AVESTA Overview: October 13 - 24

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

TASHKENT STOCK EXCHANGE

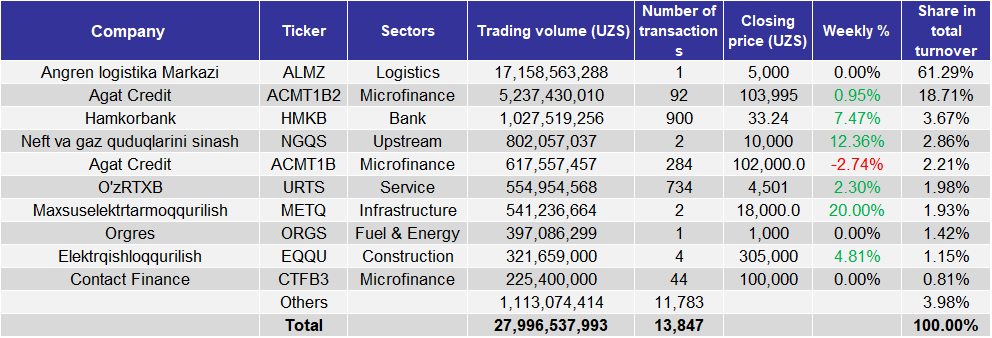

During the period, the Tashkent Stock Exchange recorded a total turnover of nearly 28bln UZS across 13,847 transactions.

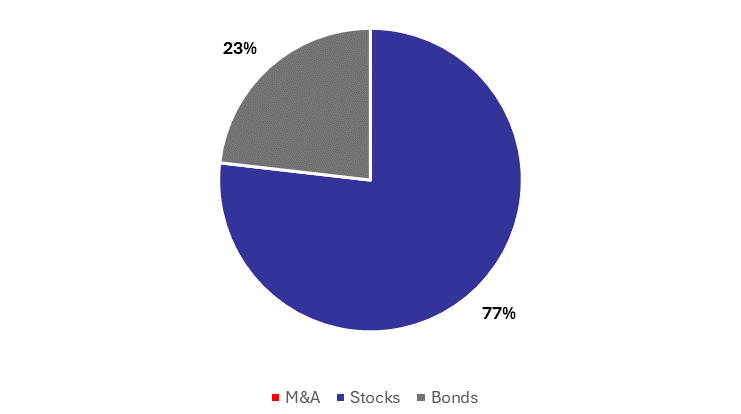

Stocks comprised approximately 77% of the total turnover. Angren logistika markazi (ALMZ) alone represented more than half of the total turnover, accounting for 61.3% and a trading volume of 17.2bln UZS. Hamkorbank (HMKB) contributed over 1bln UZS in trading volume, equivalent to 3.7% of total turnover. Neft va gaz quduqlarini sinash (NGQS) followed with a trading volume of 802.1mln UZS, representing 2.9% of the period’s total turnover.

The bond segment comprised approximately 23% of total turnover. Agat Credit bonds constituted the principal share of bond trading, representing 20.9% of overall turnover. Two Agat Credit bonds, (ACMT1B2 and ACMT1B), accounted for trading volumes of 5.2bln UZS and 617.6mln UZS, respectively. Contact Finance (CTFB3) registered a trading volume of 225.4mln UZS, equal to 0.8% of total turnover, placing it last among the top-ten companies by volume.

W-o-w price changes across the listed entities were positive on balance. Only Agat Credit bond (ACMT1B) registered a w-o-w decline of 2.7%. Notable price movements included Maxsuselektrtarmoqqurilish (METQ), which rose by 20% from 15,000 UZS to 18,000 UZS per share, Neft va gaz quduqlarini sinash (NGQS), which gained 12.4%, and Hamkorbank (HMKB), which showed 7.5% increase over the reporting period.

