AVESTA Overview: October 12 - 24

Biweekly overview on Uzbekistan securities markets by Avesta Investment Group & Europe-Uzbekistan Association for Economic Cooperation

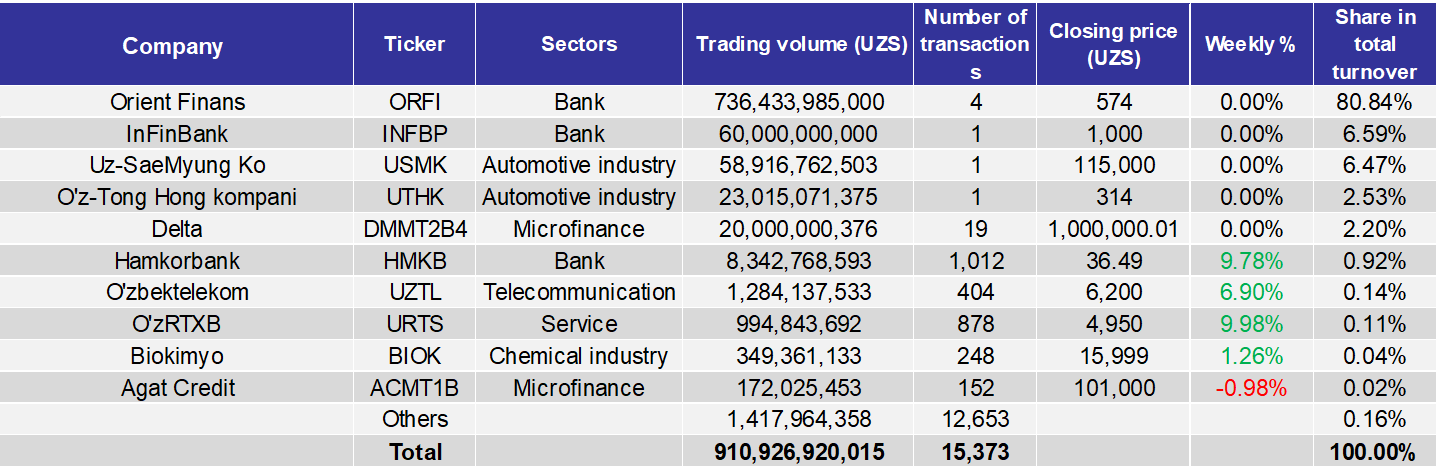

TASHKENT STOCK EXCHANGE

During the week, the Tashkent Stock Exchange recorded a total turnover of 910.9bln UZS across 15,373 transactions. Orient Finans (ORFI) accounted for 80.8% of the total, with a trading volume of 736.4bln UZS derived from the private issuance of 589,147,188 ordinary shares.

