AVESTA Overview: September 2 - 12

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

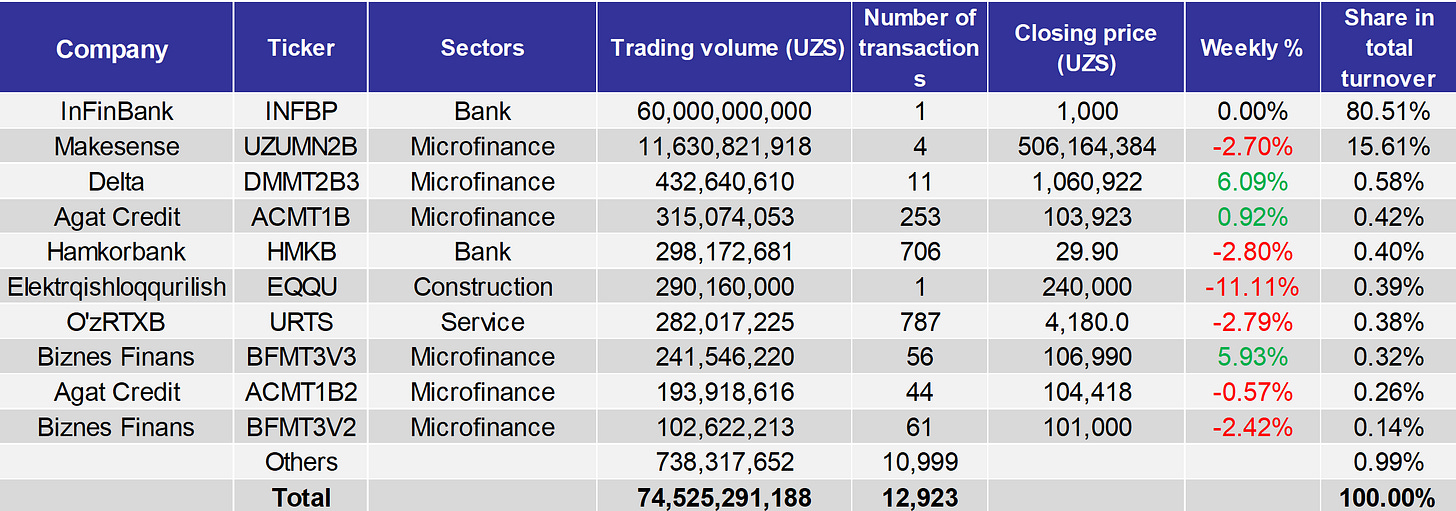

During the period, the Tashkent Stock Exchange recorded a total turnover of 74.5bln UZS across 12,923 transactions. The activity was dominated by InFinBank (INFBP), which accounted for an overwhelming 80.5% of total turnover, with a trading volume of 60bln UZS.

Excluding InFinBank (INFBP), the remainder of the stock segment contributed just 1.2% of total turnover. Hamkorbank (HMKB) led with 0.4% of total turnover, equaling 298.2mln UZS trading volume, followed by Elektrqishloqqurilish (EQQU) at 290.2mln UZS and O‘zRTXB (URTS) at 282mln UZS.

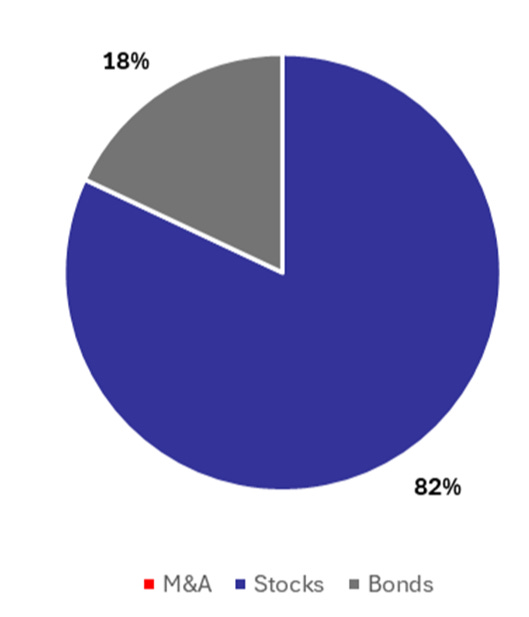

The bond segment comprised 18% of total turnover. Makesense (UZUMN2B) dominated this segment with a trading volume of 11.6bln UZS, representing 15.6% of total turnover and securing second place among the top ten companies by trading volume. This performance was supported in part by an affiliated transaction in which Uzum Bank JSC acquired bonds valued at 4.04bln UZS from Makesense LLC, as approved by its Supervisory Board on 11 September. Delta (DMMT2B3) ranked third in the bond segment with a trading volume of 432.6mln UZS, equivalent to 0.6% of total turnover. Agat Credit bonds (ACMT1B and ACMCT1B2) collectively accounted for 0.7%, while Biznes Finans bonds (BFMT3V3 and BFMT3V2) represented 0.5% of total turnover.

W-o-w price movements were predominantly negative. Elektrqishloqqurilish (EQQU) recorded the sharpest decline, with its closing price falling by 11.1%. Hamkorbank (HMKB) and O‘zRTXB (URTS) each experienced a 2.8% decrease. On the upside, Delta (DMMT2B3) saw the highest price increase of 6.1%.

