the total turnover. In this segment, Contact Finance (CTFB3) led with 1.2% of total turnover, trading volume exceeding 1.5bln UZS. This was closely followed by Hamkor invest lizing (HKIL3), also registering 1.5bln UZS. Agat Credit (ACMT1B2) held 0.4% of total turnover, representing a trading volume of 528.2mln UZS. Notably, AGAT Credit JSCM plans to issue 40bln UZS in corporate bonds at a 27% annual interest rate soon.

The weekly price analysis showed that 40% of companies, all the top four by volume, recorded no w-o-w price change. On the upside, Elektrqishloqqurilish (EQQU) registered the highest price appreciation at 21.3%, while O’zRTXB saw a 5.3% price increase. Conversely, O’zparavtotrans (UPAT) showed the steepest decline at 23.6%.

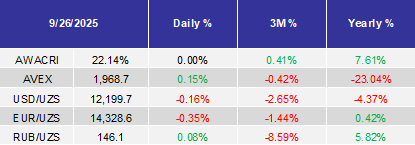

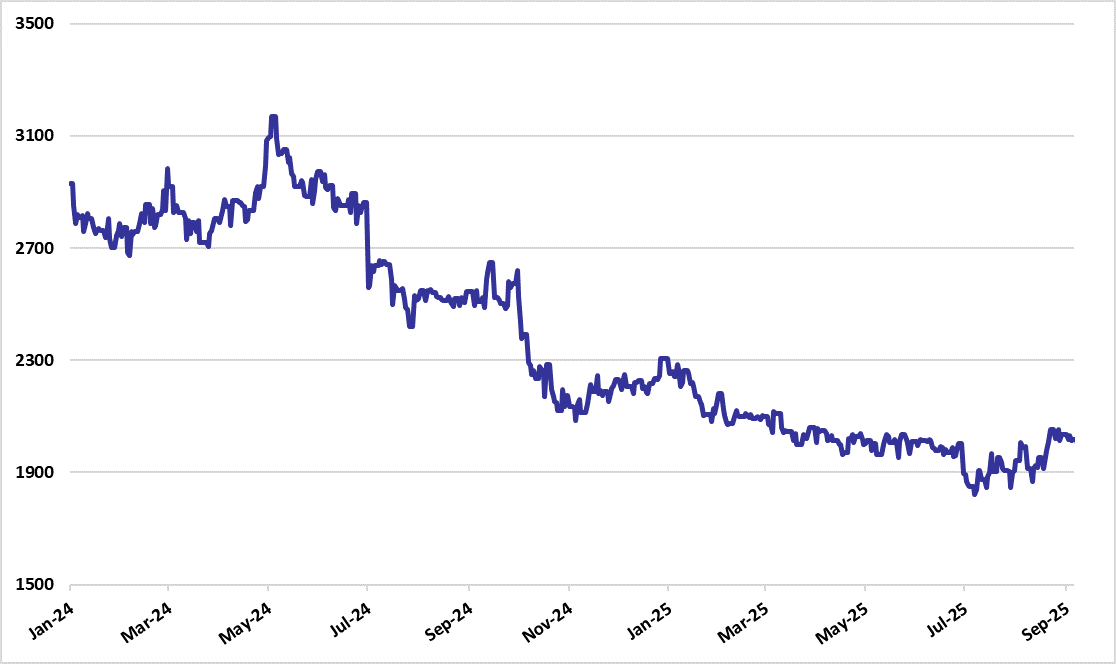

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

AGAT Credit JSCM will issue 400,000 corporate bonds worth 40bln UZS at 27% annual interest, listing them on the Tashkent exchange;

Kapitalbank JSCB (KPBA) approved contract changes with Uzum Technologies and an additional agreement with Uzum Auto;

AKFA Medline LLC will fully redeem its first corporate bond issue early, paying 262.16bln UZS, and annul the bonds;

Poytaxt Bank JSCB appointed Dilshod Pulatov as Chairman of the Management Board, with Abror Turgunov becoming Deputy Chairman, alongside other executive changes;

Milliy banklararo protsessing markazi JSC replaced Ulugbek Bakhadirov with Dilshod Sarikhodjaev as Chairman of the Supervisory Board;

Eski‑Juva Dehqon Bozori JSC reduced charter capital by 107.9mln UZS through transfer of the Ibn Sino LLC branch to state ownership;

Uzkabel JSC JV obtained a 24.5bln UZS loan from KDB Bank Uzbekistan JSCB, exceeding 340% of charter capital;

Juma Paxta Tozalash JSC shareholders approved merger into Samarkandpaxtasanoat JSC, endorsed the transfer act, and confirmed share swap terms based on appraised values;

Tenge Bank JSC shareholders approved listing 229.8mln ordinary shares (nominal 5,000 UZS) on the Republican Stock Exchange “Toshkent”;

Payme JSC concluded a 36bln UZS surety agreement with affiliated entity TBC Fin Service LLC;

Alfa Invest Insurance JSC approved a $8.3mln surety deal with Trastbank JSCB (TRSB) (114% of net assets).