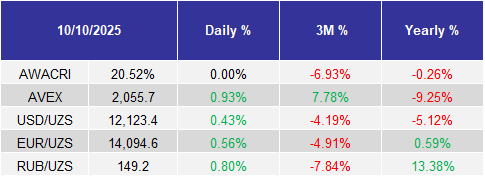

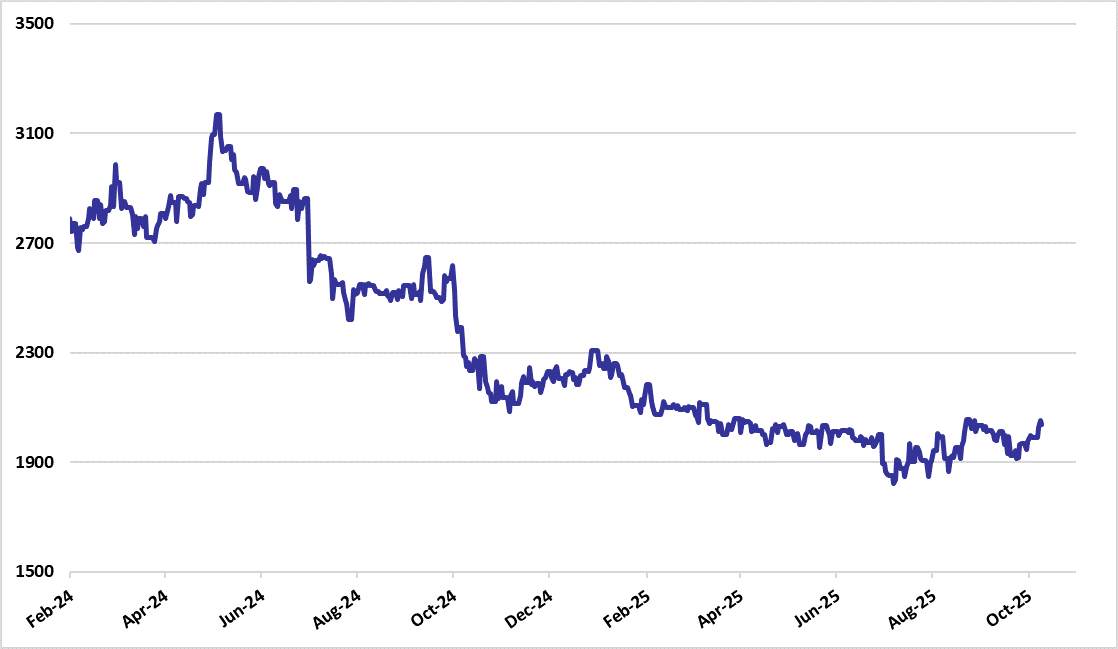

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown (September 29 – October 10, 2025)

FINANCIAL NEWS

ECONOMICS

CLICK JSC approved the listing of its securities on regulated financial markets, including the Toshkent RSE;

Tenge Bank JSC approved the listing of its securities on regulated financial markets, including the Toshkent RSE;

Apex Bank JSC approved a 135bln real estate purchase agreement with Apex Insurance JSC, equal to 31.8% of its net assets;

Payme JSC signed a 144bln UZS surety agreement with TBC Fin Service LLC, equal to 24.6% of its net assets;

Payme JSC signed a 250bln UZS credit agreement with TBC Bank JSC, equal to 45.7% of its net assets;

Delta Mikromoliya Tashkiloti LLC approved income payments of 23,013.70 UZS per corporate bond (2.3% of par value), with payouts scheduled from September 28 to October 7, 2025;

Invest Finance Bank JSC (INFB) approved a 268.4bln UZS subordinated deposit agreement with Uztex Tashkent LLC, equal to 15.7% of its net assets;

Open Bank JSC approved a cooperation agreement with affiliate Open Tijorat LLC for goods trading;

Yo‘lreftrans JSC (YRFT) confirmed that its bank account at O‘zmilliybank JSC (Mirobod branch) was frozen, affecting 12.27bln UZS in cash holdings;

O‘z-Tong Hong Kompani JSC JV rejected proposals to acquire a 75% stake in Andijon viloyati PFK LLC;

Anor Bank JSC appointed a new supervisory board, adding Maximilian Edward Johnson and Stéphanie Rivoal as members;

Delta Mikromoliya Tashkiloti LLC approved the issuance of 20,000 corporate bonds totaling 20bln UZS;

O‘zbekneftgaz JSC (UZNG) proposed dividends of 32.65 UZS per ordinary share (6.53% of par) and 125 UZS per preferred share (25% of par);

O‘zbekiston Ipotekani Qayta Moliyalashtirish Kompaniyasi JSC approved the issuance of 200,000 corporate bonds totaling 200bln UZS. The bonds will be placed via public subscription over 90 days, with a 5-year maturity and 17.5%;

Ipoteka-bank JSC (IPTB) listed its securities on regulated market, including Vienna MTF operated by the Vienna Stock Exchange;

O‘zmetkombinat JSC (UZMK) signed a €132.5mln syndicated loan agreement with Standard Chartered Bank and KFW IPEX-Bank to finance and refinance its casting and rolling complex project;

Agat Credit JSC declared income of 2,463.01 UZS per corporate bond (2.46% of face value), payable in cash between 2–15 October 2025.