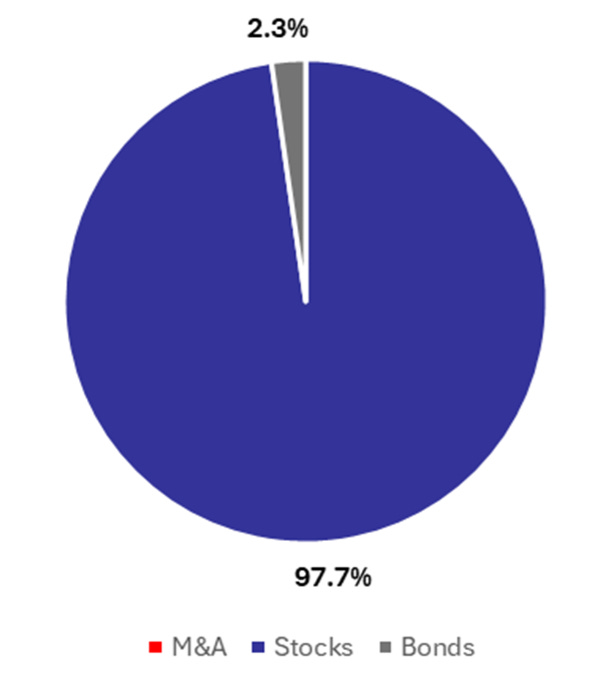

The stocks segment maintained their dominant position during the period, accounting for 97.7% of total turnover. Following the leading performer, Orient Finans (ORFI), InFinBank (INFBP) preferred shares generated the second-highest trading volume at 60bln UZS, which accounted for 6.6% of the total market activity. Uz-SaeMyung Ko (USMK) closely followed, recording a trading volume of 58.9bln UZS and a 6.5% share of the turnover. Another notable contributor from the automotive industry was O’z-Tong Hong Kompani (UTHK), which registered a trading volume exceeding 23bln UZS, representing 2.5% of the total.

The bond segment represented 2.3% of total turnover. Delta’s (DMMT2B4) new issuance of 20,000 corporate bonds generated 20bln UZS from 19 transactions, representing 2.2% of turnover. Agat Credit (ACMT1B) bonds contributed 0.02% with 172mln UZS in trading volume.

Weekly price analysis shows that 50% of the top ten companies by trading volume recorded no price changes, while the remainder trended upward, except for Agat Credit (ACMT1B), whose bond price fell nearly 1%. The highest gain was posted by O’zRTXB (URTS), up almost 10%, followed by Hamkorbank (HMKB) at 9.8%. O’zbektelekom (UZTL) rose 6.9%, while Biokimyo (BIOK) advanced 1.3%.

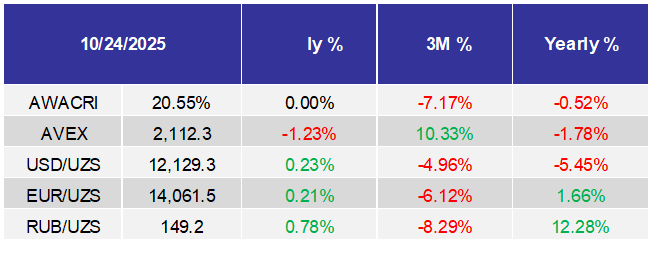

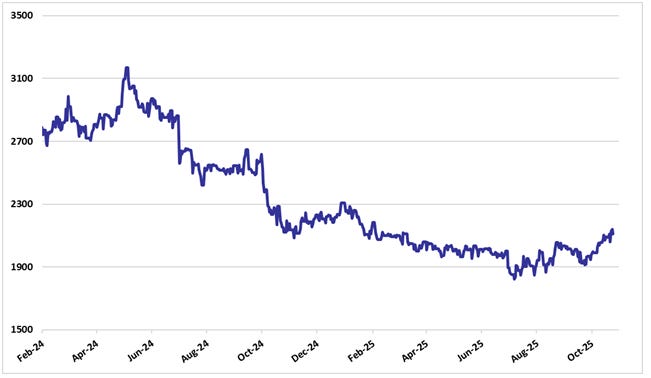

AVESTA EQUITY INDEX

*The AVEX index describes the general market trend by covering the top 20 listed companies, in a particular quarter, with the highest liquidity and transaction turnovers on the Tashkent Stock Exchange. The index is a sum of the daily stock prices multiplied by the weighted average coefficients given to selected companies. The base date is 01/01/2021 (1000).

Turnover breakdown

FINANCIAL NEWS

ECONOMICS

Makesense LLC resolved to issue 4,000 interest‑bearing corporate bonds worth 400bln UZS at 24% annual interest via open subscription;

EOPC JSC (UzCard) disclosed a major transaction with BTECH LLC valued at 320bln UZS (40.48% of net assets) for investment in real estate construction;

O’zbekiston Temir Yo’llari JSC approved transfer of its 15% stake in Temiryo‘linfratuzilma JSC (55.7mln shares at par 1,000 UZS) to the Ministry of Economy and Finance, in line with Presidential Decree PQ‑289 of 19 Sep 2025, thereby reducing the state share proportionately;