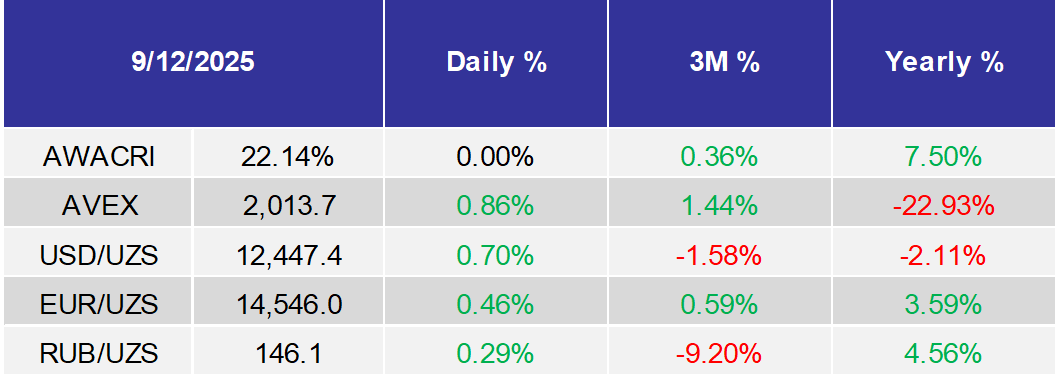

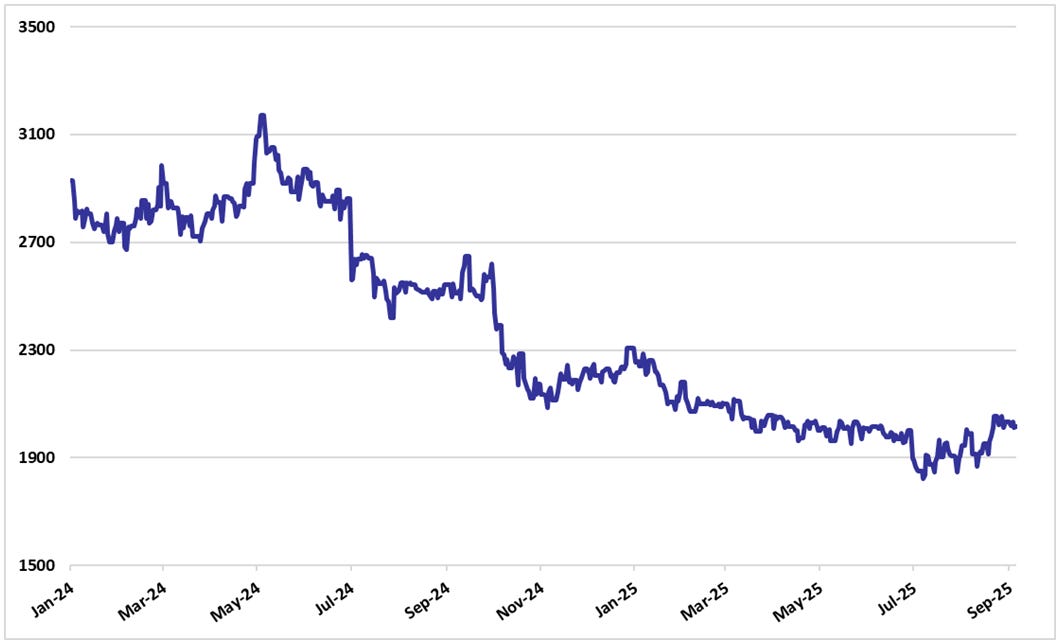

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Toshkent Republican Stock Exchange appointed Fayzulla Tashov as acting chairman of the board, replacing Georgiy Paresishvili;

Uzum Bank JSC entered a 4.04bln UZS affiliated transaction to acquire bonds from MAKESENSE LLC, approved by its Supervisory Board on September 11, 2025;

Hayot Bank JSC signed a 100bln UZS subordinated loan agreement with affiliated entity Hayot Birja LLC on 29 August 2025;

AKFA Medline LLC approved early redemption of its first bond issuance at 102.9% of indexed nominal value plus accrued interest, totaling over 262bln UZS;

Sino JSC shareholders approved full liquidation on 22 August 2025, including termination of securities, asset transfer to SAXARI LLC, and payout of 2.24bln UZS to minority shareholders.

Yevroosiyo Bank JSC sold government securities worth 24.35bln UZS to Ipak Yuli Bank JSC (IPKY), a transaction amounting to 22.41% of its net assets;

TBC Bank JSC entered a 20bln UZS affiliated transaction with Payme JSC, providing a guarantee under a surety agreement approved by its Supervisory Board on June 30, 2025;

Ipoteka-bank JSC (IPTB) approved creation of a new joint venture with UzAutoMotors’ subsidiary;

NBU Invest Group JSC approved a 353.6bln UZS charter capital reduction via cancellation of 353.6mln shares, reflecting asset transfers from Uznaсbank and the State Asset Management Agency;

Hamkorbank JSCB (HMKB) approved dividends totaling 161.7bln UZS (1.25 UZS per share), payable September 6 – November 5, 2025;

O‘zikkilamchiranglimetall JSC (UVCM) approved a 14.2bln UZS issuance of 5.4mln ordinary shares at 2,634 UZS each.