JULY 31 - AUGUST 11 , 2023: Markets Overview

Avesta Investment Group presents the bi-weekly overview of Uzbekistan's financial market.

TASHKENT STOCK EXCHANGE

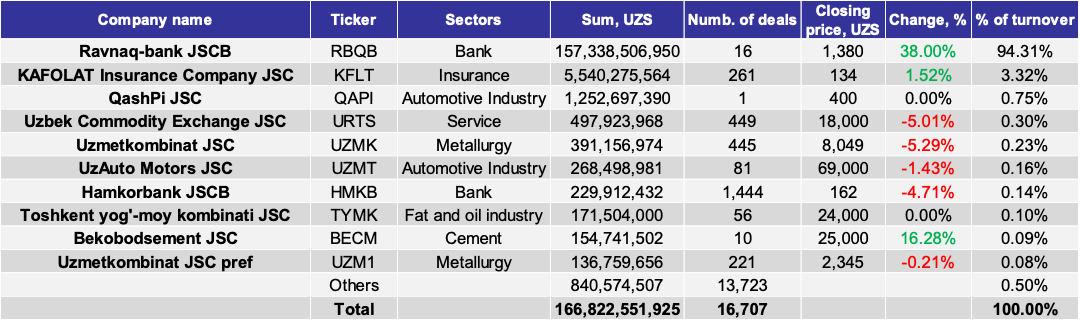

During the given period, the trading volume of RSE Toshkent reached an impressive amount of almost UZS 167 billion, which is 16.6 times higher than the trading volume of the previous period. The stock exchange observed active trading in a diverse range of 81 (-1) types of securities.

However, it is important to highlight that a single transaction involving RBQB accounted for a staggering 94.3% of the total turnover on the exchange.

In line with the published information, Iskandar Tursunov, the Chairman of the bank, increased his equity stake in the bank to 88.62%, reflecting a 17.67% increase compared to last week's transaction.

Interestingly, following RBQB, KFLT emerged as the next top security contributing to the total turnover, with a notable contribution of 3.32%. Additionally, it experienced a 1.52% increase in price and closed at 134 UZS.

It is worth mentioning that BECM witnessed a significant 16.28% increase in its closing price over the past two weeks.

AVESTA EQUITY INDEX (AVEX)

*AVEX is an index that describes the general market trend by covering the top 20 listed companies with the largest number and volume of transactions on the Tashkent Stock Exchange. The calculation of AVEX is based on the daily price of companies' stocks with their weighted average, which is determined by companies' liquidity and transaction turnovers. The base date is 01/01/2021 (1000).

FINANCIAL NEWS

OVERVIEW

Following a sharp increase in banks, the US dollar exchange rate set by the Central Bank of Uzbekistan updated the historical maximum and reached 12,075 UZS (depreciating by 3.5%).

The National Bank became a broker on the stock exchange.

Average banking NPL decreased to 3.4% by the end of 1H2023, including 3.1% for retail loans and 3.5% for corporate borrowings.

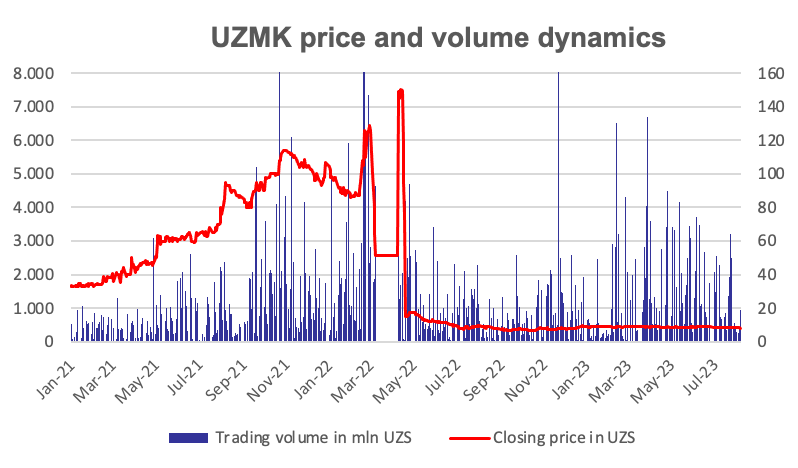

Uzmetkombinat JSC (UZMK) announced the attraction of $100mln direct non-collateralized non-guaranteed loan from the London office of Citibank.

Hayot Bank JSCB announced the establishment of the Hayot Ijara LLC subsidiary - most likely a microfinance/BNPL subsidiary for non-collateralized lending based on Islamic banking principles.

KDB Bank Uzbekistan has successfully registered the issue of common shares in the amount of 405.1 bln UZS ($34.6 mln).

JSC "Solutions Lab" (SOLA) increases the authorized capital by 800 mln UZS;

"Ferganaazot" JSC received a listing in the "Standard" category of the stock quotation list of the RSE "Toshkent" on August 9 of this year.

Sarvar Fayziev sold his 52.15% equity share in Ravnaqbank JSCB (RBQB) to the bank's Chairman Iskandar Tursunov, who consolidated 72.05% of the equity. Later, Tursunov increased his stake to 88.62%.

Universalbank JSC (UNVB) approved the capitalization of retained profits for 150bln UZS.

Supervisory Board of Uzbekcoal JSC (UZIR) recommended distributing 250 UZS dividends per ordinary and preferred share.

Madad Invest Bank JSC approved and capitalization of the retained earnings for 50bln UZS into new shares.

KDB Bank Uzbekistan JSC allocated 2.29trln UZS and 2.2trln UZS into the interbank loans with JPMORGAN CHASE BANK.

UzRTSB JSC (URTS) allocated a 100bln UZS deposit at 18% interest with Trastbank JSCB (TRSB).

Kapital Sugurta JSC (KASU) investing 10bln UZS into the shares of Anorbank JSC.

Hamkorbank JSCB (HMKB) approved the capitalization of retained earnings for 215bln UZS and will distribute 2 bonus shares per one existing. Distribution will be made according to the register closing by the 10th day after the state registration of the prospectus of issue.

Dori-Darmon JSC (DORI) announced the liquidation and acquisition of its subsidiary Sirdarya regional Dori Darmon LLC.

Muxıtdınov Xamıdulla Nurıtdınovıch became the owner of a 25% stake in Apex Bank JSCB worth 30bln UZS.

Avesta Investment Group is a leading investment banking, securities, and investment management firm in Uzbekistan, with operations in all Central Asian countries.