IMKON FINANS mikromoliya tashkiloti JSC (IMKF3) approved income accruals on corporate bonds at 23,013.7 UZS (2.3% of par), with payments scheduled from 16-25 Oct 2025 via non‑cash transfers;

Mingbuloq Paxta Tozalash JSC resolved to cease operations effective 7 Oct 2025, with creditor claims to be accepted until 31 Dec 2025, following shareholder approval of liquidation;

Andijon 1‑son Paxta Tozalash JSC approved reorganization via merger at the shareholders’ meeting on 11 Oct 2025; state registration of the new entity is set for 29 Nov 2025, with creditor claims accepted until 16 Nov 2025;

Samarqandpaxtasanoat Regional JSC endorsed the merger of Juma Cotton Cleaning JSC into the association despite negative net assets (‑634.4mln UZS);

Angren Logistika Markazi JSC (ANLM) resolved on 8 Oct 2025 to delist 1,302,803 ordinary shares with total par value 6,519,015,000 UZS from the Tashkent Stock Exchange quotation list;

Ellikqal’a Paxta Tozalash JSC resolved to cease operations effective 22 Apr 2026, with creditor claims accepted until 22 Dec 2025;

Paxtakor Paxta Tozalash JSC resolved to cease operations effective 21 Oct 2025, appointing a liquidation commission and accepting creditor claims for two months from the public notice date;

Andijon 1-son Paxta Tozalash JSC approved the merger of Andijon-3, Paytug, Sufi Qishloq, and Asaka Paxta Tozalash JSCs into its structure, with dissenting shareholders entitled to request buyback at 2,334.02 UZS per share;

Xo‘jaobod Paxta Tozalash JSC approved voluntary liquidation effective 21 Apr 2026; creditor claims accepted until 21 Dec 2025 per shareholder resolution dated 13 Oct 2025;

Angren Logistika Markazi JSC (ANLM) delisted its shares from the “Privatization” segment of the Toshkent RFB stock market on 20 Oct 2025; securities were transferred to the off-list trading platform;

Agat Credit JSC approved its transformation into Agat Credit Microfinance Bank JSC, with 73.72bln UZS authorized capital and full board appointments; charter and business plan registered with the Central Bank;

NBU Invest Group JSC signed a 319.35mln CNY affiliated-party loan agreement with the National Bank of Uzbekistan to finance internal projects; full ownership confirmed;

Sherobod Paxta Tozalash JSC shareholders approved a merger into Kumqo‘rgon Paxta Tozalash JSC with 77.83% voting in favor; dissenting shareholders may request buyback at 24,333.13 UZS per share;

Agat Credit JSC registered a 40bln UZS corporate bond issue on 23 Oct 2025, with 400,000 securities at 100,000 UZS par;

Contact Finance LLC registered a 10bln UZS corporate bond issue on 22 Oct 2025, with 100,000 securities at 100,000 UZS par;

Biznes Finans Mikromoliya Tashkiloti LLC registered a 25bln UZS corporate bond issue on 21 Oct 2025, with 250,000 securities at 100,000 UZS par;

Paresishvili Georgiy Otarovich was elected as an independent member of the supervisory board of Kapitalbank JSCB (KPBA) for a three-year term, effective upon approval by the CBU;

Goodwill Capital JSC shareholder Anvar Irchayev offered to buy out remaining shares at 0.05 UZS each on 24 Oct 2025, under Article 40 of the JSC Law, citing ownership of over 50%;

Agrobank JSCB (AGBA) approved D&O insurance coverage of $4.5mln for its supervisory board and committed to comply with state corporate governance guidelines from 1 Jan 2026;

To‘rtko‘l Paxta Tozalash JSC shareholders approved a merger with Beruniy Paxta Tozalash JSC with 87.7% voting in favor; dissenting shareholders may request buyback at 23,469 UZS per share;

Apex Insurance JSC received a perpetual insurance activity license from the National Agency for Perspective Projects on 20 Oct 2025.